Market Performance Overview

- Domestic equities were positive during the quarter, pushing the S&P 500 YTD return to 2.6%.

- Small cap stocks outperformed all other asset classes as they have less exposure to international trade concerns.

- Foreign equities saw pressure on returns due to a strengthening dollar and concerns about the England transition out of the European Union. Developed and emerging markets down -2.8% and -6.7% respectively YTD.

- Domestic bonds reacted negatively to rising interest rates and ended the quarter at -1.6% YTD.

Growth and the Federal Reserve

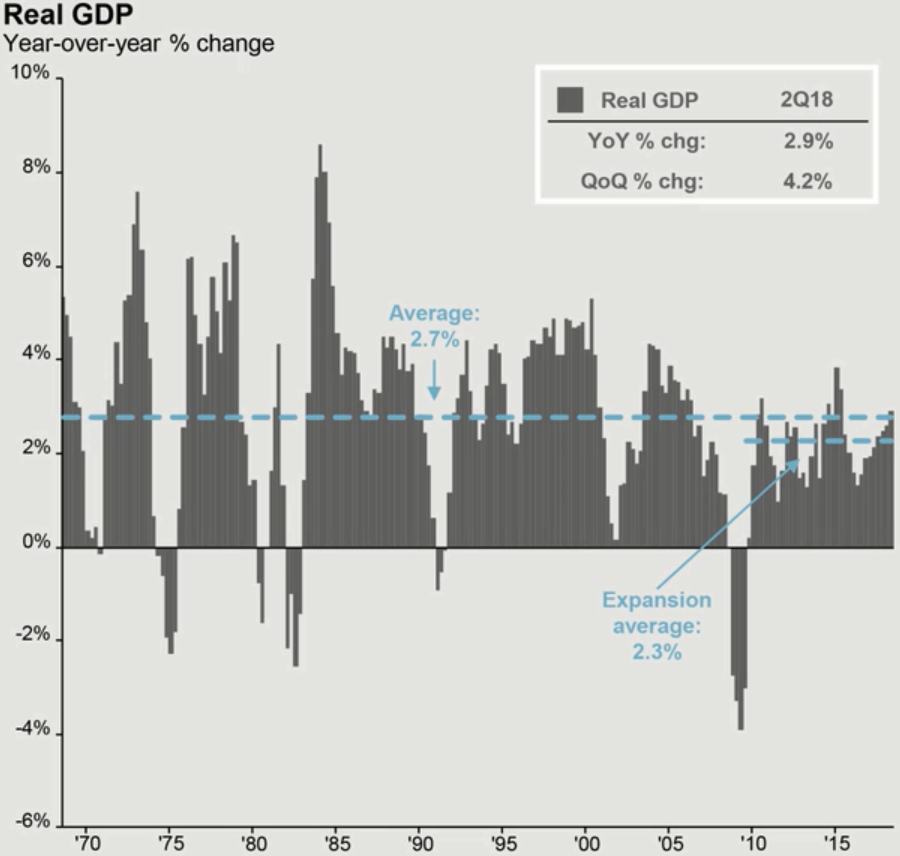

Economic growth has surged in 2018. Second quarter real GDP growth is expected to be approximately 3% year-over-year, which will be the highest growth rate in three years. Much of this growth has been caused by a surge in economic stimulus believed to be generated from the change in income tax law. This has generated increases in consumer and business spending. At the present time, this growth seems to be sustainable through 2018 with the overall economy performing well. We expect the Federal Reserve to continue raising interest rates which puts a headwind on bonds and tends to slow economic activity. However, the gradual nature of the rate increases suggests that the rate hikes do not pose an elevated threat to the growth of the economy yet.

Year-to-date, we have seen two rate hikes, with the outlook calling for another two hikes by year-end and three more in 2019. The Federal Reserve continues to raise interest rates due to the strength of the economy. As of now, the economy has reached the Fed’s long-term goals for employment, inflation, and growth. For reference, the stated Fed targets are 1.8% year-over-year growth (current quarter estimate is 3%), 2% inflation (likely to hit 2.4% this year) and unemployment below 4.5% (currently at 4%). Having met the long-term targets, the Federal Reserve is raising rates and reducing its balance sheet to prevent an overheating economy. By raising rates gradually now, they reduce the likelihood of large, rapid monetary policy moves in the future.

Domestic Equity Recap

Domestic equities bounced back in the second quarter after Q1 snapped a streak of 9 consecutive positive quarters of return. The S&P 500 corrected first quarter struggles and ended the quarter positive, returning 2.6% YTD. For investors, the ride was volatile, as talk of new tariffs and a potential trade war heightened. After seeing valuations decrease 12% in Q1 to 16.4x, the forward price-to-earnings ratio (P/E) of the S&P 500 dipped further to 16.1x. The decline in valuations brings the stock market valuation right back to its 25-year average, suggesting that the current bull market may continue to run.

Domestically, corporate profits continue to grow and are reaching all-time highs. This is due in part to a healthy economy nearing full employment, but also to an Administration set on implementing pro-business legislation (tax-reform, repatriation, deregulation). Currently, the exception to the Administration’s pro-growth agenda is the newly implemented tariffs and the discussions to increase tariffs on additional imported goods. While economist’s opinions on public policy greatly vary on many topics, most economists agree that a trade war could rock the geopolitical boat, which presents a risk to the current markets, both domestic and internationally.

Small cap stocks have modestly outperformed large cap stocks YTD due to their relative insulation from international markets and geopolitical events. The S&P 500 earns roughly 40% of its revenue abroad, whereas most small-cap stocks earn most of their revenue domestically. This ties large cap stocks more closely with the volatility associated with a potential trade war. The result has been outperformance by the small cap sector of 5.0% YTD over large cap stocks.

International Equity Recap

International returns were negative in Q2 of 2018, with developed markets and emerging markets down -1.2% and -8.0% for the quarter respectively. The dollar has strengthened YTD and has been the largest detractor of international returns through Q2. While we expect the dollar to continue to fall over the next year, an increase of the dollar would continue to dampen international returns. Additionally, international markets (particularly export dependent emerging market countries) have seen large declines due to the uncertainty surrounding a potential trade war. Trade wars hurt export dependent nations as imposed tariffs increase the cost of their goods, making domestically produced products more attractive for consumers.

The European Union (EU) remains a focal point in international markets, as the EU is working through a period of change. With Britain transitioning out of the EU, there is some concern that others may follow. Political unrest in Italy has also increased concerns that the EU is not in the clear yet. However, based on valuations, the case for international equities remains strong. The forward P/E ratio of the All Country World Index (ex-US) is currently 13x earnings. This is roughly a 10% discount on their 20-year average valuation, compared to the U.S. being right in line with past valuations.

Domestic Fixed Income Recap

Domestic fixed income continues to face headwinds with the Federal Reserve increasing interest rates. Domestic bonds are currently down 1.6% through Q2. The increased interest rates have come from the unwinding of the Federal Reserve’s balance sheet and the two rate hikes that we have seen YTD. We expect the headwinds of rising rates to continue as it is generally accepted that the Fed will raise rates five more times (.25% each hike) through the end of 2019. While this certainly presents a headwind, it doesn’t mean investors should move away from fixed income investments. Fixed income continues to generate income and stability to our portfolios, and it provides some upside in the event of a market downturn. Additionally, while rising rates tend to hurt bond performance in the short-term, long-term investors will eventually be rewarded with higher income streams from bonds with higher interest rates.

While we are not moving away from fixed income investments for our clients, we have taken several strategic steps to reduce the interest rate risk in their portfolios. Those movements have paid off for our fixed income investors by generating an overall positive return in our base bond portfolios.

International Fixed Income Recap

International fixed income had a better start to 2018 than domestic bonds, but saw declines in Q2 that ended in negative territory. The dollar reversed course from Q1, which more than eliminated the gains that we saw in the first quarter. Additionally, the European Central Bank has outlined plans to end its bond buying program by the end of 2018. While this does not mean that they are entering a phase of monetary tightening, it suggests an end to the “easy money” policies of the past. This in turn has dampened international bond returns as investors begin to prepare for an eventual tightening policy.

Remaining 2018 Outlook

As we enter the second half of 2018, we remain optimistic on the direction of the economy. Unemployment remains low and consumer spending continues to bolster corporate profits. Additionally, corporations are beginning to benefit from the recent tax legislation changes, however time will tell if this equates to an increase in spending and capital investment.

While the economy appears to be moving in the right direction, geopolitical tensions and a potential trade war threaten to impact the current expansion. With many domestic companies pulling in significant revenue from international markets, we expect the volatility to persist as trade talks continue. While there is a considerable amount of uncertainty around where the trade negotiations will go, we continue to believe that the potential for an all-out trade war is low. There is simply too much to lose by taking the negotiations and implementation of tariffs too far.

Overall, we are confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be, which is prudently managing our diversified portfolios to achieve reasonable long-term, risk adjusted returns.

2018 Quarterly Commentary Q2

Contributed by: Beth Parks

Market Performance Overview

Growth and the Federal Reserve

Economic growth has surged in 2018. Second quarter real GDP growth is expected to be approximately 3% year-over-year, which will be the highest growth rate in three years. Much of this growth has been caused by a surge in economic stimulus believed to be generated from the change in income tax law. This has generated increases in consumer and business spending. At the present time, this growth seems to be sustainable through 2018 with the overall economy performing well. We expect the Federal Reserve to continue raising interest rates which puts a headwind on bonds and tends to slow economic activity. However, the gradual nature of the rate increases suggests that the rate hikes do not pose an elevated threat to the growth of the economy yet.

Year-to-date, we have seen two rate hikes, with the outlook calling for another two hikes by year-end and three more in 2019. The Federal Reserve continues to raise interest rates due to the strength of the economy. As of now, the economy has reached the Fed’s long-term goals for employment, inflation, and growth. For reference, the stated Fed targets are 1.8% year-over-year growth (current quarter estimate is 3%), 2% inflation (likely to hit 2.4% this year) and unemployment below 4.5% (currently at 4%). Having met the long-term targets, the Federal Reserve is raising rates and reducing its balance sheet to prevent an overheating economy. By raising rates gradually now, they reduce the likelihood of large, rapid monetary policy moves in the future.

Domestic Equity Recap

Domestic equities bounced back in the second quarter after Q1 snapped a streak of 9 consecutive positive quarters of return. The S&P 500 corrected first quarter struggles and ended the quarter positive, returning 2.6% YTD. For investors, the ride was volatile, as talk of new tariffs and a potential trade war heightened. After seeing valuations decrease 12% in Q1 to 16.4x, the forward price-to-earnings ratio (P/E) of the S&P 500 dipped further to 16.1x. The decline in valuations brings the stock market valuation right back to its 25-year average, suggesting that the current bull market may continue to run.

Domestically, corporate profits continue to grow and are reaching all-time highs. This is due in part to a healthy economy nearing full employment, but also to an Administration set on implementing pro-business legislation (tax-reform, repatriation, deregulation). Currently, the exception to the Administration’s pro-growth agenda is the newly implemented tariffs and the discussions to increase tariffs on additional imported goods. While economist’s opinions on public policy greatly vary on many topics, most economists agree that a trade war could rock the geopolitical boat, which presents a risk to the current markets, both domestic and internationally.

Small cap stocks have modestly outperformed large cap stocks YTD due to their relative insulation from international markets and geopolitical events. The S&P 500 earns roughly 40% of its revenue abroad, whereas most small-cap stocks earn most of their revenue domestically. This ties large cap stocks more closely with the volatility associated with a potential trade war. The result has been outperformance by the small cap sector of 5.0% YTD over large cap stocks.

International Equity Recap

International returns were negative in Q2 of 2018, with developed markets and emerging markets down -1.2% and -8.0% for the quarter respectively. The dollar has strengthened YTD and has been the largest detractor of international returns through Q2. While we expect the dollar to continue to fall over the next year, an increase of the dollar would continue to dampen international returns. Additionally, international markets (particularly export dependent emerging market countries) have seen large declines due to the uncertainty surrounding a potential trade war. Trade wars hurt export dependent nations as imposed tariffs increase the cost of their goods, making domestically produced products more attractive for consumers.

The European Union (EU) remains a focal point in international markets, as the EU is working through a period of change. With Britain transitioning out of the EU, there is some concern that others may follow. Political unrest in Italy has also increased concerns that the EU is not in the clear yet. However, based on valuations, the case for international equities remains strong. The forward P/E ratio of the All Country World Index (ex-US) is currently 13x earnings. This is roughly a 10% discount on their 20-year average valuation, compared to the U.S. being right in line with past valuations.

Domestic Fixed Income Recap

Domestic fixed income continues to face headwinds with the Federal Reserve increasing interest rates. Domestic bonds are currently down 1.6% through Q2. The increased interest rates have come from the unwinding of the Federal Reserve’s balance sheet and the two rate hikes that we have seen YTD. We expect the headwinds of rising rates to continue as it is generally accepted that the Fed will raise rates five more times (.25% each hike) through the end of 2019. While this certainly presents a headwind, it doesn’t mean investors should move away from fixed income investments. Fixed income continues to generate income and stability to our portfolios, and it provides some upside in the event of a market downturn. Additionally, while rising rates tend to hurt bond performance in the short-term, long-term investors will eventually be rewarded with higher income streams from bonds with higher interest rates.

While we are not moving away from fixed income investments for our clients, we have taken several strategic steps to reduce the interest rate risk in their portfolios. Those movements have paid off for our fixed income investors by generating an overall positive return in our base bond portfolios.

International Fixed Income Recap

International fixed income had a better start to 2018 than domestic bonds, but saw declines in Q2 that ended in negative territory. The dollar reversed course from Q1, which more than eliminated the gains that we saw in the first quarter. Additionally, the European Central Bank has outlined plans to end its bond buying program by the end of 2018. While this does not mean that they are entering a phase of monetary tightening, it suggests an end to the “easy money” policies of the past. This in turn has dampened international bond returns as investors begin to prepare for an eventual tightening policy.

Remaining 2018 Outlook

As we enter the second half of 2018, we remain optimistic on the direction of the economy. Unemployment remains low and consumer spending continues to bolster corporate profits. Additionally, corporations are beginning to benefit from the recent tax legislation changes, however time will tell if this equates to an increase in spending and capital investment.

While the economy appears to be moving in the right direction, geopolitical tensions and a potential trade war threaten to impact the current expansion. With many domestic companies pulling in significant revenue from international markets, we expect the volatility to persist as trade talks continue. While there is a considerable amount of uncertainty around where the trade negotiations will go, we continue to believe that the potential for an all-out trade war is low. There is simply too much to lose by taking the negotiations and implementation of tariffs too far.

Overall, we are confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be, which is prudently managing our diversified portfolios to achieve reasonable long-term, risk adjusted returns.

Beth Parks

Share this post with your friends