On December 19, 2019, Congress passed a year-end appropriations bill with the SECURE Act attached to it. What is the SECURE Act? The Setting Every Community Up for Retirement Enhancement Act includes many changes to current tax law and adds new provisions beginning in 2020.

One of the biggest changes will be for future beneficiaries of Individual Retirement Accounts (IRA’s). Under previous law, beneficiaries were able to “stretch” the Inherited IRA distributions over their lifetime. For any IRA inherited prior to 1/1/2020, the beneficiary still retains the right to stretch out distributions over their life expectancy.

However, most beneficiaries who inherit after 2019 will be subject to the new 10-year rule. The 10-year rule states that all inherited assets from an IRA or defined contribution plan must be distributed by the end of the 10th year following the year of inheritance. It is important to note that unlike prior rules, there is no annual required minimum distribution. The only requirement is that the account must be emptied by the end of the 10th year. There are a few beneficiaries who are eligible to utilize the old “stretch” rules. These beneficiaries must meet one of the following criteria: spouse of the original account holder, disabled, chronically ill, less than 10 years younger than the decedent, or certain minor children (only until the age of majority).

The second major change in the SECURE Act applies to the law on Required Minimum Distributions (RMDs). Under prior law, individuals were required to take RMDs from all pre-tax accounts no later than April 1st of the year following the year in which they turned 70½.

The new law pushes back the required start date of the first RMD to April 1st of the year following the year in which an individual turns 72. Not a major change, but this will allow future retirees to delay RMDs a bit longer and expands the sweet spot for distribution planning (formerly between ages 59½ and 70½). This change only applies to individuals turning 70½ in 2020 or later. For anyone who was 70½ in 2019 or earlier, they will continue under the old rules. Notably, this does not change the age in which individuals can begin Qualified Charitable Distributions from IRA accounts; the age requirement will remain 70½.

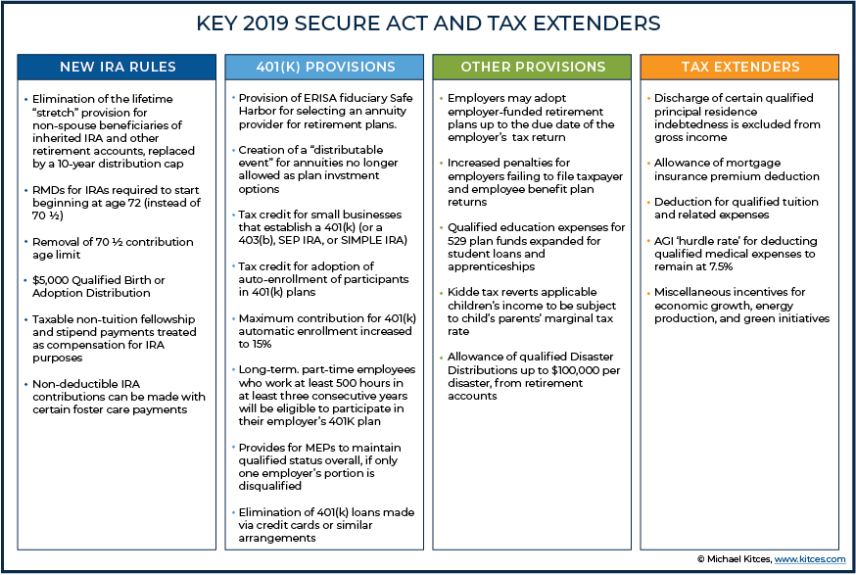

While the two aforementioned items will impact most individuals and retirees, there are many other changes that are a result of the SECURE Act. A summary of these additional items can be found on the following page.

Because this legislation is brand new, it is certainly possible that future IRS guidance and clarification can be expected and may result in slight changes to the legislation.

If you are a client of Voisard Asset Management Group, we will make sure you are aware of which new rules will impact you and how to handle the changes moving forward. If you are not a client of our firm and need assistance navigating these new rules, we would be happy to address your questions and concerns.