Market Performance Overview

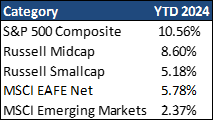

- Domestic equities were positive in Q1 returning +10.56%.

- Foreign equities were positive in Q1 returning +5.78% in developed markets and +2.37% in emerging markets.

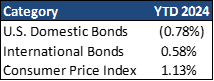

- Domestic bonds were negative in Q1 returning -0.78%.

- Foreign bonds were positive in Q1 returning +0.58%.

__________________________________________________________________________________________________

Economic Update

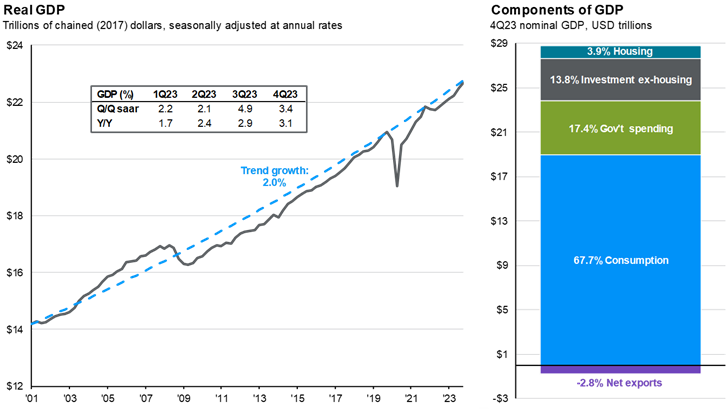

Despite facing numerous challenges in 2023, the U.S. economy defied widespread predictions of recession. Growth moderated to a still robust 3.1% pace in the 4th quarter, while inflation continued to fall towards the Federal Reserve’s 2% target, although progress has slowed in recent months. This year, moderate job gains and easing inflation should allow the U.S. economy to continue on a soft-landing path. That said, economic stability faces plenty of risks as cyclical tailwinds fade and the U.S. election approaches, impacting market performance.

Strong growth in the U.S. labor supply, driven by increased labor force participation and a surge in immigration, has supported impressive job gains. With job openings still elevated, moderate economic growth should support steady job gains ahead. While this should put downward pressure on the unemployment rate, the continued influx of migrants adding to the labor supply could keep the unemployment rate within a narrow range of 3.5% to 4.0%.

Federal Reserve

Meanwhile, while the Federal Reserve held rates steady at its March meeting, the Fed’s updated dot plot showed only the smallest possible majority of FOMC members expecting as many as 3 rate cuts in 2024. They also reduced the number of rate cuts in 2025 from 4 to 3, underscoring the very gradual nature of the projected policy easing. The committee will need more evidence that inflation is sustainably moving toward its 2% target before taking rate action. On a more positive note, they did express their intention to reduce quantitative tightening soon.

As investors adjusted to the prospect of fewer rate cuts, long-term interest rates moved higher during the first quarter. Equities, however, appeared unphased by all of this, setting new all-time highs with the largest stocks still leading the charge.

In the year ahead, attractive relative fundamentals outside of the largest stocks should support broader equity market performance, while fixed income should continue to play its traditional role of providing income and diversification.

__________________________________________________________________________________________________

Equity Recap

Resilient corporate profits and hopes for policy easing have pushed markets to new all-time highs in 2024, and U.S. equities continued their rally in the first quarter of 2024, with the S&P 500 returning 10.56%. However, market performance remains concentrated, as the largest stocks in the index have continued their dominant run. Index concentration is not a new phenomenon as the weight of the top 10 stocks in the S&P 500 has been rising since 2016. However, while the top 10 stocks dominated earnings growth last year, their earnings contribution hasn’t kept pace over the long run.

The top 10 stocks now represent a third of the index but only a fourth of the earnings, and as a result there appears to be a strong case for increasing investment to the rest of the index. If economic growth continues at a steady pace in 2024, gains should broaden out beyond the largest names as the market grinds higher. In this environment, an active approach can help identify those companies with high-quality earnings and attractive valuations that are being overlooked by the markets.

U.S. Based Investors

While many U.S. based investors may feel inclined to focus on opportunities at home, attractive fundamental tailwinds are emerging outside of the U.S. that can’t be ignored. In terms of earnings growth, the U.S. has been the standout market as of late, although prospects in other countries are improving. Higher inflation in Japan and Europe has allowed companies to raise prices and expand their margins. The end of negative interest rates in both economies should help boost profits for Financials, a key sector in both markets.

While pessimism around China has weighed on Emerging Market earnings estimates, they have stabilized in recent months, suggesting that the worst of this pessimism is already priced in. Excluding China, strong returns from global equity markets since the beginning of 2023 have pushed valuations higher. Still, in both absolute terms and historical comparison, international markets look attractively priced compared to the U.S. With U.S. consumer activity expected to slow, growth differentials between the U.S. and other economies could still narrow and allow global markets to surprise to the upside. This, combined with improving earnings expectations and margins, presents an attractive opportunity for U.S. investors to diversify abroad.

__________________________________________________________________________________________________

Fixed Income Recap

While rising interest rates led to negative bond returns in 2022, those higher rates today offer investors both positive real income and the portfolio protection provided by the traditional tendency of bonds to rally when stocks falter in the face of economic weakness. That said, bonds have struggled in the early stages of 2024 as resilient economic data reigned in market expectations for rate cuts.

With market and Fed expectations now aligned, interest rate volatility should fade. At its March meeting, the Federal Reserve left rates unchanged at a range of 5.25% to 5.50% and continued to signal three rate cuts in 2024. However, they cut their forecast for rate cuts in 2025 from four cuts to three. In addition, they boosted their projection for the federal funds rate in the long run from 2.5% to 2.6%, in a sign of a slightly more hawkish stance. With market expectations and Fed messaging very much in sync, it would likely take a meaningful change in the economic outlook to trigger any sharp movement in long-term interest rates in the months ahead.

While resilient economic activity may keep rates from moving meaningfully lower, fixed income can still play its traditional role of providing income and diversification in portfolios.

It is important to note that the bond market is priced very attractively compared to its 25-year history. Not long ago, the U.S. bond market was producing a 1.5% annual yield. The current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields while they can.

Long-Term Opportunities

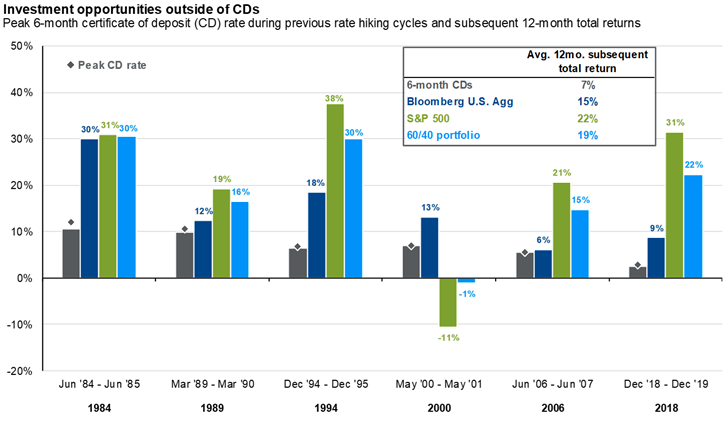

Some investors may feel tempted to lock in cash yields above 5% before they move lower. However, there is an opportunity cost to holding too much cash. In fact, history shows there has always been a better asset than cash to deploy capital after a peak in interest rates. Instead of sitting on the sidelines, investors should put long-term money to work in long-term opportunities. In the last six rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates, while the S&P 500 and a 60/40 stock-bond portfolio outperformed in 5 of these periods.

__________________________________________________________________________________________________

2024 Outlook & Beyond

As investors look into 2024, geopolitical uncertainty remains elevated, and risks to the recent market performance rally remain in place. With the higher valuations produced by the strong investment returns of 2023 and early 2024, it is more important than ever that investors maintain well-diversified

portfolios designed to reduce risk and provide solid long-term income and capital gains. In an environment like this, it is important to take a diversified approach to

portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. If you are a client of our firm, we have created your portfolio to withstand all types of markets, such as 2022. If you are not a client and have not stress-tested your portfolio or do not have a well-designed plan to navigate uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market data, and commentary sourced from J.P. Morgan Asset Management.

1st Quarter 2024 Commentary

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

- Domestic equities were positive in Q1 returning +10.56%.

- Foreign equities were positive in Q1 returning +5.78% in developed markets and +2.37% in emerging markets.

- Domestic bonds were negative in Q1 returning -0.78%.

- Foreign bonds were positive in Q1 returning +0.58%.

__________________________________________________________________________________________________Economic Update

Despite facing numerous challenges in 2023, the U.S. economy defied widespread predictions of recession. Growth moderated to a still robust 3.1% pace in the 4th quarter, while inflation continued to fall towards the Federal Reserve’s 2% target, although progress has slowed in recent months. This year, moderate job gains and easing inflation should allow the U.S. economy to continue on a soft-landing path. That said, economic stability faces plenty of risks as cyclical tailwinds fade and the U.S. election approaches, impacting market performance.Federal Reserve

Meanwhile, while the Federal Reserve held rates steady at its March meeting, the Fed’s updated dot plot showed only the smallest possible majority of FOMC members expecting as many as 3 rate cuts in 2024. They also reduced the number of rate cuts in 2025 from 4 to 3, underscoring the very gradual nature of the projected policy easing. The committee will need more evidence that inflation is sustainably moving toward its 2% target before taking rate action. On a more positive note, they did express their intention to reduce quantitative tightening soon. As investors adjusted to the prospect of fewer rate cuts, long-term interest rates moved higher during the first quarter. Equities, however, appeared unphased by all of this, setting new all-time highs with the largest stocks still leading the charge. In the year ahead, attractive relative fundamentals outside of the largest stocks should support broader equity market performance, while fixed income should continue to play its traditional role of providing income and diversification. __________________________________________________________________________________________________Equity Recap

U.S. Based Investors

While many U.S. based investors may feel inclined to focus on opportunities at home, attractive fundamental tailwinds are emerging outside of the U.S. that can’t be ignored. In terms of earnings growth, the U.S. has been the standout market as of late, although prospects in other countries are improving. Higher inflation in Japan and Europe has allowed companies to raise prices and expand their margins. The end of negative interest rates in both economies should help boost profits for Financials, a key sector in both markets. While pessimism around China has weighed on Emerging Market earnings estimates, they have stabilized in recent months, suggesting that the worst of this pessimism is already priced in. Excluding China, strong returns from global equity markets since the beginning of 2023 have pushed valuations higher. Still, in both absolute terms and historical comparison, international markets look attractively priced compared to the U.S. With U.S. consumer activity expected to slow, growth differentials between the U.S. and other economies could still narrow and allow global markets to surprise to the upside. This, combined with improving earnings expectations and margins, presents an attractive opportunity for U.S. investors to diversify abroad. __________________________________________________________________________________________________Fixed Income Recap

Long-Term Opportunities

Some investors may feel tempted to lock in cash yields above 5% before they move lower. However, there is an opportunity cost to holding too much cash. In fact, history shows there has always been a better asset than cash to deploy capital after a peak in interest rates. Instead of sitting on the sidelines, investors should put long-term money to work in long-term opportunities. In the last six rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates, while the S&P 500 and a 60/40 stock-bond portfolio outperformed in 5 of these periods. __________________________________________________________________________________________________2024 Outlook & Beyond

As investors look into 2024, geopolitical uncertainty remains elevated, and risks to the recent market performance rally remain in place. With the higher valuations produced by the strong investment returns of 2023 and early 2024, it is more important than ever that investors maintain well-diversified portfolios designed to reduce risk and provide solid long-term income and capital gains. In an environment like this, it is important to take a diversified approach to portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. If you are a client of our firm, we have created your portfolio to withstand all types of markets, such as 2022. If you are not a client and have not stress-tested your portfolio or do not have a well-designed plan to navigate uncertain times, perhaps now is the time to do so. We stand ready and available to assist you. Charts, graphs, market data, and commentary sourced from J.P. Morgan Asset Management.Brandon Bauer, CFP®

Share this post with your friends