Market Performance Overview

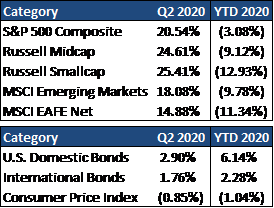

- Domestic equities were up during Q2, finishing +20.54% for the quarter.

- Foreign equities were positive for the quarter, returning +14.88% in developed markets and +18.08% in emerging markets.

- Domestic bonds were positive in Q2, returning +2.90% for the quarter.

- Foreign bonds finished positively for the quarter, finishing +1.76%.

_____________________________________________________________________________________________

Economic Update

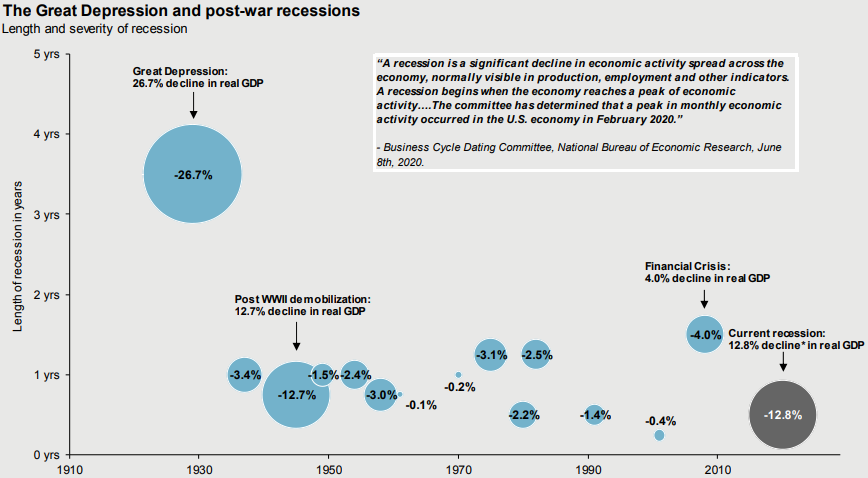

The first half of 2020 will be remembered as a very difficult and extraordinary time in modern history. COVID-19 and social distancing have triggered a very deep recession, which even with a partial reopening has left more people unemployed than any time since the great depression. Massive fiscal and monetary stimulus have softened the impacts of the recession, but also raises questions about long term financial stability. Political and racial tensions have risen also, resulting in massive nationwide protests.

Despite a very sharp correction in equities in the first quarter, markets staged a remarkable recovery in the second quarter, leaving many to wonder whether their portfolios can continue to be resilient in the face of such turmoil and uncertainty.

The third quarter of 2020 should provide some answers to this question as we get a clearer picture of the trajectory of the pandemic and the pace and shape of the economic recovery. We will also likely get a better idea of the scope of further fiscal and monetary support and investors will begin to focus intently on the implications of the November elections. All these issues, along with behavior of markets themselves, should shape investment strategy in the months ahead.

The COVID-19 pandemic has triggered a sharp and deep recession. A recession is measured from a peak in economic activity to a trough in economic activity. As such, this recession has technically been very short. Relative to other recessions in recent decades, it is very deep, with an estimated -12% decline in Gross Domestic Product. This is three times as deep of a recession as the downturn which accompanied the financial crisis of 2008-2009. With this said, we expect a strong rebound in activity in the third quarter, followed by much slower growth until the widespread distribution of a vaccine triggers a surge in economic growth, hopefully in the second half of 2021.

______________________________________________________________________________________________________

Equity Recap

Domestic equities saw a sharp rise in Q2 of 2020, as the S&P 500 finished up +20.54%. Profit growth slowed dramatically in some sectors in the second quarter, however it is important to note that the largest earnings decline appeared to be in the least important sectors in the stock market as measured by their contributions to earnings and overall market cap. The ability of many key sectors such as health care, technology, consumer staples and utilities, to ride out the pandemic relatively unscathed, may be a reason for the resilience of the stock market.

International stocks saw strong gains in Q2, with developed stocks up +14.88% and emerging stocks up +18.08%. Both U.S. and international stocks sold off at the height of the COVID-19 crisis, but the valuation gap between U.S. and international stocks that persisted throughout the recent expansion persists today. However, this dynamic could shift in the next expansion. The long-term growth prospects of international market economies still look better than for U.S. equities at this time. Valuations remain cheaper overseas and the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

_____________________________________________________________________________________________

Fixed Income Recap

Bonds have continued to insulate investors against losses in 2020, with U.S. bonds returning +2.90% and international bond returning +1.76% for the quarter. The Federal Reserve has cut rates to 0-0.25%, committed to unlimited asset purchases, and has implemented several lending facilities. These measures help financial market liquidity and provide access to credit. Although the Fed has provided unprecedented support already, there is still more capacity within the existing toolkit available. One thing the Federal Open Market Committee (FOMC) has said explicitly is that they are “not even thinking about raising rates.”

Given the recent events, fixed income has quickly become a challenging landscape as nominal Treasury yields have fallen to historic lows and real yields (yields minus inflation) are negative. In this low rate environment, investors will continue to hunt for yield. While the downturn has caused high yield spreads to widen, defaults are likely to rise, so careful security selection is critical. Additionally, high-quality fixed income will continue to play an important role in providing investors with protection if the recession should deepen. Proper diversification in the fixed income space is critical.

______________________________________________________________________________________________

2020 Outlook

Given the extraordinary disruption to the U.S. and global economy this year, it is remarkable how resilient the financial markets have proven to be thus far. Investors should not take this for granted. The next few months should answer many questions regarding the race to produce a vaccine for COVID-19, as well as the pace and shape of the U.S. and global recoveries from the social distancing recession. Despite the recent rebound in markets, the economy, labor market and earnings recoveries will likely be much slower. With additional risks ahead such as a resurgence of the virus and the election in November, investors would likely benefit from a focus on quality in equity and fixed income, with a balanced approach to confront a range of outcomes in one of the most difficult and unusual years in modern history.

Investors should recognize that their plan should account for periods of negative returns and that attempting to time the market is extremely difficult and dangerous. It is important to note, that while we are not yet out of the woods, this period of large market declines has led to opportunities for investors if they are properly positioned, allowing for some great rebalancing opportunities within their portfolio. Looking forward, we believe that it is important for investors to stick to their plan, especially if their plan was designed and tested for markets like we are currently experiencing. If investors attempt to abandon their plan now, they run the risk of jeopardizing their financial success and causing long-term irreversible damage.

Controlling what you can control, such as spending, and not attempting to time the markets, are key in environments in which we face. If you are a client, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

2020 Quarterly Commentary Q2

Contributed by: Beth Parks

Market Performance Overview

_____________________________________________________________________________________________

Economic Update

The first half of 2020 will be remembered as a very difficult and extraordinary time in modern history. COVID-19 and social distancing have triggered a very deep recession, which even with a partial reopening has left more people unemployed than any time since the great depression. Massive fiscal and monetary stimulus have softened the impacts of the recession, but also raises questions about long term financial stability. Political and racial tensions have risen also, resulting in massive nationwide protests.

Despite a very sharp correction in equities in the first quarter, markets staged a remarkable recovery in the second quarter, leaving many to wonder whether their portfolios can continue to be resilient in the face of such turmoil and uncertainty.

The third quarter of 2020 should provide some answers to this question as we get a clearer picture of the trajectory of the pandemic and the pace and shape of the economic recovery. We will also likely get a better idea of the scope of further fiscal and monetary support and investors will begin to focus intently on the implications of the November elections. All these issues, along with behavior of markets themselves, should shape investment strategy in the months ahead.

The COVID-19 pandemic has triggered a sharp and deep recession. A recession is measured from a peak in economic activity to a trough in economic activity. As such, this recession has technically been very short. Relative to other recessions in recent decades, it is very deep, with an estimated -12% decline in Gross Domestic Product. This is three times as deep of a recession as the downturn which accompanied the financial crisis of 2008-2009. With this said, we expect a strong rebound in activity in the third quarter, followed by much slower growth until the widespread distribution of a vaccine triggers a surge in economic growth, hopefully in the second half of 2021.

______________________________________________________________________________________________________

Equity Recap

Domestic equities saw a sharp rise in Q2 of 2020, as the S&P 500 finished up +20.54%. Profit growth slowed dramatically in some sectors in the second quarter, however it is important to note that the largest earnings decline appeared to be in the least important sectors in the stock market as measured by their contributions to earnings and overall market cap. The ability of many key sectors such as health care, technology, consumer staples and utilities, to ride out the pandemic relatively unscathed, may be a reason for the resilience of the stock market.

International stocks saw strong gains in Q2, with developed stocks up +14.88% and emerging stocks up +18.08%. Both U.S. and international stocks sold off at the height of the COVID-19 crisis, but the valuation gap between U.S. and international stocks that persisted throughout the recent expansion persists today. However, this dynamic could shift in the next expansion. The long-term growth prospects of international market economies still look better than for U.S. equities at this time. Valuations remain cheaper overseas and the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

_____________________________________________________________________________________________

Fixed Income Recap

Bonds have continued to insulate investors against losses in 2020, with U.S. bonds returning +2.90% and international bond returning +1.76% for the quarter. The Federal Reserve has cut rates to 0-0.25%, committed to unlimited asset purchases, and has implemented several lending facilities. These measures help financial market liquidity and provide access to credit. Although the Fed has provided unprecedented support already, there is still more capacity within the existing toolkit available. One thing the Federal Open Market Committee (FOMC) has said explicitly is that they are “not even thinking about raising rates.”

Given the recent events, fixed income has quickly become a challenging landscape as nominal Treasury yields have fallen to historic lows and real yields (yields minus inflation) are negative. In this low rate environment, investors will continue to hunt for yield. While the downturn has caused high yield spreads to widen, defaults are likely to rise, so careful security selection is critical. Additionally, high-quality fixed income will continue to play an important role in providing investors with protection if the recession should deepen. Proper diversification in the fixed income space is critical.

______________________________________________________________________________________________

2020 Outlook

Given the extraordinary disruption to the U.S. and global economy this year, it is remarkable how resilient the financial markets have proven to be thus far. Investors should not take this for granted. The next few months should answer many questions regarding the race to produce a vaccine for COVID-19, as well as the pace and shape of the U.S. and global recoveries from the social distancing recession. Despite the recent rebound in markets, the economy, labor market and earnings recoveries will likely be much slower. With additional risks ahead such as a resurgence of the virus and the election in November, investors would likely benefit from a focus on quality in equity and fixed income, with a balanced approach to confront a range of outcomes in one of the most difficult and unusual years in modern history.

Investors should recognize that their plan should account for periods of negative returns and that attempting to time the market is extremely difficult and dangerous. It is important to note, that while we are not yet out of the woods, this period of large market declines has led to opportunities for investors if they are properly positioned, allowing for some great rebalancing opportunities within their portfolio. Looking forward, we believe that it is important for investors to stick to their plan, especially if their plan was designed and tested for markets like we are currently experiencing. If investors attempt to abandon their plan now, they run the risk of jeopardizing their financial success and causing long-term irreversible damage.

Controlling what you can control, such as spending, and not attempting to time the markets, are key in environments in which we face. If you are a client, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Beth Parks

Share this post with your friends