Market Performance Overview

- Domestic equities were up during Q3, finishing +8.93% for the quarter.

- Foreign equities were positive for the quarter, returning +4.80% in developed markets and +9.56% in emerging markets.

- Domestic bonds were positive in Q3, returning +0.62% for the quarter.

- Foreign bonds finished positively for the quarter, finishing +0.68%.

__________________________________________________________________________________________________

Economic Update

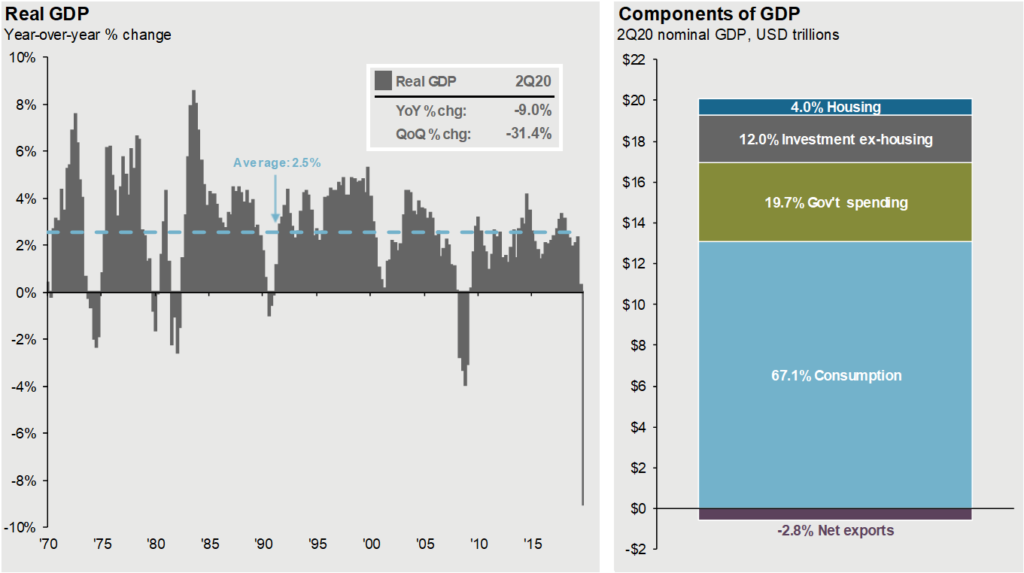

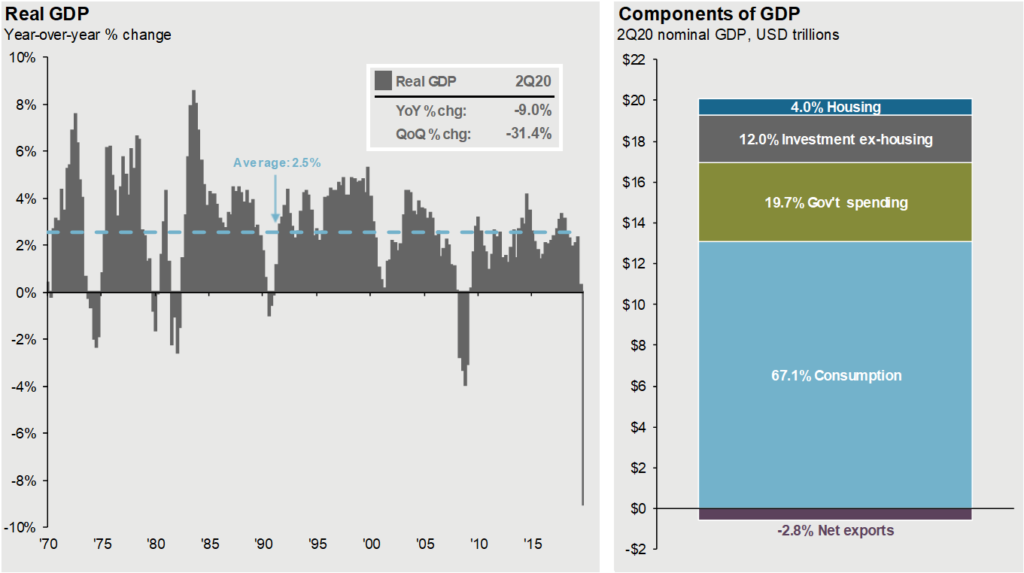

It goes without saying that 2020 has turned out to be one of the most difficult and extraordinary years in modern history. A pandemic has swept the globe, killing more than one million people worldwide and over 200,000 in the United States. Social distancing triggered a very deep recession in Q2. While the summer months saw a sharp bounce upward in output following the drop in the spring, both real Gross Domestic Product (as seen in the chart below) and employment remain far below their levels at the start of the year, with further progress being impeded by the continued pandemic.

Massive fiscal and monetary stimulus measures have softened the impacts of the recession but have also raised questions about long-term financial stability. In addition, the political tension and uncertainty remains very high in the U.S. as the nation approaches the November elections. Through it all, despite a very sharp decline in equities in the first quarter, markets have staged a remarkable recovery leaving many to wonder whether their portfolios can continue to be resilient in the face of such turmoil and uncertainty.

The fourth quarter of 2020 should provide some answers to these questions as we get a clearer picture of the trajectory of the pandemic and the pace of economic recovery. We will also presumably get more clarity on the direction of both politics and policy. All these issues, along with the behavior of markets themselves, should shape investment strategy in the months ahead. We believe that developing such a strategy should start with a broad assessment of the economic and financial landscape. This has always been our fundamental goal when assisting our clients.

__________________________________________________________________________________________________

Equity Recap

U.S. equities have recovered significantly from the March lows and have done so at a record speed. Domestic equities were positive during the third quarter of 2020, with the S&P 500 finishing up +8.93% for the quarter and +5.57% thus far in 2020. Valuations in Q3 shifted higher and now sit well above historical averages. However, investors should recognize that any valuation based on future 12-month earnings will look high when earnings are in an unusually deep recession. Valuations look much closer to normal levels based on their earnings before the coronavirus. While markets may experience volatility ahead with risks such as a resurgence of the virus or election uncertainty, ultra-low rates and support from the Federal Reserve provide meaningful support to equities.

International stocks saw strong gains in Q3, with developed country stocks up +4.80% and emerging country (EM) stocks up +9.56% for the quarter. Both U.S. and international stocks sold off at the height of the COVID crisis, but the valuation gap between U.S. and international stocks that persisted throughout the recent expansion persists today. However, this dynamic could shift in the next expansion. The long-term growth prospects of EM economies still look better than the U.S. and valuations remain cheaper overseas. Further, the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

__________________________________________________________________________________________________

Fixed Income Recap

Bonds have continued to insulate investors in 2020, with U.S. bonds returning +0.62% and international bonds returning +0.68% for the quarter. U.S. bonds continue to outpace man asset categories thus far in 2020. With the Federal funds rate at 0-0.25% and with expectations for low rates in the coming years, nominal Treasury yields have fallen to historic lows and real yields are negative. In this low rate environment, investors will continue to hunt for yield. Although interest rate spreads have widened for lower quality bonds, they have come back meaningfully, making their risk-return dynamic less attractive. Despite current unattractive yields, high quality fixed income will continue to play an important role in providing investors with downside protection and diversification.

In August, the Federal Reserve adopted an “Average Inflation Targeting” operating strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. In order to achieve this, they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for a period of time. Critically, the Fed’s willingness to buy almost unlimited quantities of Treasuries is enabling the Federal Government to deploy the most aggressive fiscal stimulus since World War II. If this continues, the Fed may well achieve its above 2% inflation goal within the next few years.

__________________________________________________________________________________________________

2020 Outlook

Despite the strong rebound in stock prices, the economic and labor market recoveries will likely be much slower. With additional risks ahead such as a resurgence of the virus and the election in November, investors would likely benefit from a focus on quality in equity and fixed income, with a balanced approach to confront a range of outcomes. Long-term, we expect that the continued progress on a vaccine will lead to an eventual return to normal. This will continue to push the economy toward a recovery in the labor market and in the rise of corporate profits back to pre-pandemic levels.

While the volatility in the meantime may be unsettling, investors should recognize that their plan should account for periods of flat or negative returns. These periods of volatility lead to opportunities for investors who are properly positioned, allowing for rebalancing opportunities within their portfolio. If you are a client, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

2020 Quarterly Commentary Q3

Contributed by: Beth Parks

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

It goes without saying that 2020 has turned out to be one of the most difficult and extraordinary years in modern history. A pandemic has swept the globe, killing more than one million people worldwide and over 200,000 in the United States. Social distancing triggered a very deep recession in Q2. While the summer months saw a sharp bounce upward in output following the drop in the spring, both real Gross Domestic Product (as seen in the chart below) and employment remain far below their levels at the start of the year, with further progress being impeded by the continued pandemic.

Massive fiscal and monetary stimulus measures have softened the impacts of the recession but have also raised questions about long-term financial stability. In addition, the political tension and uncertainty remains very high in the U.S. as the nation approaches the November elections. Through it all, despite a very sharp decline in equities in the first quarter, markets have staged a remarkable recovery leaving many to wonder whether their portfolios can continue to be resilient in the face of such turmoil and uncertainty.

The fourth quarter of 2020 should provide some answers to these questions as we get a clearer picture of the trajectory of the pandemic and the pace of economic recovery. We will also presumably get more clarity on the direction of both politics and policy. All these issues, along with the behavior of markets themselves, should shape investment strategy in the months ahead. We believe that developing such a strategy should start with a broad assessment of the economic and financial landscape. This has always been our fundamental goal when assisting our clients.

__________________________________________________________________________________________________

Equity Recap

U.S. equities have recovered significantly from the March lows and have done so at a record speed. Domestic equities were positive during the third quarter of 2020, with the S&P 500 finishing up +8.93% for the quarter and +5.57% thus far in 2020. Valuations in Q3 shifted higher and now sit well above historical averages. However, investors should recognize that any valuation based on future 12-month earnings will look high when earnings are in an unusually deep recession. Valuations look much closer to normal levels based on their earnings before the coronavirus. While markets may experience volatility ahead with risks such as a resurgence of the virus or election uncertainty, ultra-low rates and support from the Federal Reserve provide meaningful support to equities.

International stocks saw strong gains in Q3, with developed country stocks up +4.80% and emerging country (EM) stocks up +9.56% for the quarter. Both U.S. and international stocks sold off at the height of the COVID crisis, but the valuation gap between U.S. and international stocks that persisted throughout the recent expansion persists today. However, this dynamic could shift in the next expansion. The long-term growth prospects of EM economies still look better than the U.S. and valuations remain cheaper overseas. Further, the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

__________________________________________________________________________________________________

Fixed Income Recap

Bonds have continued to insulate investors in 2020, with U.S. bonds returning +0.62% and international bonds returning +0.68% for the quarter. U.S. bonds continue to outpace man asset categories thus far in 2020. With the Federal funds rate at 0-0.25% and with expectations for low rates in the coming years, nominal Treasury yields have fallen to historic lows and real yields are negative. In this low rate environment, investors will continue to hunt for yield. Although interest rate spreads have widened for lower quality bonds, they have come back meaningfully, making their risk-return dynamic less attractive. Despite current unattractive yields, high quality fixed income will continue to play an important role in providing investors with downside protection and diversification.

In August, the Federal Reserve adopted an “Average Inflation Targeting” operating strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. In order to achieve this, they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for a period of time. Critically, the Fed’s willingness to buy almost unlimited quantities of Treasuries is enabling the Federal Government to deploy the most aggressive fiscal stimulus since World War II. If this continues, the Fed may well achieve its above 2% inflation goal within the next few years.

__________________________________________________________________________________________________

2020 Outlook

Despite the strong rebound in stock prices, the economic and labor market recoveries will likely be much slower. With additional risks ahead such as a resurgence of the virus and the election in November, investors would likely benefit from a focus on quality in equity and fixed income, with a balanced approach to confront a range of outcomes. Long-term, we expect that the continued progress on a vaccine will lead to an eventual return to normal. This will continue to push the economy toward a recovery in the labor market and in the rise of corporate profits back to pre-pandemic levels.

While the volatility in the meantime may be unsettling, investors should recognize that their plan should account for periods of flat or negative returns. These periods of volatility lead to opportunities for investors who are properly positioned, allowing for rebalancing opportunities within their portfolio. If you are a client, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Beth Parks

Share this post with your friends