Market Performance Overview

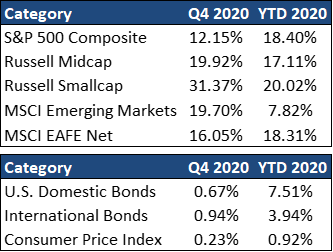

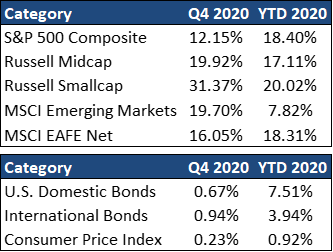

- Domestic equities were up during Q4, finishing +12.15% for the quarter and +18.40 in 2020.

- Foreign equities were positive for the quarter, returning +16.05% (+7.82 YTD) in developed markets and +19.70% (+18.31% YTD) in emerging markets.

- Domestic bonds were positive in Q4, returning +0.67% for the quarter and +7.51% in 2020.

- Foreign bonds finished positively for the quarter, finishing +0.94% and +3.94% in 2020.

__________________________________________________________________________________________________

Economic Update

2020 turned out to be one of the most difficult and extraordinary years in modern history. A pandemic swept the globe, resulting in social distancing measures and reduced business activity, which triggered a very deep recession in Q2. While the summer months saw a sharp bounce upward in output following the drop in the spring, both real Gross Domestic Product (GDP) and employment remain far below their levels at the start of 2020, with further progress being impeded by the continued pandemic. The approval of several effective vaccines in the U.S. should allow for the inoculation of roughly 150 million people in the first half of 2021, allowing life to largely return to normal by the fall of 2021.

The heart of the economic damage has been with consumers and businesses, resulting in the U.S. government delivering a multi-trillion-dollar fiscal package to mitigate permanent economic damage at the onset of the pandemic. Pending further fiscal support and possible infrastructure spending, the budget deficit could further increase in 2021, but will likely be below 2020 levels. However, the national debt as a share of GDP will continue to grow to the highest levels since WWII. While we do not believe this will result in a fiscal crisis in the next few years, a failure to rein in deficits and debt monetization once the economy accelerates in the wake of a vaccine could lead to significant problems. This suggests that eventually the government will have to make some tough choices regarding tax hikes and spending cuts.

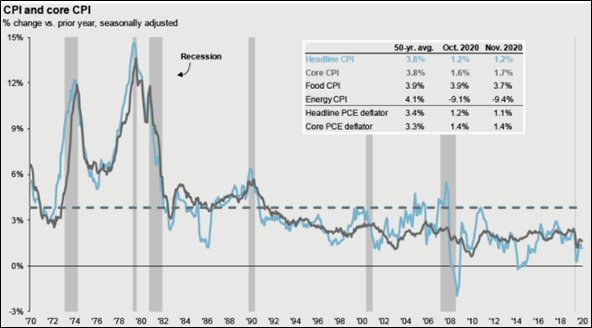

The onset of the recession, combined with a collapse in oil prices, triggered a decline in already low inflation. Although inflation normally reaches a low after the end of a recession, things may be a little different this time around, particularly given the potential for further fiscal stimulus, the continuing extra costs of operating during a pandemic and the likelihood of an economic surge following the distribution of a vaccine. Consequently, we expect inflation, using both CPI and personal deflator measures, to edge over 2% by the middle of 2021 and stay at close to this pace into 2022.

__________________________________________________________________________________________________

Equity Recap

U.S. equities continued their recovery in Q4 of 2020. Domestic equities were positive during the fourth quarter of 2020, with the S&P 500 finishing up +12.15% for the quarter and +18.40 % in 2020. As markets look through the virus and the downturn to the recovery, valuations are well above historical averages. Investors should recognize that earnings are likely to continue to grow quickly in the year ahead which should lead to some compression in these ratios. Moreover, a continuation of relatively low interest rates likely justifies some elevation of valuation measures above their historical averages. Still, rich valuations may constrain equity returns over the long run. Consequently, investors may want to consider diversifying their equity exposure by adding more to value stocks as well as reducing weightings to the very largest companies in the stock market.

International stocks also saw strong gains in Q4, with developed country stocks up +16.05% and finishing +18.31% in 2020. Emerging country (EM) stocks were up +19.70% for the quarter, finishing +7.82 in 2020. Both U.S. and international stocks sold off at the height of the COVID crisis, but the valuation gap between U.S. and international stocks that persisted throughout the recent expansion persists today. However, this dynamic could shift in the next expansion. The long-term growth prospects of EM economies still look better than for the U.S., valuations remain cheaper overseas, and the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

__________________________________________________________________________________________________

Fixed Income Recap

U.S. bonds returned +0.67% during the fourth quarter, finishing +7.51% in 2020. International bonds returned +0.94% for the quarter, while finishing +3.94% in 2020. With the Federal funds rate at 0-0.25%, nominal Treasury yields have fallen to near-historic lows and real yields are negative. In this low-rate environment, investors will continue to hunt for yield. Although spreads had widened in riskier fixed income, they have come in meaningfully, making risk-return dynamics less attractive. However, despite unattractive yields, high quality fixed income will continue to play an important role in providing investors with downside protection and diversification

In August, the Fed adopted an “Average Inflation Targeting” strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. To achieve this, they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for some time. Although the Fed pledged to maintain its current asset purchases until “substantial further progress” has been made to achieving its inflation and employment goals, it is important to note that this timetable suggests that the Fed will reduce its bond purchases well in advance of any increase in short-term interest rates. This, in turn, suggests a steepening of the yield curve as the economy continues to recover in 2021.

__________________________________________________________________________________________________

2021 Outlook

Given the extraordinary disruption to the U.S. and global economies in 2020, it is remarkable how resilient financial markets have proven to be. However, investors should recognize that the blessing of strong performance brings with it the challenge of higher valuations. The next few months should answer many questions regarding our collective success in ending the pandemic as well as the pace and shape of the U.S. and global recoveries from the social distancing recession. Given all the uncertainties surrounding these and other questions, investors would be wise to maintain a somewhat defensive and very diversified stance after one of the most difficult and unusual years in modern history.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

2020 Quarterly Commentary Q4

Contributed by: Beth Parks

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

2020 turned out to be one of the most difficult and extraordinary years in modern history. A pandemic swept the globe, resulting in social distancing measures and reduced business activity, which triggered a very deep recession in Q2. While the summer months saw a sharp bounce upward in output following the drop in the spring, both real Gross Domestic Product (GDP) and employment remain far below their levels at the start of 2020, with further progress being impeded by the continued pandemic. The approval of several effective vaccines in the U.S. should allow for the inoculation of roughly 150 million people in the first half of 2021, allowing life to largely return to normal by the fall of 2021.

The heart of the economic damage has been with consumers and businesses, resulting in the U.S. government delivering a multi-trillion-dollar fiscal package to mitigate permanent economic damage at the onset of the pandemic. Pending further fiscal support and possible infrastructure spending, the budget deficit could further increase in 2021, but will likely be below 2020 levels. However, the national debt as a share of GDP will continue to grow to the highest levels since WWII. While we do not believe this will result in a fiscal crisis in the next few years, a failure to rein in deficits and debt monetization once the economy accelerates in the wake of a vaccine could lead to significant problems. This suggests that eventually the government will have to make some tough choices regarding tax hikes and spending cuts.

The onset of the recession, combined with a collapse in oil prices, triggered a decline in already low inflation. Although inflation normally reaches a low after the end of a recession, things may be a little different this time around, particularly given the potential for further fiscal stimulus, the continuing extra costs of operating during a pandemic and the likelihood of an economic surge following the distribution of a vaccine. Consequently, we expect inflation, using both CPI and personal deflator measures, to edge over 2% by the middle of 2021 and stay at close to this pace into 2022.

__________________________________________________________________________________________________

Equity Recap

U.S. equities continued their recovery in Q4 of 2020. Domestic equities were positive during the fourth quarter of 2020, with the S&P 500 finishing up +12.15% for the quarter and +18.40 % in 2020. As markets look through the virus and the downturn to the recovery, valuations are well above historical averages. Investors should recognize that earnings are likely to continue to grow quickly in the year ahead which should lead to some compression in these ratios. Moreover, a continuation of relatively low interest rates likely justifies some elevation of valuation measures above their historical averages. Still, rich valuations may constrain equity returns over the long run. Consequently, investors may want to consider diversifying their equity exposure by adding more to value stocks as well as reducing weightings to the very largest companies in the stock market.

International stocks also saw strong gains in Q4, with developed country stocks up +16.05% and finishing +18.31% in 2020. Emerging country (EM) stocks were up +19.70% for the quarter, finishing +7.82 in 2020. Both U.S. and international stocks sold off at the height of the COVID crisis, but the valuation gap between U.S. and international stocks that persisted throughout the recent expansion persists today. However, this dynamic could shift in the next expansion. The long-term growth prospects of EM economies still look better than for the U.S., valuations remain cheaper overseas, and the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for turnaround with more promising efforts towards fiscal integration.

__________________________________________________________________________________________________

Fixed Income Recap

U.S. bonds returned +0.67% during the fourth quarter, finishing +7.51% in 2020. International bonds returned +0.94% for the quarter, while finishing +3.94% in 2020. With the Federal funds rate at 0-0.25%, nominal Treasury yields have fallen to near-historic lows and real yields are negative. In this low-rate environment, investors will continue to hunt for yield. Although spreads had widened in riskier fixed income, they have come in meaningfully, making risk-return dynamics less attractive. However, despite unattractive yields, high quality fixed income will continue to play an important role in providing investors with downside protection and diversification

In August, the Fed adopted an “Average Inflation Targeting” strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. To achieve this, they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for some time. Although the Fed pledged to maintain its current asset purchases until “substantial further progress” has been made to achieving its inflation and employment goals, it is important to note that this timetable suggests that the Fed will reduce its bond purchases well in advance of any increase in short-term interest rates. This, in turn, suggests a steepening of the yield curve as the economy continues to recover in 2021.

__________________________________________________________________________________________________

2021 Outlook

Given the extraordinary disruption to the U.S. and global economies in 2020, it is remarkable how resilient financial markets have proven to be. However, investors should recognize that the blessing of strong performance brings with it the challenge of higher valuations. The next few months should answer many questions regarding our collective success in ending the pandemic as well as the pace and shape of the U.S. and global recoveries from the social distancing recession. Given all the uncertainties surrounding these and other questions, investors would be wise to maintain a somewhat defensive and very diversified stance after one of the most difficult and unusual years in modern history.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Beth Parks

Share this post with your friends