Market Performance Overview

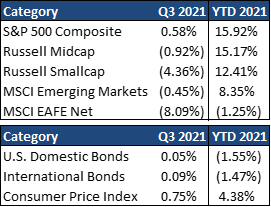

- Domestic equities were positive in Q3, with large cap stocks finishing +0.58% for the quarter and +15.92% YTD.

- Foreign equities were negative in Q3, returning -0.45% in developed markets and -8.09% in emerging markets. Developed markets are +8.35% YTD while emerging markets are -1.25% in 2021.

- Domestic bonds were positive in Q3, returning +0.05%, while returning -1.55% YTD.

- Foreign bonds were positive in Q3, finishing +0.09%, while returning -1.47% YTD.

__________________________________________________________________________________________________

Economic Update

Entering the fall of 2021, the American economy is continuing to rebound from the pandemic recession. However, the road to recovery has been bumpier than expected recently, with the Delta variant slowing the travel and entertainment industries, continuing to constrain supply chains, boosting inflation and impeding production. Thankfully, there are now signs that this latest wave of the pandemic is beginning to ebb. If this continues, the economy should reaccelerate, helped by strong gains in equity markets and home prices, pent up consumer demand and the continued impact of the fiscal stimulus.

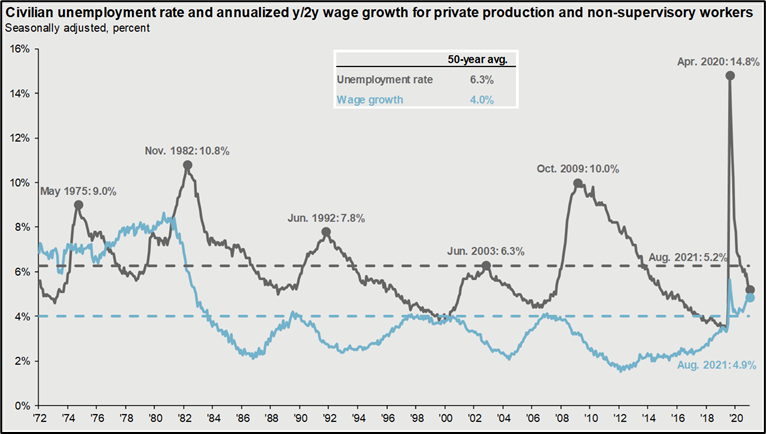

With surging labor demand, employers have had to raise wages to attract workers. While recent employment reports have yielded somewhat disappointing results, rising wages and indicators of robust labor demand suggest slower job gains are primarily an issue of labor supply. This should keep wages elevated as the recovery continues. Higher wages should feed through to higher inflation, implying that the economy could reach “maximum employment” sooner than later.

The Federal Government’s debt-to-GDP ratio is at the highest level since WWII, in part due to the recent stimulus packages that have been passed. The $1.9 trillion American Rescue Plan is still working itself through the system and will continue to support the economy through the end of the year and into 2022. Further, negotiations continue in Washington on additional spending aimed at infrastructure, childcare, and education, among other initiatives. However, the new stimulus would be stretched out over a decade and at least partially financed by tax increases, providing much less short-term stimulus to the economy than aid packages passed over the previous 18 months.

The months ahead may bring economic challenges as strained supply chains, rising inflation and labor market distortions from the pandemic remain headwinds for the U.S. recovery. In addition, fiscal and monetary policy is set to become slightly less accommodative from both the Federal Reserve and the Federal Government. Looking forward into 2022 and beyond, the global economy should finally see synchronized growth as the pandemic continues to retreat.

__________________________________________________________________________________________________

Equity Recap

Domestic equities performed well through the first half of 2021, however, have slowed during the third quarter, with large company stocks yielding  just +0.58% in Q3 and remaining +15.92% year to date in 2021. Earnings have recovered spectacularly since the big declines in early 2020 and are now expected to hit a new all-time high in 2021. This reflects not only stellar profits in sectors like technology and health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most in 2020.

just +0.58% in Q3 and remaining +15.92% year to date in 2021. Earnings have recovered spectacularly since the big declines in early 2020 and are now expected to hit a new all-time high in 2021. This reflects not only stellar profits in sectors like technology and health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most in 2020.

The S&P 500 valuation dispersion shows a widening valuation gap between the most and least favored stocks in the index when compared to its 25-year average. The wide dispersion in valuations points to an opportunity for active management in the coming months. After many years of strong outperformance from growth stocks, most notably during the pandemic in 2020, value has started to recover. Even with the most recent outperformance, value stocks appear to remain cheap relative to growth stocks when compared to long-term averages. Additionally, value generally tends to outperform growth during periods of above-trend economic activity and rising interest rates.

While the expected synchronized global recovery has been delayed, it has not been derailed as vaccination progress overseas has gained speed with many countries now outpacing the U.S. We expect the global economy to continue to grow above trend over the course of next year and for robust earnings growth to be an important catalyst for international markets. In addition, valuations remain attractive with both emerging market and developed market stocks at some of their cheapest levels relative to the U.S. in the last 20 years. This, along with a global post-pandemic economic rebound, lower trade tensions and the prospect of a lower dollar in the long run, argues for maintaining our allocation to international equities.

__________________________________________________________________________________________________

Fixed Income Recap

U.S. bonds saw slight gains this quarter, finishing +0.05%, while remaining -1.55% year to date. Looking back to the first half of 2020, the Federal Reserve took strong action to support the economy including cutting the federal funds rate to a range of 0-0.25%, opening a wide range of facilities to support the bond market and adding dramatically to its balance sheet. In addition, in August of 2020, the Fed adopted an “Average Inflation Targeting” strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. To achieve this target, they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for some time.

The combination of these very easy monetary policy positions and a recession has left 10-year Treasury yields at very low levels. Interest rates will likely move higher into 2022, against the backdrop of rising inflation, faster growth, and a less accommodative Federal Reserve as they begin reducing bond purchases. There continues to be a place in portfolios for fixed income assets to provide diversification and protection in the case of an equity market or economic relapse, but investors may want to focus on shorter duration bonds to be well-positioned if long-term rates resume their ascent.

__________________________________________________________________________________________________

2021 Outlook & Beyond

Looking forward to the end of 2021 and into 2022, returns will depend more heavily on profit margins. Rising wages, supply chain disruptions, and higher taxes could all negatively impact profit margins over the next few years. However, while elevated valuations may pose a speed limit for the market, the outlook for returns remains positive amidst strong fundamentals and corporate profitability.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

2021 Quarterly Commentary Q3

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

Entering the fall of 2021, the American economy is continuing to rebound from the pandemic recession. However, the road to recovery has been bumpier than expected recently, with the Delta variant slowing the travel and entertainment industries, continuing to constrain supply chains, boosting inflation and impeding production. Thankfully, there are now signs that this latest wave of the pandemic is beginning to ebb. If this continues, the economy should reaccelerate, helped by strong gains in equity markets and home prices, pent up consumer demand and the continued impact of the fiscal stimulus.

With surging labor demand, employers have had to raise wages to attract workers. While recent employment reports have yielded somewhat disappointing results, rising wages and indicators of robust labor demand suggest slower job gains are primarily an issue of labor supply. This should keep wages elevated as the recovery continues. Higher wages should feed through to higher inflation, implying that the economy could reach “maximum employment” sooner than later.

The Federal Government’s debt-to-GDP ratio is at the highest level since WWII, in part due to the recent stimulus packages that have been passed. The $1.9 trillion American Rescue Plan is still working itself through the system and will continue to support the economy through the end of the year and into 2022. Further, negotiations continue in Washington on additional spending aimed at infrastructure, childcare, and education, among other initiatives. However, the new stimulus would be stretched out over a decade and at least partially financed by tax increases, providing much less short-term stimulus to the economy than aid packages passed over the previous 18 months.

The months ahead may bring economic challenges as strained supply chains, rising inflation and labor market distortions from the pandemic remain headwinds for the U.S. recovery. In addition, fiscal and monetary policy is set to become slightly less accommodative from both the Federal Reserve and the Federal Government. Looking forward into 2022 and beyond, the global economy should finally see synchronized growth as the pandemic continues to retreat.

__________________________________________________________________________________________________

Equity Recap

Domestic equities performed well through the first half of 2021, however, have slowed during the third quarter, with large company stocks yielding just +0.58% in Q3 and remaining +15.92% year to date in 2021. Earnings have recovered spectacularly since the big declines in early 2020 and are now expected to hit a new all-time high in 2021. This reflects not only stellar profits in sectors like technology and health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most in 2020.

just +0.58% in Q3 and remaining +15.92% year to date in 2021. Earnings have recovered spectacularly since the big declines in early 2020 and are now expected to hit a new all-time high in 2021. This reflects not only stellar profits in sectors like technology and health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most in 2020.

The S&P 500 valuation dispersion shows a widening valuation gap between the most and least favored stocks in the index when compared to its 25-year average. The wide dispersion in valuations points to an opportunity for active management in the coming months. After many years of strong outperformance from growth stocks, most notably during the pandemic in 2020, value has started to recover. Even with the most recent outperformance, value stocks appear to remain cheap relative to growth stocks when compared to long-term averages. Additionally, value generally tends to outperform growth during periods of above-trend economic activity and rising interest rates.

While the expected synchronized global recovery has been delayed, it has not been derailed as vaccination progress overseas has gained speed with many countries now outpacing the U.S. We expect the global economy to continue to grow above trend over the course of next year and for robust earnings growth to be an important catalyst for international markets. In addition, valuations remain attractive with both emerging market and developed market stocks at some of their cheapest levels relative to the U.S. in the last 20 years. This, along with a global post-pandemic economic rebound, lower trade tensions and the prospect of a lower dollar in the long run, argues for maintaining our allocation to international equities.

__________________________________________________________________________________________________

Fixed Income Recap

U.S. bonds saw slight gains this quarter, finishing +0.05%, while remaining -1.55% year to date. Looking back to the first half of 2020, the Federal Reserve took strong action to support the economy including cutting the federal funds rate to a range of 0-0.25%, opening a wide range of facilities to support the bond market and adding dramatically to its balance sheet. In addition, in August of 2020, the Fed adopted an “Average Inflation Targeting” strategy, by which they will aim to achieve inflation of above 2% for some time to make up for years of undershooting this target. To achieve this target, they have pledged to hold the federal funds rate at its current 0-0.25% target range until inflation is at 2% and on track to moderately exceed 2% for some time.

The combination of these very easy monetary policy positions and a recession has left 10-year Treasury yields at very low levels. Interest rates will likely move higher into 2022, against the backdrop of rising inflation, faster growth, and a less accommodative Federal Reserve as they begin reducing bond purchases. There continues to be a place in portfolios for fixed income assets to provide diversification and protection in the case of an equity market or economic relapse, but investors may want to focus on shorter duration bonds to be well-positioned if long-term rates resume their ascent.

__________________________________________________________________________________________________

2021 Outlook & Beyond

Looking forward to the end of 2021 and into 2022, returns will depend more heavily on profit margins. Rising wages, supply chain disruptions, and higher taxes could all negatively impact profit margins over the next few years. However, while elevated valuations may pose a speed limit for the market, the outlook for returns remains positive amidst strong fundamentals and corporate profitability.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Brandon Bauer, CFP®

Share this post with your friends