Market Performance Overview

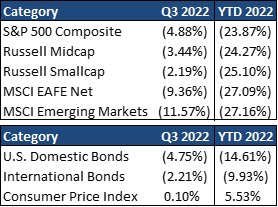

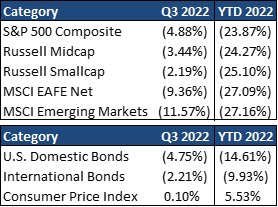

- Domestic equities were negative in Q3 with large cap stocks finishing -4.88% (-23.87% YTD).

- Foreign equities were negative in Q3 returning -9.36% in developed markets and -11.57% in emerging markets. YTD, developed markets are down -27.09% and emerging markets are down -27.16%.

- Domestic bonds were negative in Q3 returning -4.75% for the quarter (-14.61% YTD).

- Foreign bonds were negative in Q3 finishing the quarter at -2.21% (-9.93% YTD).

__________________________________________________________________________________________________

Economic Update

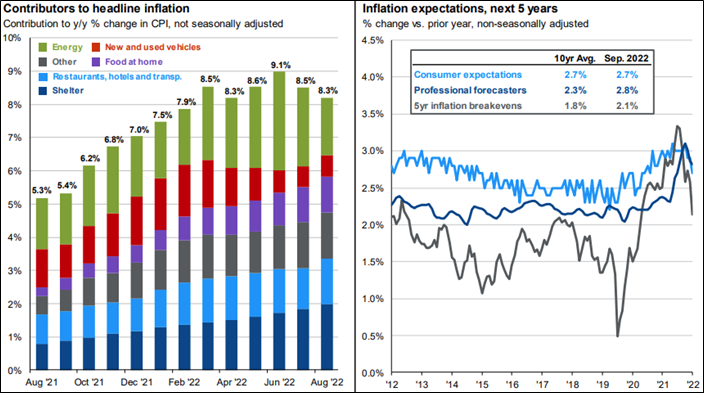

Economic and market conditions remained very challenging through the third quarter of this year. While year-over-year inflation appears to have peaked in June, the inflation outlook remains very uncertain due to Russia’s continued war in Ukraine, China’s strict COVID policy, and a tight U.S. labor market. In response, the Federal Reserve has doubled down on its hawkish stance by reducing its balance sheet, raising the federal funds rate by a total of 3% this year, and signaling further aggressive tightening moves going forward. Meanwhile, recession worries have increased due to ongoing fiscal drag, weakness overseas, and sharp increases in both interest rates and the dollar. Not surprisingly, this has led to further declines in both the stock and bonds markets. However, this does leave valuations at a much more reasonable level than at the start of the year. The questions investors are facing now is when to take advantage of these better valuations and which areas to overweight or underweight in a very complicated economic environment.

On the bright side, broad inflation pressures look set to ease in the year ahead. Wage growth will likely moderate as the labor market rebalances and shelter costs decelerate as younger households reach their rent limits. Global supply chains have also improved along with declining commodity prices, which should allow a broad range of goods and materials prices to stabilize. Meanwhile, long term inflation expectations from consumers, Treasury market investors, and professional forecasters are only slightly elevated from their historical averages, with average annual CPI inflation over the next five years expected to be within a range of 2.5% and 3.0%. While the pathway to “normal” will likely be bumpy, receding supply pressures and stable expectations should allow inflation to ease over the next few years, regardless of whether the economy falls into recession or not.

__________________________________________________________________________________________________

Equity Recap

Following a spectacular 2021, in which S&P 500 operating earnings per share (EPS) rose by 70%, profit growth is much slower in 2022. In the first  half of the year, operating EPS fell by 3.2% year-over-year and analysts now expect a less than 1% gain for full-year 2022. Companies may have difficulty even meeting these modest estimates. While energy companies will continue to benefit from high margins, elsewhere, rising labor costs, higher interest rates and slowing nominal sales growth should bite into profits. In addition, a much higher dollar will erode the value of overseas sales while recession concerns could lead company management to book more discretionary losses while they have a macroeconomic excuse to do so.

half of the year, operating EPS fell by 3.2% year-over-year and analysts now expect a less than 1% gain for full-year 2022. Companies may have difficulty even meeting these modest estimates. While energy companies will continue to benefit from high margins, elsewhere, rising labor costs, higher interest rates and slowing nominal sales growth should bite into profits. In addition, a much higher dollar will erode the value of overseas sales while recession concerns could lead company management to book more discretionary losses while they have a macroeconomic excuse to do so.

International equities have also had a very rough year with market declines across developed countries and emerging markets. The local markets of Europe, Japan and EM outside of China have sold off less than in the United States, but the sharp spike in the dollar has amplified these losses for U.S. investors. It is worth noting that the dollar is now at a near 40-year high in real terms relative to our major trading partners and should eventually decline. In addition, equity valuations outside the United States remain far below their U.S. counterparts and their long-term averages. For long-term investors, international equities should provide solid returns from these starting valuations. Moreover, the possibility of a ceasefire in Ukraine, more stable Chinese growth, or a pivot to a more dovish Fed would lead to a simultaneous rebound in both international currencies and equities.

__________________________________________________________________________________________________

Fixed Income Recap

A strong labor market and upside surprises on inflation in the first half of the year have pushed the Federal Reserve (Fed) to adopt a much more hawkish stance. At its September meeting, the Fed increased the federal funds rate by a third consecutive 0.75%, following increases of 0.25% and 0.50% in March and May, respectively. In total, this has brought the key rate to a range of 3.00%-3.25%. In the Summary of Economic Projections, the median expectation among FOMC members indicated cumulative further increases of 1.25% this year and 0.25% next year, taking the federal funds rate to a range of 4.25%-4.50% by the end of 2022 and 4.50%-4.75% by the end of 2023. Meanwhile, the Fed is continuing to reduce its massive bond holdings at a pace of $95 billion per month.

High inflation and the Fed’s much more hawkish stance have led to a sharp backup in bond yields so far this year, resulting in negative returns across fixed income markets. However, while the Fed appears likely to continue hiking rates through the end of the year, increased recession risks should limit further increases in long-term Treasury yields. Importantly, the sell-off in fixed income has also reduced valuations to much more attractive levels. With much higher yields, high-quality fixed income can now provide more of a buffer for portfolios in the case of a market correction or an economic downturn.

__________________________________________________________________________________________________

2022 Outlook & Beyond

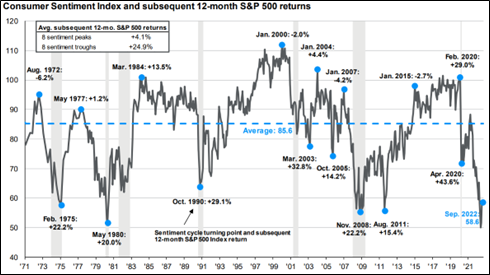

For many Americans, 2022 has been very disappointing with the Omicron variant prolonging the pandemic,  sharply rising inflation and interest rates, falling stock prices, and the shock of Russia’s brutal invasion of Ukraine. These factors, combined with a still very divided political environment, have driven consumer sentiment down to its lowest level on record.

sharply rising inflation and interest rates, falling stock prices, and the shock of Russia’s brutal invasion of Ukraine. These factors, combined with a still very divided political environment, have driven consumer sentiment down to its lowest level on record.

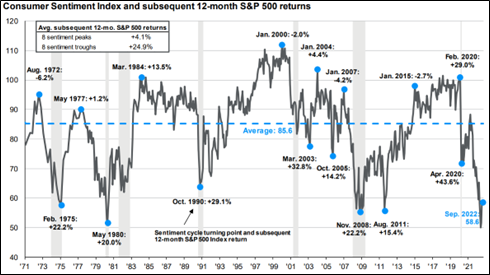

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets, stocks in particular. However, history demonstrates that trying to time markets in this way is a mistake. This slide shows consumer sentiment over the past 50 years with 8 distinct peaks and troughs and the S&P 500 gain or loss in the 12 months following. On average, buying at a confidence peak returned 4.1% while buying at a trough returned 24.9%.

Importantly, this is not to suggest that U.S. stocks will return anything like 24.9% in the year ahead, as many other factors will determine the actual outcome. However, it does rationalize that when planning for the rest of 2022 and beyond, investors should focus on fundamentals and valuations rather than how they feel about the world.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

2022 Quarterly Commentary Q3

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

Economic and market conditions remained very challenging through the third quarter of this year. While year-over-year inflation appears to have peaked in June, the inflation outlook remains very uncertain due to Russia’s continued war in Ukraine, China’s strict COVID policy, and a tight U.S. labor market. In response, the Federal Reserve has doubled down on its hawkish stance by reducing its balance sheet, raising the federal funds rate by a total of 3% this year, and signaling further aggressive tightening moves going forward. Meanwhile, recession worries have increased due to ongoing fiscal drag, weakness overseas, and sharp increases in both interest rates and the dollar. Not surprisingly, this has led to further declines in both the stock and bonds markets. However, this does leave valuations at a much more reasonable level than at the start of the year. The questions investors are facing now is when to take advantage of these better valuations and which areas to overweight or underweight in a very complicated economic environment.

On the bright side, broad inflation pressures look set to ease in the year ahead. Wage growth will likely moderate as the labor market rebalances and shelter costs decelerate as younger households reach their rent limits. Global supply chains have also improved along with declining commodity prices, which should allow a broad range of goods and materials prices to stabilize. Meanwhile, long term inflation expectations from consumers, Treasury market investors, and professional forecasters are only slightly elevated from their historical averages, with average annual CPI inflation over the next five years expected to be within a range of 2.5% and 3.0%. While the pathway to “normal” will likely be bumpy, receding supply pressures and stable expectations should allow inflation to ease over the next few years, regardless of whether the economy falls into recession or not.

__________________________________________________________________________________________________

Equity Recap

Following a spectacular 2021, in which S&P 500 operating earnings per share (EPS) rose by 70%, profit growth is much slower in 2022. In the first half of the year, operating EPS fell by 3.2% year-over-year and analysts now expect a less than 1% gain for full-year 2022. Companies may have difficulty even meeting these modest estimates. While energy companies will continue to benefit from high margins, elsewhere, rising labor costs, higher interest rates and slowing nominal sales growth should bite into profits. In addition, a much higher dollar will erode the value of overseas sales while recession concerns could lead company management to book more discretionary losses while they have a macroeconomic excuse to do so.

half of the year, operating EPS fell by 3.2% year-over-year and analysts now expect a less than 1% gain for full-year 2022. Companies may have difficulty even meeting these modest estimates. While energy companies will continue to benefit from high margins, elsewhere, rising labor costs, higher interest rates and slowing nominal sales growth should bite into profits. In addition, a much higher dollar will erode the value of overseas sales while recession concerns could lead company management to book more discretionary losses while they have a macroeconomic excuse to do so.

International equities have also had a very rough year with market declines across developed countries and emerging markets. The local markets of Europe, Japan and EM outside of China have sold off less than in the United States, but the sharp spike in the dollar has amplified these losses for U.S. investors. It is worth noting that the dollar is now at a near 40-year high in real terms relative to our major trading partners and should eventually decline. In addition, equity valuations outside the United States remain far below their U.S. counterparts and their long-term averages. For long-term investors, international equities should provide solid returns from these starting valuations. Moreover, the possibility of a ceasefire in Ukraine, more stable Chinese growth, or a pivot to a more dovish Fed would lead to a simultaneous rebound in both international currencies and equities.

__________________________________________________________________________________________________

Fixed Income Recap

A strong labor market and upside surprises on inflation in the first half of the year have pushed the Federal Reserve (Fed) to adopt a much more hawkish stance. At its September meeting, the Fed increased the federal funds rate by a third consecutive 0.75%, following increases of 0.25% and 0.50% in March and May, respectively. In total, this has brought the key rate to a range of 3.00%-3.25%. In the Summary of Economic Projections, the median expectation among FOMC members indicated cumulative further increases of 1.25% this year and 0.25% next year, taking the federal funds rate to a range of 4.25%-4.50% by the end of 2022 and 4.50%-4.75% by the end of 2023. Meanwhile, the Fed is continuing to reduce its massive bond holdings at a pace of $95 billion per month.

High inflation and the Fed’s much more hawkish stance have led to a sharp backup in bond yields so far this year, resulting in negative returns across fixed income markets. However, while the Fed appears likely to continue hiking rates through the end of the year, increased recession risks should limit further increases in long-term Treasury yields. Importantly, the sell-off in fixed income has also reduced valuations to much more attractive levels. With much higher yields, high-quality fixed income can now provide more of a buffer for portfolios in the case of a market correction or an economic downturn.

__________________________________________________________________________________________________

2022 Outlook & Beyond

For many Americans, 2022 has been very disappointing with the Omicron variant prolonging the pandemic, sharply rising inflation and interest rates, falling stock prices, and the shock of Russia’s brutal invasion of Ukraine. These factors, combined with a still very divided political environment, have driven consumer sentiment down to its lowest level on record.

sharply rising inflation and interest rates, falling stock prices, and the shock of Russia’s brutal invasion of Ukraine. These factors, combined with a still very divided political environment, have driven consumer sentiment down to its lowest level on record.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets, stocks in particular. However, history demonstrates that trying to time markets in this way is a mistake. This slide shows consumer sentiment over the past 50 years with 8 distinct peaks and troughs and the S&P 500 gain or loss in the 12 months following. On average, buying at a confidence peak returned 4.1% while buying at a trough returned 24.9%.

Importantly, this is not to suggest that U.S. stocks will return anything like 24.9% in the year ahead, as many other factors will determine the actual outcome. However, it does rationalize that when planning for the rest of 2022 and beyond, investors should focus on fundamentals and valuations rather than how they feel about the world.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

Brandon Bauer, CFP®

Share this post with your friends