Market Performance Overview

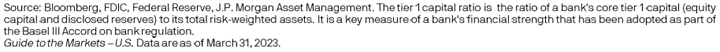

- Domestic equities were positive in Q1 returning +7.50%.

- Foreign equities were positive in Q1 returning +8.47% in developed markets and +3.96% in emerging markets.

- Domestic bonds were positive in Q1 returning +2.96%.

- Foreign bonds were positive in Q1 returning +2.86%.

__________________________________________________________________________________________________

Economic Update

The U.S. economy proved more resilient than many anticipated in the early months of 2023. Stronger-than-expected economic data, a modest uptick in inflation and a still-tight labor market sparked fears of higher interest rates for longer. Risks of a policy-induced recession rose, and markets became more volatile after a strong start to the year.

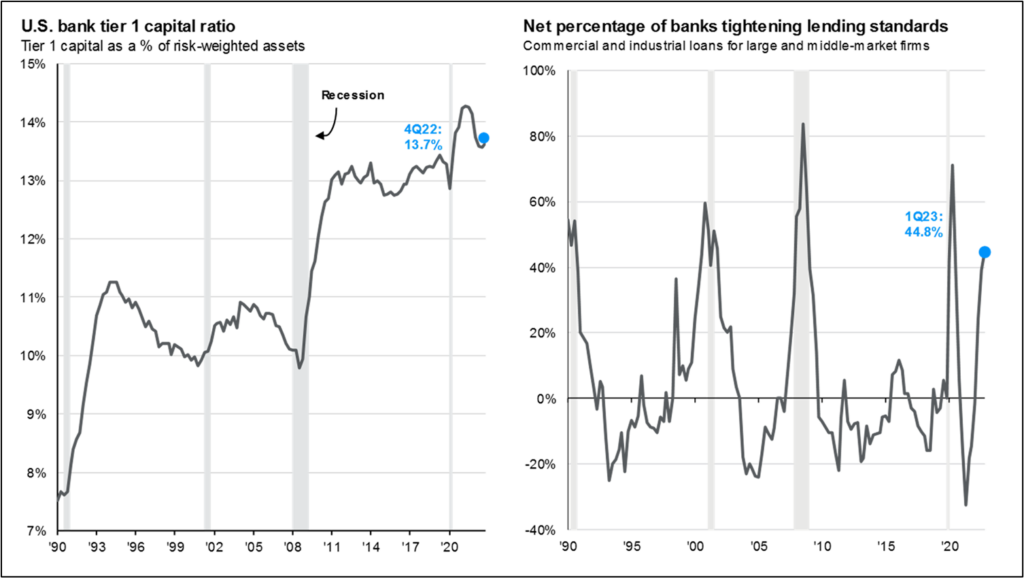

The failure of Silicon Valley Bank and several other regional banks contributed to new bouts of market volatility and raised concerns about the health of the U.S. banking system, increasing the potential for a wider fallout and the risk of recession. While regional bank turmoil has been worrying, investors do not need to fear a repeat of the 2008 financial crisis, as illustrated by the US bank tier 1 capital ratio in the chart below. The management of deposits and the concentration of the depositor base were unique problems that acutely impacted Silicon Valley Bank and led to their downfall.

Despite banking concerns, the Federal Reserve continued to tighten policy at its March meeting, raising interest rates by .25%, totaling an aggressive 4.75% in just a year since the tightening cycle began. The Fed does seem to be near the end of rate hikes, but tighter financial conditions and the regional banking crisis have narrowed the window for a soft landing, particularly as the economy continues to confront challenges posed by lower household savings, poor consumer sentiment and a strong dollar.

Even considering the twists and turns of this quarter, many sectors of the markets have still posted gains year-to-date. Moreover, last year’s market corrections left valuations at very attractive levels compared to historical averages. The questions that remain for investors are when to take advantage of these better valuations and which areas to overweight or underweight in this very complicated macro environment.

__________________________________________________________________________________________________

Equity Recap

Last year, higher costs and receding demand led to a slump in corporate profits relative to a spectacular 2021. S&P 500 operating earnings per share were down 13% from a year earlier in the fourth quarter and down 6% for all of 2022. Looking forward, consensus expectations for a double-digit gain in earnings in 2023 look to be too optimistic, and we expect earnings will more likely be flat-to-down relative to 2022.

Rising costs, rather than deteriorating sales, have caused weakness in earnings. Pricing power should continue to differentiate winners and losers in 2023. Energy companies will continue to benefit from high margins, while businesses that provide essential goods and services should be supported.

Elsewhere, rising labor costs, higher interest rates and slowing nominal sales growth should bite into profits. In addition, a much higher dollar poses a headwind for companies with overseas sales, and recession concerns could cause management teams to further reel in spending and investment.

Global Recap

In Europe, business confidence improved, and economic activity rebounded during the first quarter after an energy crisis failed to materialize, contributing to underlying inflation pressures. This has prompted monetary tightening, with the European Central Bank (ECB) and the Bank of England delivering additional rate hikes in March, bringing their respective policy rates to 3.00% and 4.25%, respectively. However, with recent turmoil in the European financial sector, the ECB delivered more dovish forward guidance that has lowered expectations for further tightening. On the other hand, Japan has been the exception to the hawkish rule. After widening its yield curve control tolerance band in December, the Bank of Japan has held its key policy rate in slightly negative territory.

As investors assess positioning in the remainder of the year, it’s important to evaluate both the remaining risks on the horizon as well as the menu of investment opportunities in the aftermath of last year’s market corrections. Specifically, investors may do well to lean into some of the “cheap” areas of the market and remain selective in “expensive” ones, while still positioning towards the opportunities poised to drive long-run returns beyond the cycle.

__________________________________________________________________________________________________

Fixed Income Recap

Just a year into tightening, the Federal Reserve has hiked rates to a target range of 4.75%-5.0% to try and accelerate the decline in inflation. Despite emerging financial strains, the Fed hiked rates by an additional quarter percentage point at its March meeting, but its forward guidance signaled that the end of its tightening cycle is near. In particular, the Fed revealed the potential for another 0.25% rate hike, but also that this hike would likely be their last. Thereafter, rates are expected to fall in 2024 but remain at restrictive levels. While the median expectation was unchanged for 2023, some policymakers are becoming more hawkish and the divergence between projections has widened, perhaps underscoring the level of debate occurring among the FOMC members.

In the months ahead, the exact path of global policy rates remain unclear. It is clear, however, that global tightening efforts have brought rates to much more normal levels. In Europe, for instance, rates have finally emerged from their negative rate purgatory and are expected to remain positive going forward.

__________________________________________________________________________________________________

2023 Outlook & Beyond

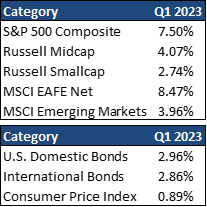

Rising inflation, tighter monetary policy and Russia’s invasion of Ukraine drove consumer sentiment to record lows in 2022. Now, fears of an impending banking crisis and a slowing economy pose new threats in 2023. While sentiment has staged a modest comeback since last year, the increased risk of recession may keep consumer sentiment depressed this year.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets. However, history advocates that trying to time markets in this way is a mistake. The chart below shows consumer sentiment over the past 50 years, with 8 distinct peaks and troughs, and how much the S&P 500 gained or lost in the 12 months following sentiment lows and highs. On average, buying at a confidence peak returned 3.5%, while buying at a trough returned 24.9% just one year later.

Importantly, this is not to suggest that U.S. stocks will return anything like 24.9% in the year ahead, as many other factors will determine that outcome. However, it does suggest that when planning for 2023 and beyond, investors should focus on fundamentals and valuations rather than how they feel about the world.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress-tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

2023 Quarterly Commentary Q1

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

The U.S. economy proved more resilient than many anticipated in the early months of 2023. Stronger-than-expected economic data, a modest uptick in inflation and a still-tight labor market sparked fears of higher interest rates for longer. Risks of a policy-induced recession rose, and markets became more volatile after a strong start to the year.

The failure of Silicon Valley Bank and several other regional banks contributed to new bouts of market volatility and raised concerns about the health of the U.S. banking system, increasing the potential for a wider fallout and the risk of recession. While regional bank turmoil has been worrying, investors do not need to fear a repeat of the 2008 financial crisis, as illustrated by the US bank tier 1 capital ratio in the chart below. The management of deposits and the concentration of the depositor base were unique problems that acutely impacted Silicon Valley Bank and led to their downfall.

Despite banking concerns, the Federal Reserve continued to tighten policy at its March meeting, raising interest rates by .25%, totaling an aggressive 4.75% in just a year since the tightening cycle began. The Fed does seem to be near the end of rate hikes, but tighter financial conditions and the regional banking crisis have narrowed the window for a soft landing, particularly as the economy continues to confront challenges posed by lower household savings, poor consumer sentiment and a strong dollar.

Even considering the twists and turns of this quarter, many sectors of the markets have still posted gains year-to-date. Moreover, last year’s market corrections left valuations at very attractive levels compared to historical averages. The questions that remain for investors are when to take advantage of these better valuations and which areas to overweight or underweight in this very complicated macro environment.

__________________________________________________________________________________________________

Equity Recap

Last year, higher costs and receding demand led to a slump in corporate profits relative to a spectacular 2021. S&P 500 operating earnings per share were down 13% from a year earlier in the fourth quarter and down 6% for all of 2022. Looking forward, consensus expectations for a double-digit gain in earnings in 2023 look to be too optimistic, and we expect earnings will more likely be flat-to-down relative to 2022.

Rising costs, rather than deteriorating sales, have caused weakness in earnings. Pricing power should continue to differentiate winners and losers in 2023. Energy companies will continue to benefit from high margins, while businesses that provide essential goods and services should be supported.

Elsewhere, rising labor costs, higher interest rates and slowing nominal sales growth should bite into profits. In addition, a much higher dollar poses a headwind for companies with overseas sales, and recession concerns could cause management teams to further reel in spending and investment.

Global Recap

In Europe, business confidence improved, and economic activity rebounded during the first quarter after an energy crisis failed to materialize, contributing to underlying inflation pressures. This has prompted monetary tightening, with the European Central Bank (ECB) and the Bank of England delivering additional rate hikes in March, bringing their respective policy rates to 3.00% and 4.25%, respectively. However, with recent turmoil in the European financial sector, the ECB delivered more dovish forward guidance that has lowered expectations for further tightening. On the other hand, Japan has been the exception to the hawkish rule. After widening its yield curve control tolerance band in December, the Bank of Japan has held its key policy rate in slightly negative territory.

As investors assess positioning in the remainder of the year, it’s important to evaluate both the remaining risks on the horizon as well as the menu of investment opportunities in the aftermath of last year’s market corrections. Specifically, investors may do well to lean into some of the “cheap” areas of the market and remain selective in “expensive” ones, while still positioning towards the opportunities poised to drive long-run returns beyond the cycle.

__________________________________________________________________________________________________

Fixed Income Recap

Just a year into tightening, the Federal Reserve has hiked rates to a target range of 4.75%-5.0% to try and accelerate the decline in inflation. Despite emerging financial strains, the Fed hiked rates by an additional quarter percentage point at its March meeting, but its forward guidance signaled that the end of its tightening cycle is near. In particular, the Fed revealed the potential for another 0.25% rate hike, but also that this hike would likely be their last. Thereafter, rates are expected to fall in 2024 but remain at restrictive levels. While the median expectation was unchanged for 2023, some policymakers are becoming more hawkish and the divergence between projections has widened, perhaps underscoring the level of debate occurring among the FOMC members.

In the months ahead, the exact path of global policy rates remain unclear. It is clear, however, that global tightening efforts have brought rates to much more normal levels. In Europe, for instance, rates have finally emerged from their negative rate purgatory and are expected to remain positive going forward.

__________________________________________________________________________________________________

2023 Outlook & Beyond

Rising inflation, tighter monetary policy and Russia’s invasion of Ukraine drove consumer sentiment to record lows in 2022. Now, fears of an impending banking crisis and a slowing economy pose new threats in 2023. While sentiment has staged a modest comeback since last year, the increased risk of recession may keep consumer sentiment depressed this year.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets. However, history advocates that trying to time markets in this way is a mistake. The chart below shows consumer sentiment over the past 50 years, with 8 distinct peaks and troughs, and how much the S&P 500 gained or lost in the 12 months following sentiment lows and highs. On average, buying at a confidence peak returned 3.5%, while buying at a trough returned 24.9% just one year later.

Importantly, this is not to suggest that U.S. stocks will return anything like 24.9% in the year ahead, as many other factors will determine that outcome. However, it does suggest that when planning for 2023 and beyond, investors should focus on fundamentals and valuations rather than how they feel about the world.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress-tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

Brandon Bauer, CFP®

Share this post with your friends