Market Performance Overview

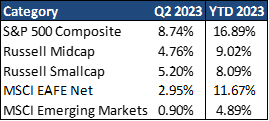

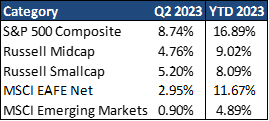

- Domestic equities were positive in Q2, returning 8.7% in the quarter and 9% YTD.

- Foreign equities were positive in Q2, returning 2.9% in developed markets (11.7% YTD) and .9% in emerging markets (4.9% YTD).

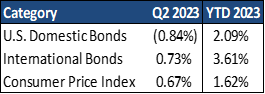

- Domestic bonds were negative in Q2, returning -.9% and 1% YTD.

- Foreign bonds were positive in Q2, returning .4% and 3.6% YTD. __________________________________________________________________________________________________

Economic Update

The U.S. economy showed resiliency in the first half of 2023, with stronger-than-expected economic data lifting market returns. With employment remaining strong and inflation receding, the risks of a recession in the second half of the year seem to have subsided, pushing expectations for weaker data to come in 2024. While the start of the year produced rosier data than expected, the outlook for the economy in moving forward is slower growth given the current economic headwinds.

The fears of the liquidity crunch in the banking system have largely dissipated due to the Federal Reserve’s actions and the liquidity they provided to the financial system. While this strain has been lifted for now, investors have shifted their attention to the financial health of the consumer and the Fed’s expectations for additional rate hikes in 2023. While consumers have held up remarkably in the first half of 2023, the data suggests that may be changing. The consumer savings rate has fallen from a long-term average of 8.9% to 4.2%. This has coincided with a depletion of savings balances and an increase in debt to maintain current lifestyles. Couple this with the resumption of student loans in October, and we should see consumer spending slow in the coming months.

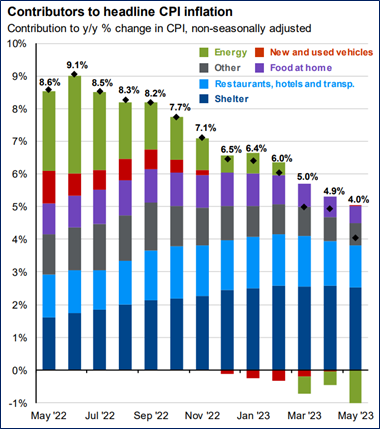

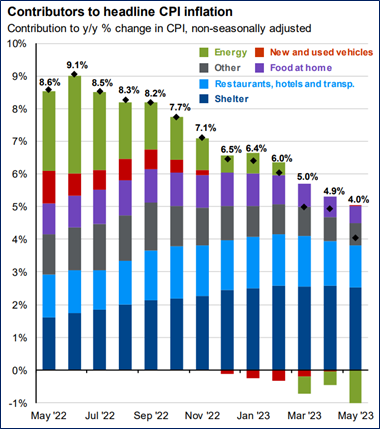

The Fed continues to take a strong stance against inflation, with current markets pricing in two more .25% hikes this y ear. This would bring the Fed Funds rate to roughly 5.5%, the highest level since 2001. As the chart to the right illustrates, their strong stance has been working. We have seen headline CPI drop from 9.1% in June of 2022 to a rate of 3% in June of 2023. This provides a silver lining as it suggests we may be close to the end of interest rate hikes.

ear. This would bring the Fed Funds rate to roughly 5.5%, the highest level since 2001. As the chart to the right illustrates, their strong stance has been working. We have seen headline CPI drop from 9.1% in June of 2022 to a rate of 3% in June of 2023. This provides a silver lining as it suggests we may be close to the end of interest rate hikes.

Over time, reduced inflation will ease the restrictive nature of the Fed’s policy, but in the meantime, the increased rates have made servicing debt more expensive. While this can take time to filter through the economy, it should contribute to slowing economic growth which in turn makes the economy more sensitive to any shocks. While this is in no way a guarantee of a coming recession, risks remain on the horizon that could push a slow-moving economy into one.

While job openings have remained plentiful, there are some cracks beginning to emerge in the labor market. Weekly initial claims for unemployment have been ticking higher and could pick up speed as layoff announcements become more widespread. Tying this all together, the labor market could continue to decelerate in the coming months which would be a signal to the markets that the economy is likely entering into a recession.

Even considering the risks on the horizon, we have seen the stock and bond markets rebound YTD as the economic data still looks better than was expected in 2022. That said, we expect market volatility to continue in the months ahead as investors attempt to determine if the economy will be thrust into a recession or if a soft landing becomes more probable.

_____________________________________________________________________________________________________

Equity Recap

Despite economic headwinds, equity markets have had a solid 2023 so far, supported by a better-than-expected first-quarter earnings season and expectations for an end to Fed tightening. S&P 500 operating earnings per share rose 6.4% from a year earlier and 4.3% from the fourth quarter. Profit margins also rose to 11.7%, indicating that companies have had success in defending margins. That said, risks to earnings remain on the downside. With a heightened risk of recession in the coming year, profit estimates should come under further pressure.

The current commentary also suggests that firms plan to rein in investment, although cuts will not be evenly distributed. Investment in equipment tends to see the largest pullback as the economy slows, suggesting we may see cuts within the manufacturing and mining sectors. However, investment in technology, specifically artificial intelligence, should continue to rise as companies seek to optimize processes for long-term cost savings.

At the current juncture, it is difficult to be overly bullish on equities. While performance this year has been better, it has been entirely driven by valuation expansion on the back of lower interest rate expectations, with the top ten companies in the S&P 500 accounting for 13.8 percentage points of the 14.9% price return YTD. As expectations adjust, multiples could come under further pressure if we see weaker economic data in the months ahead. A period of economic weakness where the Fed must cut rates to spark the economy can be a difficult environment for high-risk, growth assets. As a result, high-quality companies with strong cash flows remain attractive. This, along with slowing growth weighing on earnings expectations, creates a challenging backdrop for equities ahead. While equities may be facing headwinds, international equities continue to trade at a historic discount, making them attractive in moving forward.

_____________________________________________________________________________________________________

Fixed Income Recap

The fixed income markets were flat to negative this quarter, as the expected peak interest rate has increased. The Fed has continued its strong stance on bringing inflation down to its 2% target. Fed Chair Jerome Powell has not waivered in his emphasis on the 2% target being their number one priority and is willing to keep rates higher for longer if he feels necessary. This has continued to produce volatility as the bond market attempts to pinpoint the peak of interest rate hikes. While returns are positive YTD, we are now sitting at a 2.1% increase thus far.

It is important to note that the bond market is priced very attractively as compared to its 25-year history. It was not long ago that the U.S. bond market was producing a 1.5% annual yield, while the current yield sits at 4.2%. As we saw in 2022, there can certainly be volatility in the bond market, but over time, bonds tend to return close to their stated yield at purchase. The rising rates over the last 18 months have produced a strong headwind for bondholders but as we look into the future, we find we are looking a very attractive bond market.

_____________________________________________________________________________________________________

2023 Outlook & Beyond

When positioning portfolios for the remainder of 2023 and beyond, it is important to assess both the remaining risks on the horizon as well as the menu of opportunities presented in the aftermath of last year’s market corrections. Within equities, investors may want to lean into international markets and focus on finding attractively valued companies within the U.S. style spectrum. Moreover, the current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields while we can still get them.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress-tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management

2nd Quarter 2023 Commentary

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

Economic Update

The U.S. economy showed resiliency in the first half of 2023, with stronger-than-expected economic data lifting market returns. With employment remaining strong and inflation receding, the risks of a recession in the second half of the year seem to have subsided, pushing expectations for weaker data to come in 2024. While the start of the year produced rosier data than expected, the outlook for the economy in moving forward is slower growth given the current economic headwinds.

The fears of the liquidity crunch in the banking system have largely dissipated due to the Federal Reserve’s actions and the liquidity they provided to the financial system. While this strain has been lifted for now, investors have shifted their attention to the financial health of the consumer and the Fed’s expectations for additional rate hikes in 2023. While consumers have held up remarkably in the first half of 2023, the data suggests that may be changing. The consumer savings rate has fallen from a long-term average of 8.9% to 4.2%. This has coincided with a depletion of savings balances and an increase in debt to maintain current lifestyles. Couple this with the resumption of student loans in October, and we should see consumer spending slow in the coming months.

The Fed continues to take a strong stance against inflation, with current markets pricing in two more .25% hikes this y ear. This would bring the Fed Funds rate to roughly 5.5%, the highest level since 2001. As the chart to the right illustrates, their strong stance has been working. We have seen headline CPI drop from 9.1% in June of 2022 to a rate of 3% in June of 2023. This provides a silver lining as it suggests we may be close to the end of interest rate hikes.

ear. This would bring the Fed Funds rate to roughly 5.5%, the highest level since 2001. As the chart to the right illustrates, their strong stance has been working. We have seen headline CPI drop from 9.1% in June of 2022 to a rate of 3% in June of 2023. This provides a silver lining as it suggests we may be close to the end of interest rate hikes.

Over time, reduced inflation will ease the restrictive nature of the Fed’s policy, but in the meantime, the increased rates have made servicing debt more expensive. While this can take time to filter through the economy, it should contribute to slowing economic growth which in turn makes the economy more sensitive to any shocks. While this is in no way a guarantee of a coming recession, risks remain on the horizon that could push a slow-moving economy into one.

While job openings have remained plentiful, there are some cracks beginning to emerge in the labor market. Weekly initial claims for unemployment have been ticking higher and could pick up speed as layoff announcements become more widespread. Tying this all together, the labor market could continue to decelerate in the coming months which would be a signal to the markets that the economy is likely entering into a recession.

Even considering the risks on the horizon, we have seen the stock and bond markets rebound YTD as the economic data still looks better than was expected in 2022. That said, we expect market volatility to continue in the months ahead as investors attempt to determine if the economy will be thrust into a recession or if a soft landing becomes more probable.

_____________________________________________________________________________________________________

Equity Recap

Despite economic headwinds, equity markets have had a solid 2023 so far, supported by a better-than-expected first-quarter earnings season and expectations for an end to Fed tightening. S&P 500 operating earnings per share rose 6.4% from a year earlier and 4.3% from the fourth quarter. Profit margins also rose to 11.7%, indicating that companies have had success in defending margins. That said, risks to earnings remain on the downside. With a heightened risk of recession in the coming year, profit estimates should come under further pressure.

The current commentary also suggests that firms plan to rein in investment, although cuts will not be evenly distributed. Investment in equipment tends to see the largest pullback as the economy slows, suggesting we may see cuts within the manufacturing and mining sectors. However, investment in technology, specifically artificial intelligence, should continue to rise as companies seek to optimize processes for long-term cost savings.

At the current juncture, it is difficult to be overly bullish on equities. While performance this year has been better, it has been entirely driven by valuation expansion on the back of lower interest rate expectations, with the top ten companies in the S&P 500 accounting for 13.8 percentage points of the 14.9% price return YTD. As expectations adjust, multiples could come under further pressure if we see weaker economic data in the months ahead. A period of economic weakness where the Fed must cut rates to spark the economy can be a difficult environment for high-risk, growth assets. As a result, high-quality companies with strong cash flows remain attractive. This, along with slowing growth weighing on earnings expectations, creates a challenging backdrop for equities ahead. While equities may be facing headwinds, international equities continue to trade at a historic discount, making them attractive in moving forward.

_____________________________________________________________________________________________________

Fixed Income Recap

The fixed income markets were flat to negative this quarter, as the expected peak interest rate has increased. The Fed has continued its strong stance on bringing inflation down to its 2% target. Fed Chair Jerome Powell has not waivered in his emphasis on the 2% target being their number one priority and is willing to keep rates higher for longer if he feels necessary. This has continued to produce volatility as the bond market attempts to pinpoint the peak of interest rate hikes. While returns are positive YTD, we are now sitting at a 2.1% increase thus far.

It is important to note that the bond market is priced very attractively as compared to its 25-year history. It was not long ago that the U.S. bond market was producing a 1.5% annual yield, while the current yield sits at 4.2%. As we saw in 2022, there can certainly be volatility in the bond market, but over time, bonds tend to return close to their stated yield at purchase. The rising rates over the last 18 months have produced a strong headwind for bondholders but as we look into the future, we find we are looking a very attractive bond market.

_____________________________________________________________________________________________________

2023 Outlook & Beyond

When positioning portfolios for the remainder of 2023 and beyond, it is important to assess both the remaining risks on the horizon as well as the menu of opportunities presented in the aftermath of last year’s market corrections. Within equities, investors may want to lean into international markets and focus on finding attractively valued companies within the U.S. style spectrum. Moreover, the current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields while we can still get them.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress-tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management

Brandon Bauer, CFP®

Share this post with your friends