Market Performance Overview

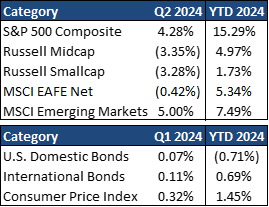

- Domestic equities were positive in Q2, returning 4.28% in the quarter and 29% YTD.

- Foreign equities were mixed in Q2, returning -0.42% in developed markets (5.34% YTD) and 5.00% in emerging markets (7.49% YTD).

- Domestic bonds were positive in Q2, returning 0.07% and -0.71%

- Foreign bonds were positive in Q2, returning 0.11% and 0.69%

__________________________________________________________________________________________________

Economic Update

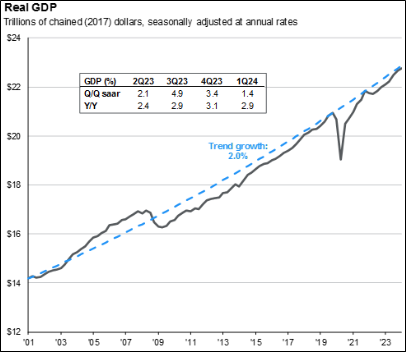

Despite some weakness at the headline level, underlying U.S. economic momentum remained solid through the first half of the year. Inflation remained stubbornly elevated above 3% during the first half of 2024, feeding concerns that inflation may be sticky above the Fed’s 2% target. While the journey down may take longer than expected, stable supply chains, moderating wage growth, and substantial decreases in shelter and auto insurance inflation should allow overall inflation to resume its slow descent and return to 2% by the middle of next year.

Sticky inflation forced the Federal Reserve to reassert its hawkish tone. At the June meeting, the Fed’s updated dot plot showed that it expects to deliver just one rate cut this year, down from the three rate cuts they projected back in March. While they delayed rate cuts, the Fed has begun to slow the pace of quantitative tightening. Elsewhere, other global central banks have begun to ease monetary policy, and a widening gap in short-term interest rates between the United States and other developed economies could keep the U.S. dollar in an elevated position for some time to come.

Strong growth in the U.S. labor supply, driven by increased labor force participation and a surge in immigration, has supported impressive job gains without higher inflation. Moving forward, tighter labor supply, falling job openings, and solid productivity growth could slow the pace of job gains. That said, a backlog of migrant workers waiting to be integrated into the U.S. economy should allow employment growth to continue solidly, and the unemployment rate should stay low.

Bonds have rebounded after a challenging start to the year, while equities have maintained their upward trajectory and notched multiple new all-time highs during the second quarter. Moving forward, broadening earnings growth should support a more inclusive stock market rally. Investors may want to use this extended period of higher rates to lock in attractive yields in fixed income. Outside of traditional markets, alternatives can also help better prepare portfolios for challenges that may lay ahead, whether it be through enhanced income, alpha, or diversification.

Moving forward, a resilient consumer should allow the U.S. economy to sustain a soft landing into next year. However, with still elevated geopolitical tensions and an upcoming U.S. election, risks remain that are worth monitoring.

__________________________________________________________________________________________________

Equity Recap

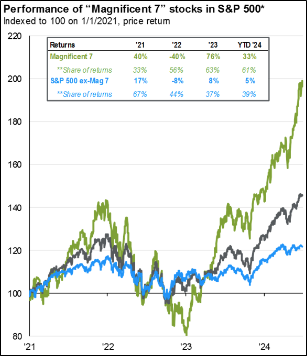

The S&P 500 continued its dominant run in Q2, finishing up 15.29% through the year’s first half. As has been the case for some time now, market performance remains concentrated as earnings growth has remained dominated by the “Magnificent 7.” However, we don’t expect this trend to last. As 2024 progresses, broadening profit leadership across sectors should support a more inclusive equity market rally. While valuations look stretched at roughly 21 times earnings, there are still plenty of attractive opportunities beneath the surface, and an active approach can help investors identify those companies with high-quality earnings and attractive valuations.

After a sluggish ending to 2023, prospects for the global economy are improving, resulting in strong performance across international markets, pushing valuations higher since the start of 2024. Economic surprises have turned positive in Europe, and while China’s recovery has been shaky, other parts of Asia should benefit from a turn in the electronics cycle and continued AI tailwinds. With U.S. consumer activity expected to slow, narrowing growth differentials should highlight plenty of attractive opportunities across global markets. In both absolute terms and relative to their histories, international markets continue to look attractively priced compared to the U.S. This, combined with improving earnings expectations and a more favorable economic backdrop, presents an attractive opportunity for U.S. investors to diversify abroad.

____________________________________________________________________________________________

Fixed Income Recap

Stalling progress on disinflation has caused the Federal Reserve to reassert its hawkish tone. While it remains biased toward easing policy, the Fed needs more evidence that inflation is sustainably moving back toward its 2% target before taking action, and rate cuts have likely been postponed until the end of the year.

As a result, bonds have continued to struggle in 2024, as economic data reigned in market expectations for rate cuts. While the past few years have been frustrating for bondholders, higher interest rates today offer fixed-income investors both positive real income and the portfolio protection provided by the traditional tendency of bonds to rally when stocks falter in the face of economic weakness. With market and Fed expectations now aligned, interest rate volatility should continue to fade. At its June meeting, the Federal Reserve left rates unchanged at a range of 5.25% to 5.50% and signaled only one rate cut in 2024. In addition, they boosted their projection for the federal funds rate in the long run from 2.6% to 2.8%, a sign of a slightly more hawkish stance. With market expectations and Fed messaging in sync, it would likely take a meaningful change in the economic outlook to trigger any sharp movement in long-term interest rates throughout the remainder of 2024.

As a result, bonds have continued to struggle in 2024, as economic data reigned in market expectations for rate cuts. While the past few years have been frustrating for bondholders, higher interest rates today offer fixed-income investors both positive real income and the portfolio protection provided by the traditional tendency of bonds to rally when stocks falter in the face of economic weakness. With market and Fed expectations now aligned, interest rate volatility should continue to fade. At its June meeting, the Federal Reserve left rates unchanged at a range of 5.25% to 5.50% and signaled only one rate cut in 2024. In addition, they boosted their projection for the federal funds rate in the long run from 2.6% to 2.8%, a sign of a slightly more hawkish stance. With market expectations and Fed messaging in sync, it would likely take a meaningful change in the economic outlook to trigger any sharp movement in long-term interest rates throughout the remainder of 2024.

It is important to note that the bond market is still priced very attractively compared to its 25-year history. Not long ago, the U.S. bond market was producing a 1.5% annual yield. The current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields while they can.

Be careful of the inverted yield curve, as some investors continue to be tempted to lock in cash yields above 5% before they move lower. There is an opportunity cost to holding too much cash. In fact, history shows there has been a better asset than cash to deploy capital after a peak in interest rates. Instead of sitting on the sidelines, investors should put long-term money to work in long-term opportunities. In the last six rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates, while the S&P 500 and a 60/40 stock-bond portfolio outperformed in 5 of these periods.

__________________________________________________________________________________________________

2024 Outlook & Beyond

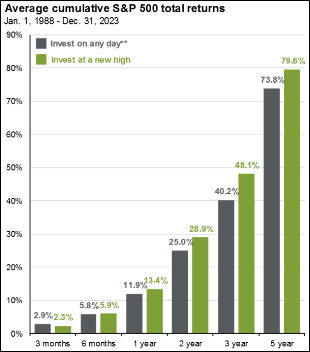

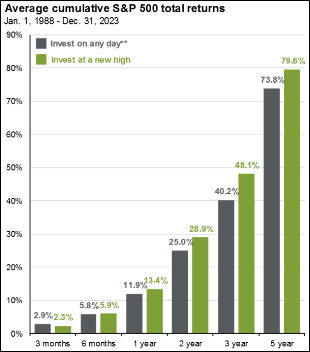

As investors look to the back half of 2024, geopolitical uncertainty remains elevated, and risks to the recent market rally remain in place. With the higher valuations produced by the strong investment returns of 2023 and 2024 thus far, it is more important than ever that investors maintain well-diversified portfolios designed to reduce risk and provide solid long-term income and capital gains. In an environment like this, it is important to take a diversified approach to portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. History shows that even at all-time highs, markets can still be attractive, as strong performance tends to beget more strong performance. If you are a client of our firm, we have created your portfolio to withstand all types of markets, such as 2022. If you are not a client and have not stress-tested your portfolio or do not have a well-designed plan to navigate uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

**Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

2nd Quarter 2024 Commentary

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

Despite some weakness at the headline level, underlying U.S. economic momentum remained solid through the first half of the year. Inflation remained stubbornly elevated above 3% during the first half of 2024, feeding concerns that inflation may be sticky above the Fed’s 2% target. While the journey down may take longer than expected, stable supply chains, moderating wage growth, and substantial decreases in shelter and auto insurance inflation should allow overall inflation to resume its slow descent and return to 2% by the middle of next year.

Sticky inflation forced the Federal Reserve to reassert its hawkish tone. At the June meeting, the Fed’s updated dot plot showed that it expects to deliver just one rate cut this year, down from the three rate cuts they projected back in March. While they delayed rate cuts, the Fed has begun to slow the pace of quantitative tightening. Elsewhere, other global central banks have begun to ease monetary policy, and a widening gap in short-term interest rates between the United States and other developed economies could keep the U.S. dollar in an elevated position for some time to come.

Strong growth in the U.S. labor supply, driven by increased labor force participation and a surge in immigration, has supported impressive job gains without higher inflation. Moving forward, tighter labor supply, falling job openings, and solid productivity growth could slow the pace of job gains. That said, a backlog of migrant workers waiting to be integrated into the U.S. economy should allow employment growth to continue solidly, and the unemployment rate should stay low.

Bonds have rebounded after a challenging start to the year, while equities have maintained their upward trajectory and notched multiple new all-time highs during the second quarter. Moving forward, broadening earnings growth should support a more inclusive stock market rally. Investors may want to use this extended period of higher rates to lock in attractive yields in fixed income. Outside of traditional markets, alternatives can also help better prepare portfolios for challenges that may lay ahead, whether it be through enhanced income, alpha, or diversification.

Moving forward, a resilient consumer should allow the U.S. economy to sustain a soft landing into next year. However, with still elevated geopolitical tensions and an upcoming U.S. election, risks remain that are worth monitoring.

__________________________________________________________________________________________________

Equity Recap

The S&P 500 continued its dominant run in Q2, finishing up 15.29% through the year’s first half. As has been the case for some time now, market performance remains concentrated as earnings growth has remained dominated by the “Magnificent 7.” However, we don’t expect this trend to last. As 2024 progresses, broadening profit leadership across sectors should support a more inclusive equity market rally. While valuations look stretched at roughly 21 times earnings, there are still plenty of attractive opportunities beneath the surface, and an active approach can help investors identify those companies with high-quality earnings and attractive valuations.

After a sluggish ending to 2023, prospects for the global economy are improving, resulting in strong performance across international markets, pushing valuations higher since the start of 2024. Economic surprises have turned positive in Europe, and while China’s recovery has been shaky, other parts of Asia should benefit from a turn in the electronics cycle and continued AI tailwinds. With U.S. consumer activity expected to slow, narrowing growth differentials should highlight plenty of attractive opportunities across global markets. In both absolute terms and relative to their histories, international markets continue to look attractively priced compared to the U.S. This, combined with improving earnings expectations and a more favorable economic backdrop, presents an attractive opportunity for U.S. investors to diversify abroad.

____________________________________________________________________________________________

Fixed Income Recap

Stalling progress on disinflation has caused the Federal Reserve to reassert its hawkish tone. While it remains biased toward easing policy, the Fed needs more evidence that inflation is sustainably moving back toward its 2% target before taking action, and rate cuts have likely been postponed until the end of the year.

It is important to note that the bond market is still priced very attractively compared to its 25-year history. Not long ago, the U.S. bond market was producing a 1.5% annual yield. The current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields while they can.

Be careful of the inverted yield curve, as some investors continue to be tempted to lock in cash yields above 5% before they move lower. There is an opportunity cost to holding too much cash. In fact, history shows there has been a better asset than cash to deploy capital after a peak in interest rates. Instead of sitting on the sidelines, investors should put long-term money to work in long-term opportunities. In the last six rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates, while the S&P 500 and a 60/40 stock-bond portfolio outperformed in 5 of these periods.

__________________________________________________________________________________________________

2024 Outlook & Beyond

As investors look to the back half of 2024, geopolitical uncertainty remains elevated, and risks to the recent market rally remain in place. With the higher valuations produced by the strong investment returns of 2023 and 2024 thus far, it is more important than ever that investors maintain well-diversified portfolios designed to reduce risk and provide solid long-term income and capital gains. In an environment like this, it is important to take a diversified approach to portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. History shows that even at all-time highs, markets can still be attractive, as strong performance tends to beget more strong performance. If you are a client of our firm, we have created your portfolio to withstand all types of markets, such as 2022. If you are not a client and have not stress-tested your portfolio or do not have a well-designed plan to navigate uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

**Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

Brandon Bauer, CFP®

Share this post with your friends