Market Performance Overview

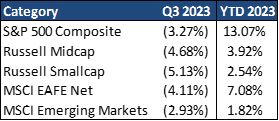

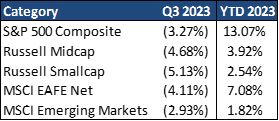

- Domestic equities were negative in Q3 with large cap stocks finishing -3.27% (+13.07% YTD).

- Foreign equities were negative in Q3 returning -4.11% in developed markets and -2.93% in emerging markets. YTD, developed markets are up +7.08% and emerging markets are up +1.82%.

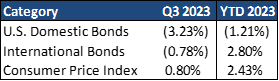

- Domestic bonds were negative in Q3 returning -3.23% for the quarter (-1.21% YTD).

- Foreign bonds were negative in Q3 finishing the quarter at -0.78% (+2.80% YTD).

__________________________________________________________________________________________________

Economic Update

Resiliency seems to be the most apt description of the U.S. economy this year. In fact, the Atlanta Fed GDP model is now calling for an acceleration in growth during the third quarter. At the same time, inflation is continuing to moderate, helping to spark enthusiasm for a soft landing. However, with tailwinds from the consumer and business sectors likely to fade in the coming months, the path to a soft landing may be narrower than expected.

Meanwhile, reaccelerating growth in a still-tight labor market has complicated things at the Federal Reserve, as they continue to balance the risks of over versus under-tightening. At its September meeting, the Fed kept rates unchanged at 5.25%-5.50%, but forward guidance left the door open for another hike. Nevertheless, the Fed does seem to be near the end of tightening and the pace of interest rate cuts next year will be largely dependent on whether or not the U.S. economy falls into a recession. Current valuations, while still below 2021 levels, do look more expensive compared to historical averages, making the market more sensitive to economic headwinds.

Consumer Trends: Job Growth, Spending Patterns, and Rising Financial Pressures

Consumers have remained resilient in the third quarter, supported by solid job growth, and rising real wages. The pace of job gains, while still robust, has been trending lower since last year. Cooling demand for labor suggests that job growth should decelerate in the coming months.

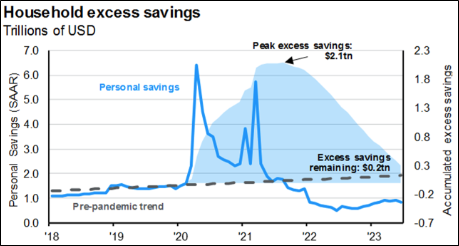

Additionally, consumers have been depleting their savings balances and taking on more debt to maintain current spending, and delinquencies are starting to rise. The chart on the right outlines the boom in consumer cash from the COVID stimulus, with roughly 90% of the excess cash being spent already. This, along with the lagged impacts of monetary tightening, higher energy prices, and the forthcoming resumption of student loan payments, should weigh on consumer spending in the coming months.

__________________________________________________________________________________________________

Equity Recap

Last year’s market sell-off led to new investment opportunities across asset classes. The 2023 rebound has been uneven; while overall valuations improved, some assets look more attractive. Equities, especially the S&P 500, have shown gains. Tech stocks have significantly boosted the S&P 500 this year. However, high valuations call for caution. Active management may better target undervalued market segments than passive investing.

Globally, economic momentum was weak last year, but recent developments in Europe and China suggest potential growth. Yet, both regions are performing below expectations, complicating the global economic outlook.

Global Recap

In China, low consumer confidence and business investment have led to a lackluster reopening. The government is implementing policies to boost the economy. Europe faces a weak growth outlook amid high inflation and manufacturing pessimism. India and Japan, however, show economic strengths. India’s economy is buoyed by cyclical and structural factors, while Japan benefits from tourism and exports.

Globally, Europe and China’s slow growth contrasts with India and Japan’s stronger performance. Reduced Chinese export prices might aid the global inflation fight. Emerging markets, excluding China, are showing promise. Investors could find attractive technology investments in East-Asian markets, differing from the U.S. focus.

As 2024 approaches, investors should evaluate risks and opportunities, considering international markets and companies with long-term growth potential.

__________________________________________________________________________________________________

Fixed Income Recap

Domestic fixed income was negative this quarter, as the Fed increased interest rates yet again. The Fed has continued its strong stance on bringing inflation down to its 2% target. Fed Chair

Jerome Powell has not wavered in his emphasis on the 2% target being their number one priority and he indicated he is willing to keep rates higher for longer if he feels necessary. This has continued to produce volatility, as the bond market attempts to pinpoint the peak of interest rate hikes. At their September meeting, the Fed left the federal funds rate unchanged in a range of 5.25% – 5.50%. While this move was widely telegraphed, forward guidance indicates there may be another rate hike coming. Indeed, the median Federal Open Market Committee member still expects one more rate hike this year, but now expects only two cuts in 2024.

It appears the Fed is near, if not already at, the end of its hiking cycle, which will divert investor attention to the potential for rate cuts as opposed to rate hikes. If the economy avoids a recession, the Fed will be able to deliver mild cuts next year. However, if the U.S. economy enters a recession, the Fed may be forced to cut rates rapidly. Both outcomes, however, should bode well for high-quality fixed-income investments.

It is important to note that the bond market is priced very attractively as compared to its 25-year history. It was not long ago that the U.S. bond market was producing a 1.5% annual yield. The current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields.

__________________________________________________________________________________________________

2023 Outlook & Beyond

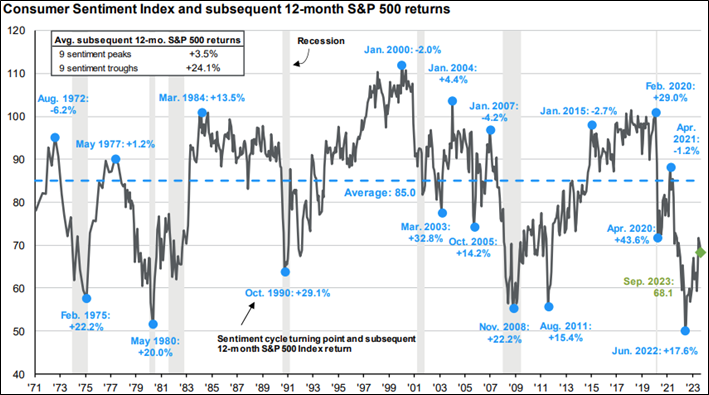

Strong market performance, moderating inflation, and tight labor markets have allowed consumer sentiment to rebound after its trough in June of 2022. This summer saw a less gloomy consumer, with strong sentiment gains in June and July. However, the fall is splashing some cold water on this exuberance, with higher gasoline prices and the gradual pass-through of higher interest rates to borrowing costs likely weighing on sentiment going forward.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risky assets. However, history suggests that trying to time markets in this way is a mistake. This illustration shows consumer sentiment over the past 50 years, with 9 distinct peaks and troughs, and how much the S&P 500 gained or lost in the 12 months following. On average, buying at a confidence peak returned 3.5% while buying at a low consumer confidence point returned 24.0%.

Importantly, this is not to suggest that U.S. stocks will return anything like 24.0% in the year ahead, as many other factors will determine that outcome. However, it does suggest that when planning for 2024 and beyond, investors should focus on fundamentals and valuations rather than how they feel about the world.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress-tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

3rd Quarter 2023 Commentary

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

- Domestic equities were negative in Q3 with large cap stocks finishing -3.27% (+13.07% YTD).

- Foreign equities were negative in Q3 returning -4.11% in developed markets and -2.93% in emerging markets. YTD, developed markets are up +7.08% and emerging markets are up +1.82%.

- Domestic bonds were negative in Q3 returning -3.23% for the quarter (-1.21% YTD).

- Foreign bonds were negative in Q3 finishing the quarter at -0.78% (+2.80% YTD).

__________________________________________________________________________________________________Economic Update

Resiliency seems to be the most apt description of the U.S. economy this year. In fact, the Atlanta Fed GDP model is now calling for an acceleration in growth during the third quarter. At the same time, inflation is continuing to moderate, helping to spark enthusiasm for a soft landing. However, with tailwinds from the consumer and business sectors likely to fade in the coming months, the path to a soft landing may be narrower than expected. Meanwhile, reaccelerating growth in a still-tight labor market has complicated things at the Federal Reserve, as they continue to balance the risks of over versus under-tightening. At its September meeting, the Fed kept rates unchanged at 5.25%-5.50%, but forward guidance left the door open for another hike. Nevertheless, the Fed does seem to be near the end of tightening and the pace of interest rate cuts next year will be largely dependent on whether or not the U.S. economy falls into a recession. Current valuations, while still below 2021 levels, do look more expensive compared to historical averages, making the market more sensitive to economic headwinds.Consumer Trends: Job Growth, Spending Patterns, and Rising Financial Pressures

Equity Recap

Last year’s market sell-off led to new investment opportunities across asset classes. The 2023 rebound has been uneven; while overall valuations improved, some assets look more attractive. Equities, especially the S&P 500, have shown gains. Tech stocks have significantly boosted the S&P 500 this year. However, high valuations call for caution. Active management may better target undervalued market segments than passive investing. Globally, economic momentum was weak last year, but recent developments in Europe and China suggest potential growth. Yet, both regions are performing below expectations, complicating the global economic outlook.Global Recap

In China, low consumer confidence and business investment have led to a lackluster reopening. The government is implementing policies to boost the economy. Europe faces a weak growth outlook amid high inflation and manufacturing pessimism. India and Japan, however, show economic strengths. India’s economy is buoyed by cyclical and structural factors, while Japan benefits from tourism and exports. Globally, Europe and China’s slow growth contrasts with India and Japan’s stronger performance. Reduced Chinese export prices might aid the global inflation fight. Emerging markets, excluding China, are showing promise. Investors could find attractive technology investments in East-Asian markets, differing from the U.S. focus. As 2024 approaches, investors should evaluate risks and opportunities, considering international markets and companies with long-term growth potential. __________________________________________________________________________________________________Fixed Income Recap

Domestic fixed income was negative this quarter, as the Fed increased interest rates yet again. The Fed has continued its strong stance on bringing inflation down to its 2% target. Fed Chair2023 Outlook & Beyond

Strong market performance, moderating inflation, and tight labor markets have allowed consumer sentiment to rebound after its trough in June of 2022. This summer saw a less gloomy consumer, with strong sentiment gains in June and July. However, the fall is splashing some cold water on this exuberance, with higher gasoline prices and the gradual pass-through of higher interest rates to borrowing costs likely weighing on sentiment going forward. When investors feel gloomy and worried about the outlook, their natural tendency is to sell risky assets. However, history suggests that trying to time markets in this way is a mistake. This illustration shows consumer sentiment over the past 50 years, with 9 distinct peaks and troughs, and how much the S&P 500 gained or lost in the 12 months following. On average, buying at a confidence peak returned 3.5% while buying at a low consumer confidence point returned 24.0%.Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

Brandon Bauer, CFP®

Share this post with your friends