Market Performance Overview

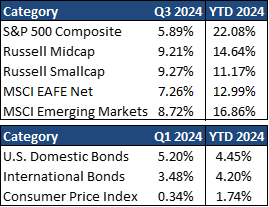

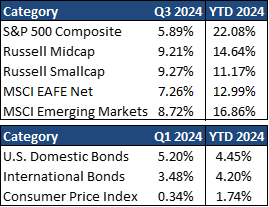

- US stocks were positive in Q3, returning 5.89% in the quarter and 08% YTD.

- Foreign has a strong quarter as well, returning 7.26% in developed markets (12.99% YTD) and 8.72% in emerging markets (16.86% YTD).

- US bonds rebounded in Q3, returning 5.20% and 45% YTD.

- Foreign bonds were positive in Q3, returning 3.48% and 4.20%

__________________________________________________________________________________________________

Economic Update

The U.S. economy maintained a solid pace over the summer, fueled by resilient consumer spending. At the same time, inflation continued on a path back toward the Federal Reserve’s 2% target, while the rising unemployment rate sparked fears the labor market is cooling too quickly. Moving forward, steady consumer spending should support trends like economic growth into 2025, and with few excesses building across the cyclical sectors of the economy, a near-term recession seems unlikely. Meanwhile, cooling inflation has allowed the Federal Reserve to focus more on the labor market, prompting it to join other global central banks in easing policy and delivering a 50 basis point (.50%) rate cut in September. While the Fed’s updated economic projections forecast two more rate cuts this year, the pace of cuts will depend heavily on incoming data. It does appear, however, that rates will settle at a structurally higher level relative to the past decade, barring any economic shocks.

For markets, this summer was anything but calm. Equity market volatility spiked in August due to lackluster guidance from the Magnificent 7 stocks, weaker economic data, and policy action from the Bank of Japan. This said, market jitters have faded in recent weeks, with broadening earnings growth and rate-cut bets pushing markets higher, resulting in elevated valuations.

Expectations for dovish policy action have helped bonds rally, too, and yields are lower now than at the start of the year. With U.S. elections quickly approaching, geo-political tensions are still elevated, and the Federal Reserve is keen on normalizing policy without sending gloomy signals. However, risks remain that could keep markets volatile and tip the U.S. economy into recession. Against this backdrop, we have looked to lean into attractive opportunities while diversifying across asset classes.

__________________________________________________________________________________________________

Equity Recap

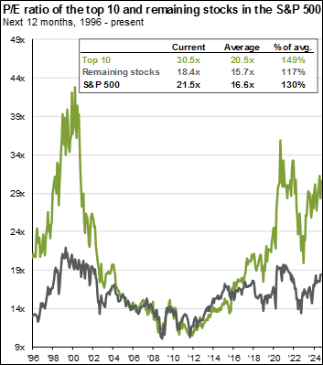

Resilient economic activity and earnings growth north of 10% have propelled U.S. stocks higher in recent months. Notably, the rally has extended to a broader cohort of stocks, and earnings growth outside the most dominant companies inflected positively in 2Q24. While valuations at over 21x earnings remain a risk, the richest parts of the market have some of the strongest fundamentals. Moreover, other segments of the market remain depressed relative to the broader index, providing investors with plenty of opportunities across sectors.

Despite a volatile third quarter, international equities have maintained their upward momentum, and many markets are up over 10% this year. Even so, in  both absolute terms and relative to their histories, international markets continue to look attractively priced compared to the U.S. This, combined with improving fundamentals, structurally higher interest rates, and a more favorable economic backdrop, presents an attractive opportunity for U.S. investors to diversify abroad.

both absolute terms and relative to their histories, international markets continue to look attractively priced compared to the U.S. This, combined with improving fundamentals, structurally higher interest rates, and a more favorable economic backdrop, presents an attractive opportunity for U.S. investors to diversify abroad.

Global economic activity has improved from last year’s sluggish pace, although there has been divergence beneath the surface. Manufacturing activity remains subdued in Europe, while domestic demand in China has been weak. However, other parts of Asia have benefitted from a turn in the technology cycle, driven by investments in AI and other advanced technologies. With many global central banks focused on normalizing policy, renewed economic tailwinds should highlight numerous attractive opportunities across global markets.

__________________________________________________________________________________________________

Fixed Income Recap

Expectations for aggressive policy easing propelled bonds higher during the third quarter, leaving them up over 5% year-to-date. Cooling inflation in recent months has allowed the Federal Reserve to focus on supporting the labor market, prompting it to deliver a 50-basis point rate cut at its September meeting. The pace of future cuts will hinge on the incoming data. While yields across the fixed income market have fallen, they are still trading above their 10-year medians in many sectors.

Investors may want to lock in attractive yields while they still can. Absent any economic shocks, current yields are likely to fade as the Federal Reserve cuts rates further, causing interest rates to settle at a structurally higher level than they were in the past decade.

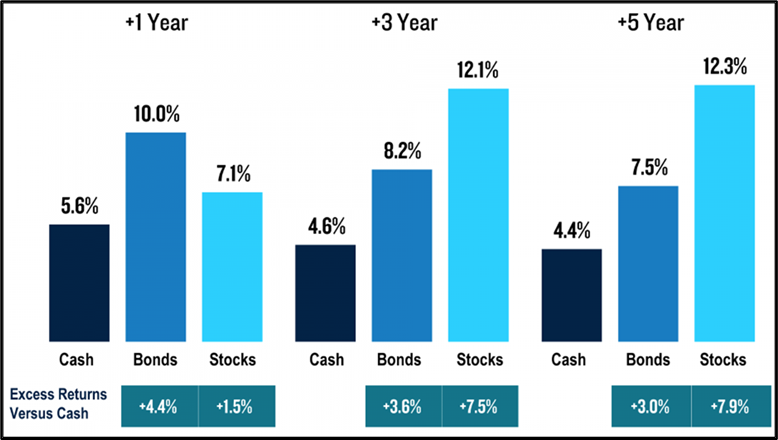

We continue to caution investors of the inverted yield curve. Some investors are tempted to lock in cash yields around 5%. However, there is an opportunity cost to holding too much cash. History shows there have been better assets than cash to deploy capital into once the Federal Reserve begins cutting interest rates. The chart to the right outlines average returns for stocks, bonds, and cash following the first rate cut over 1, 3, and 5 years. Instead of sitting on the sidelines, investors should put long-term money to work in long-term opportunities.

__________________________________________________________________________________________________

2024 Outlook & Beyond

As investors look to the last quarter of 2024, geopolitical uncertainty remains elevated. With the higher valuations produced by the strong investment returns of 2023 and 2024 thus far, it is more important than ever that investors maintain well-diversified portfolios designed to reduce risk and provide solid long-term income and capital gains. In an environment like this, it is crucial to take a diversified approach to portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. History shows that even at all-time highs, markets can still be attractive for long-term investors, as strong performance tends to beget strong performance. If you are a client of our firm, we have created your portfolio to weather a range of market environments. If you are not a client and have not stress-tested your portfolio or do not have a well-designed plan to navigate uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

**Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

3rd Quarter 2024 Commentary

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

The U.S. economy maintained a solid pace over the summer, fueled by resilient consumer spending. At the same time, inflation continued on a path back toward the Federal Reserve’s 2% target, while the rising unemployment rate sparked fears the labor market is cooling too quickly. Moving forward, steady consumer spending should support trends like economic growth into 2025, and with few excesses building across the cyclical sectors of the economy, a near-term recession seems unlikely. Meanwhile, cooling inflation has allowed the Federal Reserve to focus more on the labor market, prompting it to join other global central banks in easing policy and delivering a 50 basis point (.50%) rate cut in September. While the Fed’s updated economic projections forecast two more rate cuts this year, the pace of cuts will depend heavily on incoming data. It does appear, however, that rates will settle at a structurally higher level relative to the past decade, barring any economic shocks.

For markets, this summer was anything but calm. Equity market volatility spiked in August due to lackluster guidance from the Magnificent 7 stocks, weaker economic data, and policy action from the Bank of Japan. This said, market jitters have faded in recent weeks, with broadening earnings growth and rate-cut bets pushing markets higher, resulting in elevated valuations.

Expectations for dovish policy action have helped bonds rally, too, and yields are lower now than at the start of the year. With U.S. elections quickly approaching, geo-political tensions are still elevated, and the Federal Reserve is keen on normalizing policy without sending gloomy signals. However, risks remain that could keep markets volatile and tip the U.S. economy into recession. Against this backdrop, we have looked to lean into attractive opportunities while diversifying across asset classes.

__________________________________________________________________________________________________

Equity Recap

Resilient economic activity and earnings growth north of 10% have propelled U.S. stocks higher in recent months. Notably, the rally has extended to a broader cohort of stocks, and earnings growth outside the most dominant companies inflected positively in 2Q24. While valuations at over 21x earnings remain a risk, the richest parts of the market have some of the strongest fundamentals. Moreover, other segments of the market remain depressed relative to the broader index, providing investors with plenty of opportunities across sectors.

Despite a volatile third quarter, international equities have maintained their upward momentum, and many markets are up over 10% this year. Even so, in both absolute terms and relative to their histories, international markets continue to look attractively priced compared to the U.S. This, combined with improving fundamentals, structurally higher interest rates, and a more favorable economic backdrop, presents an attractive opportunity for U.S. investors to diversify abroad.

both absolute terms and relative to their histories, international markets continue to look attractively priced compared to the U.S. This, combined with improving fundamentals, structurally higher interest rates, and a more favorable economic backdrop, presents an attractive opportunity for U.S. investors to diversify abroad.

Global economic activity has improved from last year’s sluggish pace, although there has been divergence beneath the surface. Manufacturing activity remains subdued in Europe, while domestic demand in China has been weak. However, other parts of Asia have benefitted from a turn in the technology cycle, driven by investments in AI and other advanced technologies. With many global central banks focused on normalizing policy, renewed economic tailwinds should highlight numerous attractive opportunities across global markets.

__________________________________________________________________________________________________

Fixed Income Recap

Expectations for aggressive policy easing propelled bonds higher during the third quarter, leaving them up over 5% year-to-date. Cooling inflation in recent months has allowed the Federal Reserve to focus on supporting the labor market, prompting it to deliver a 50-basis point rate cut at its September meeting. The pace of future cuts will hinge on the incoming data. While yields across the fixed income market have fallen, they are still trading above their 10-year medians in many sectors.

Investors may want to lock in attractive yields while they still can. Absent any economic shocks, current yields are likely to fade as the Federal Reserve cuts rates further, causing interest rates to settle at a structurally higher level than they were in the past decade.

We continue to caution investors of the inverted yield curve. Some investors are tempted to lock in cash yields around 5%. However, there is an opportunity cost to holding too much cash. History shows there have been better assets than cash to deploy capital into once the Federal Reserve begins cutting interest rates. The chart to the right outlines average returns for stocks, bonds, and cash following the first rate cut over 1, 3, and 5 years. Instead of sitting on the sidelines, investors should put long-term money to work in long-term opportunities.

__________________________________________________________________________________________________

2024 Outlook & Beyond

As investors look to the last quarter of 2024, geopolitical uncertainty remains elevated. With the higher valuations produced by the strong investment returns of 2023 and 2024 thus far, it is more important than ever that investors maintain well-diversified portfolios designed to reduce risk and provide solid long-term income and capital gains. In an environment like this, it is crucial to take a diversified approach to portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. History shows that even at all-time highs, markets can still be attractive for long-term investors, as strong performance tends to beget strong performance. If you are a client of our firm, we have created your portfolio to weather a range of market environments. If you are not a client and have not stress-tested your portfolio or do not have a well-designed plan to navigate uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

**Charts, graphs, market performance data, and commentary sourced from J.P. Morgan Asset Management.

Brandon Bauer, CFP®

Share this post with your friends