Investing isn’t just about crunching numbers; it’s a mental game. Our brains, while powerful, are wired with biases that can significantly derail our financial goals. Understanding these psychological traps is crucial for building and preserving wealth. Let’s explore four key areas where emotions can sabotage your investment success:

1. The Illusion of Control

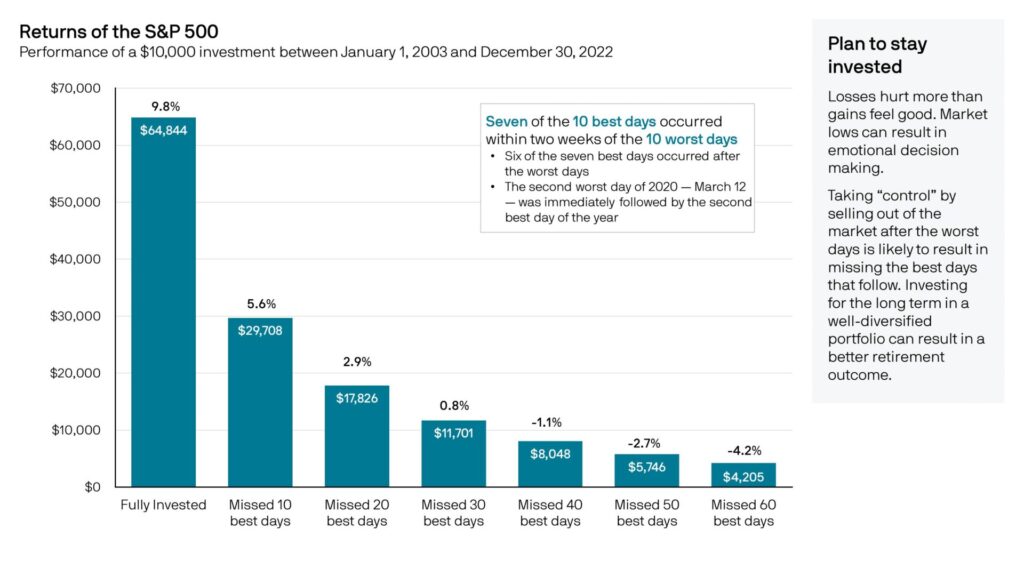

We often overestimate our ability to predict market movements. This illusion of control leads to overconfidence and excessive trading, ultimately hurting returns. We might think we can consistently pick winning stocks or perfectly time the market, but the reality is far more complex and often driven by factors outside our control.

2. Mental Shortcuts Gone Wrong: Biases That Cloud Judgment

Our brains use mental shortcuts to simplify decision-making. However, these shortcuts can lead to systematic errors in judgment. Common biases that can distort our risk perception and lead to emotional, rather than rational, investment choices include:

- Anchoring: Over-reliance on the first piece of information we receive, even if it’s irrelevant. For example, fixating on a stock’s initial price.

- Availability Bias: Favoring recent or easily recalled events, leading us to overestimate their likelihood. Think panic selling after a market dip.

- Loss Aversion: Feeling the pain of losses more acutely than the pleasure of gains. This can lead to holding on to losing investments for too long, hoping they’ll “come back.”

3. Risk: It’s More Than Just a Number

The most important investment decision an investor can make is their allocation to risk. The thing is, risk isn’t a one-size-fits-all concept. It involves three key components:

- Risk Tolerance: How much risk you’re willing to take.

- Risk Perception: How you view risk.

- Risk Capacity: How much risk you can afford to take.

These factors can change over time and are influenced by individual circumstances, and market conditions. Understanding your own risk profile is essential for aligning your investments with your goals and comfort level.

4. Black Swan Events

Black Swan events, like 9/11 or the COVID-19 pandemic, are rare and unpredictable events that can significantly disrupt even the most well-planned portfolios. While impossible to predict, understanding our biases is crucial. Fear-driven reactions, such as panic selling, can exacerbate losses. A disciplined approach, focusing on what you can control (asset allocation and long-term strategy), is key to navigating these turbulent times.

Voisard Asset Management is here to support our clients through all economic conditions. We believe regular communication is essential for navigating market fluctuations and achieving long-term financial goals.