Market Performance Overview

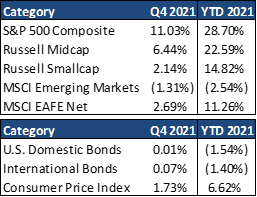

- Domestic equities were positive in Q4, with large cap stocks finishing +11.03% for the quarter and +28.70% in 2021.

- Foreign equities were mixed in Q4, returning 2.69% in developed markets and -1.31% in emerging markets. Developed markets were +11.26% in 2021 while emerging markets are -2.54% in 2021.

- Domestic bonds were essentially flat in Q4, returning +0.01%, while returning -1.54% YTD.

- Foreign bonds were positive in Q4, finishing +0.07%, while returning -1.40% YTD.

___________________________________________________________________________________________________________________

Economic Update

At the start of a new year, financial markets are still being impacted by COVID-19. However, two years into the pandemic, these impacts are slowly starting to fade. In part this is because most Americans now have some immunity to the virus, either through inoculation or infection. It is also because the American economy has now adapted to the pandemic, with many people simply resuming their normal activities and others adjusting their lives to provide themselves with greater protection from infection while still fully participating in the economy. This has allowed the U.S. economy to fully recover from the pandemic recession, and following a weak third quarter, economic growth is accelerating into the winter. This acceleration has prompted a sharp fall in the unemployment rate and has contributed to strong growth in corporate profits. However, it is also being accompanied by some of the strongest inflation seen in the past forty years.

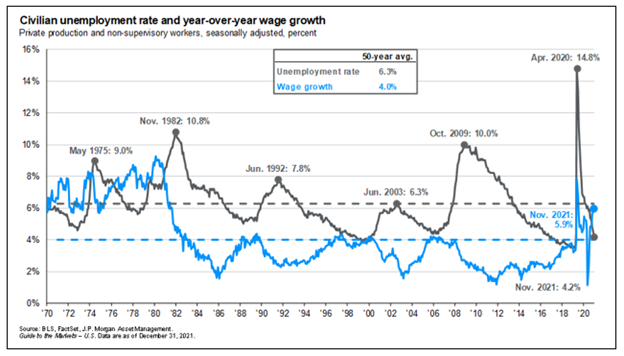

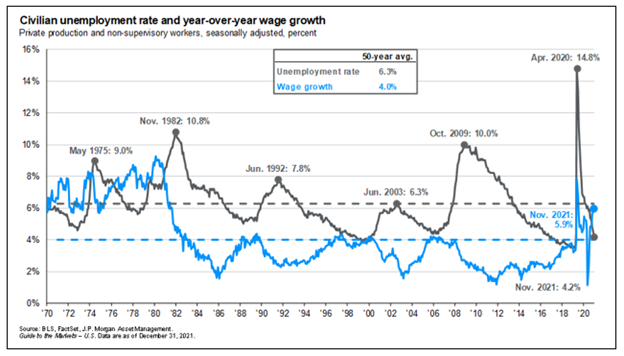

The labor market saw huge improvement over the course of 2021, with the unemployment rate falling from 6.7% in December 2020 to 4.2% by November 2021. However, even with these recent gains, employment remains 3.9 million below its peak in February of 2020. While this might suggest that a small amount of labor market slack remains, wages tell a different story. Wage growth has been rising and is at annualized rates not seen since the 1980s. Put this together with surging labor demand, this suggests the employment shortfall is primarily an issue of labor supply. Labor supply has likely been constrained by enhanced unemployment benefits, lower immigration, higher costs of childcare, and lingering pandemic fears. The worker shortage may persist for some time, but we expect some of the pandemic effects to recede, allowing unemployment to fall below 4.0% in the first half of 2022.

As the pandemic fades, the extraordinary fiscal support provided by the federal government is diminishing. Legislation passed in the last two fiscal years has added $5.3 trillion to the economy and has proven to be a powerful accelerant for the recovery. This stimulus is likely to drop sharply in the 2022. The details of additional stimulus aimed at infrastructure, childcare, education, and other initiatives continues to be negotiated in Washington. New stimulus would be stretched out over a decade and at least partially financed by tax increases, providing much less stimulus to the economy than we have seen over the last two years. In 2022, the economy should be much healthier than over the last two years, but it will also receive much less government support, which doesn’t appear to be needed given current economic indicators.

___________________________________________________________________________________________________________________

Equity Recap

Domestic equities performed well throughout 2021, returning +28.70% in 2021. Earnings have recovered spectacularly since the big declines in early 2020 and hit a new all-time high in 2021. This partly reflects stellar profits in some of the most important sectors of the U.S. equity market such as technology and health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most last year. More generally, earnings have been bolstered by powerful consumer demand and higher productivity as businesses have been able to reduce costs in a more virtual environment. However, from 2022 on, slower economic growth, higher wage costs, higher interest rates and, potentially, higher corporate taxes could make further gains much more difficult to achieve.

Domestic equities performed well throughout 2021, returning +28.70% in 2021. Earnings have recovered spectacularly since the big declines in early 2020 and hit a new all-time high in 2021. This partly reflects stellar profits in some of the most important sectors of the U.S. equity market such as technology and health care throughout the pandemic, but also a rebound in many of the cyclical sectors that struggled the most last year. More generally, earnings have been bolstered by powerful consumer demand and higher productivity as businesses have been able to reduce costs in a more virtual environment. However, from 2022 on, slower economic growth, higher wage costs, higher interest rates and, potentially, higher corporate taxes could make further gains much more difficult to achieve.

In 2021, equities were characterized by range-bound valuations and rising earnings expectations. Stock prices based on current forward P/E ratios still look elevated, although they have come down somewhat as earnings have played catch-up. Looking forward to 2022, returns will depend more heavily on profit margins. Rising wages, supply chain disruptions, and higher taxes could all negatively impact profit margins over the next few years. However, while elevated valuations may pose a speed limit for the market, the outlook for returns remains positive amidst strong fundamentals and corporate profitability. After multiple years of strong outperformance of growth stocks, most notably during the pandemic in 2020, value stocks began to recover in the first half of 2021. Value stocks generally tend to outperform growth stocks during periods of above-trend economic activity and rising interest rates. However, investors don’t necessarily have to choose between value and growth – the best allocation will be a blend of the two.

While the global recovery has been delayed, it has not been derailed, and the global economy is registering solid momentum at the start of the year. We expect the global economy to continue to grow above trend over the course of next year as pandemic effects recede and for robust earnings growth to be an important catalyst for international markets. In addition, valuations remain attractive with both emerging market and developed market stocks at some of their cheapest levels relative to the U.S. in the last 20 years. This, along with a global post-pandemic economic rebound, lower trade tensions and the prospect of a lower dollar in the long run argue for a greater allocation to international equities.

____________________________________________________________________________________________________________

Fixed Income Recap

U.S. bonds saw slight gains this quarter, finishing +0.01%, while losing -1.54% in 2021. A rapidly improving labor market and persistent inflationary pressures has pushed the Federal Reserve (Fed) to adopt a more hawkish stance towards monetary policy. At its December meeting, the Federal Reserve made clear that while the delta variant has slowed economic progress, the labor market recovery has been robust and inflation may be stickier than they previously assumed. Consequently, the Fed accelerated the pace of tapering by $30 billion per month, suggesting they would conclude the process by March 2022. This would clear the way for increases in the federal funds rate starting in June and the potential for three rate hikes by the end of next year, as suggested by the median dot plot.

There continues to be a place in portfolios for fixed income to provide diversification and protection in the case of an equity market or economic relapse. However, with interest rates likely moving higher in 2022, against the backdrop of rising inflation, faster growth, and a less accommodative Fed, investors will want to focus on shorter duration bonds to be well-positioned if long-term rates resume their ascent.

_____________________________________________________________________________________________________________

2022 Outlook & Beyond

The U.S. economy has had a bumpy recovery with much higher-than-expected inflation but is still on strong footing as we enter 2022. Additionally, further progress on the pandemic will continue to be a tailwind for the global economic recovery. Given the substantial growth markets have had thus far in the economic cycle, investors would be wise to focus on fundamentals and maintain a diversified stance as we move forward to a more vibrant, and healthier 2022.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

2021 Quarterly Commentary Q4

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

___________________________________________________________________________________________________________________

Economic Update

At the start of a new year, financial markets are still being impacted by COVID-19. However, two years into the pandemic, these impacts are slowly starting to fade. In part this is because most Americans now have some immunity to the virus, either through inoculation or infection. It is also because the American economy has now adapted to the pandemic, with many people simply resuming their normal activities and others adjusting their lives to provide themselves with greater protection from infection while still fully participating in the economy. This has allowed the U.S. economy to fully recover from the pandemic recession, and following a weak third quarter, economic growth is accelerating into the winter. This acceleration has prompted a sharp fall in the unemployment rate and has contributed to strong growth in corporate profits. However, it is also being accompanied by some of the strongest inflation seen in the past forty years.

The labor market saw huge improvement over the course of 2021, with the unemployment rate falling from 6.7% in December 2020 to 4.2% by November 2021. However, even with these recent gains, employment remains 3.9 million below its peak in February of 2020. While this might suggest that a small amount of labor market slack remains, wages tell a different story. Wage growth has been rising and is at annualized rates not seen since the 1980s. Put this together with surging labor demand, this suggests the employment shortfall is primarily an issue of labor supply. Labor supply has likely been constrained by enhanced unemployment benefits, lower immigration, higher costs of childcare, and lingering pandemic fears. The worker shortage may persist for some time, but we expect some of the pandemic effects to recede, allowing unemployment to fall below 4.0% in the first half of 2022.

As the pandemic fades, the extraordinary fiscal support provided by the federal government is diminishing. Legislation passed in the last two fiscal years has added $5.3 trillion to the economy and has proven to be a powerful accelerant for the recovery. This stimulus is likely to drop sharply in the 2022. The details of additional stimulus aimed at infrastructure, childcare, education, and other initiatives continues to be negotiated in Washington. New stimulus would be stretched out over a decade and at least partially financed by tax increases, providing much less stimulus to the economy than we have seen over the last two years. In 2022, the economy should be much healthier than over the last two years, but it will also receive much less government support, which doesn’t appear to be needed given current economic indicators.

___________________________________________________________________________________________________________________

Equity Recap

In 2021, equities were characterized by range-bound valuations and rising earnings expectations. Stock prices based on current forward P/E ratios still look elevated, although they have come down somewhat as earnings have played catch-up. Looking forward to 2022, returns will depend more heavily on profit margins. Rising wages, supply chain disruptions, and higher taxes could all negatively impact profit margins over the next few years. However, while elevated valuations may pose a speed limit for the market, the outlook for returns remains positive amidst strong fundamentals and corporate profitability. After multiple years of strong outperformance of growth stocks, most notably during the pandemic in 2020, value stocks began to recover in the first half of 2021. Value stocks generally tend to outperform growth stocks during periods of above-trend economic activity and rising interest rates. However, investors don’t necessarily have to choose between value and growth – the best allocation will be a blend of the two.

While the global recovery has been delayed, it has not been derailed, and the global economy is registering solid momentum at the start of the year. We expect the global economy to continue to grow above trend over the course of next year as pandemic effects recede and for robust earnings growth to be an important catalyst for international markets. In addition, valuations remain attractive with both emerging market and developed market stocks at some of their cheapest levels relative to the U.S. in the last 20 years. This, along with a global post-pandemic economic rebound, lower trade tensions and the prospect of a lower dollar in the long run argue for a greater allocation to international equities.

____________________________________________________________________________________________________________

Fixed Income Recap

U.S. bonds saw slight gains this quarter, finishing +0.01%, while losing -1.54% in 2021. A rapidly improving labor market and persistent inflationary pressures has pushed the Federal Reserve (Fed) to adopt a more hawkish stance towards monetary policy. At its December meeting, the Federal Reserve made clear that while the delta variant has slowed economic progress, the labor market recovery has been robust and inflation may be stickier than they previously assumed. Consequently, the Fed accelerated the pace of tapering by $30 billion per month, suggesting they would conclude the process by March 2022. This would clear the way for increases in the federal funds rate starting in June and the potential for three rate hikes by the end of next year, as suggested by the median dot plot.

There continues to be a place in portfolios for fixed income to provide diversification and protection in the case of an equity market or economic relapse. However, with interest rates likely moving higher in 2022, against the backdrop of rising inflation, faster growth, and a less accommodative Fed, investors will want to focus on shorter duration bonds to be well-positioned if long-term rates resume their ascent.

_____________________________________________________________________________________________________________

2022 Outlook & Beyond

The U.S. economy has had a bumpy recovery with much higher-than-expected inflation but is still on strong footing as we enter 2022. Additionally, further progress on the pandemic will continue to be a tailwind for the global economic recovery. Given the substantial growth markets have had thus far in the economic cycle, investors would be wise to focus on fundamentals and maintain a diversified stance as we move forward to a more vibrant, and healthier 2022.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Brandon Bauer, CFP®

Share this post with your friends