There is no “perfect” allocation to stocks and bonds, as an individual’s allocation should be based on their portfolio’s ability to assume risk and their appetite for risk. For some, a mix of 0% stocks and 100% bonds may be sufficient. For others, a 100% allocation to stocks may better suit them due to factors such as age, income, and financial goals. For the purpose of this article, we are focusing on a balanced portfolio of 50% stocks and 50% bonds (50/50 portfolio).

Many believe that in order to achieve great returns, an investor’s portfolio must be comprised entirely of stocks. While historically an all stock portfolio will yield higher returns, it will also experience higher volatility. Bonds are generally utilized within a portfolio to dampen the volatility of stocks and provide more stability in returns.

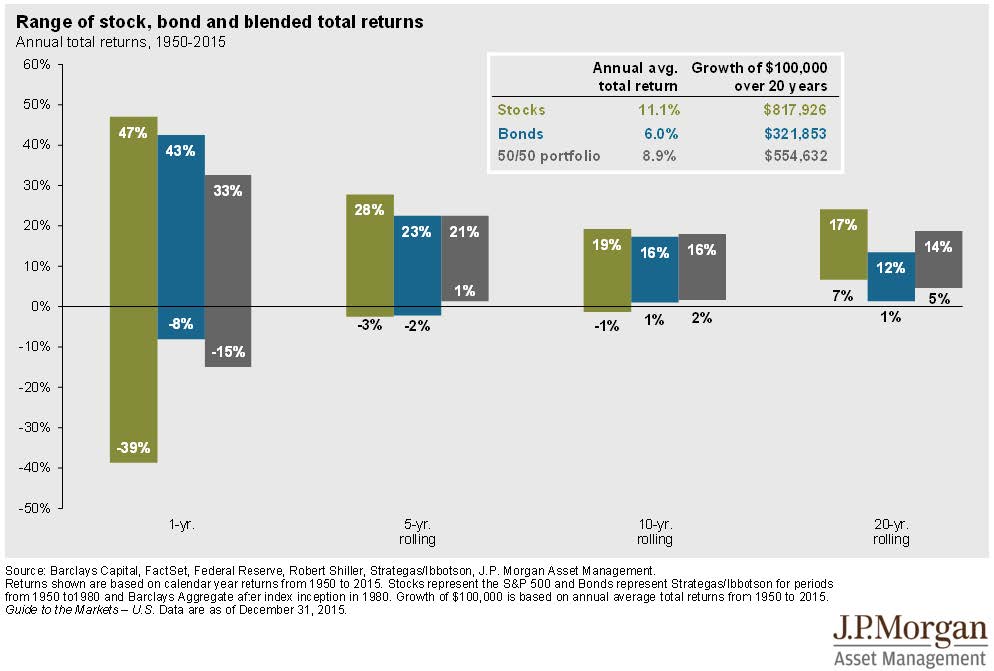

In order to help determine what investors may expect out of a balanced portfolio, it is often helpful to see how portfolios have performed in the past. While this does not guarantee future returns, it is an indication of what may happen moving forward. The chart below shows average historical returns for stocks, bonds, and a 50/50 portfolio since 1950. The returns shown within the chart represent the highest and lowest returns that have occurred over 1, 5, 10 and 20 year rolling periods. Rolling returns are calculated by taking a specific time period, for example five years (1950-1954), dropping a year off the back and adding it to the front (1951-1955.) The chart continues this process through 2015.

As you may notice, there is a large variance when looking at 1-year returns. The top return year for a 50/50 portfolio was 33%. Conversely, the worst return year for a 50/50 portfolio was -15%. Looking out past the 1-year returns, the spread between the highs and lows begins to narrow. The highest return in any 5-year period since 1950 was 21%, while the lowest return in any 5-year period was 1%. As we continue to expand our time horizon, the highest return in any 20-year period since 1950 for a 50/50 portfolio was 14% and the lowest return in any 20-year period was 5%. The average 20-year rolling return was 8.9% for a 50/50 portfolio.

Many investors would be satisfied with an average return of 8.9%. However, many investors never see these returns because they do not look past 1 and 5-year returns. Often times, investors get caught up in how their portfolio has done over the short-term and as a result make short-sighted decisions. As mentioned in our last communication piece titled “The Creation of Long Term Wealth,” the S&P 500 returned an average of 9.1% annually from 1995 to 2014. However, the average investor with a portfolio invested in 100% stocks only earned approximately 5.2% annually during that same time frame. Results like these occur most often when markets drop and fears rise, causing investors not to follow their plan. Sticking to your tailored plan through the tough years when markets are flat or even negative can help you avoid pitfalls that many investors experience.

Many clients have asked recently, “Are we going anywhere?” The large company market was down approximately 1% in 2015 (excluding dividends). Further, the first two months of 2016 have landed in negative territory. Many people misinterpret charts like the one above and think the 8.9% average return should happen year over year. They begin to think something is wrong when returns over two or three years are not at that level. As the chart shows, the range of returns in a balanced portfolio is wide when only looking at 1 and 5-year returns. It is not until the 20-year rolling period that we see the spread between the highs and lows tighten. In conclusion, the time horizon for most investors should not be one or even five years. Long-term investors should look out 10+ years and expect a wide range of results for shorter periods of time. Historically, investors who stick to their plan to achieve the positive results they expect.

Please Notice: This document is provided for informational purposes only and does not constitute an offer or solicitation to purchase or sell any security or commodity. The information herein is provided to you on a confidential basis and is intended only for the anticipated recipient or their agents. Any opinions expressed are subject to change at any time without notice. Information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed.

Past performance is not a guarantee of future results. This material is distributed with an understanding that it does not constitute tax, legal or accounting advice and is not intended to replace the advice of a qualified attorney or tax advisor. Investing involves risk, including risk of loss. Diversification does not ensure a profit or guarantee against loss. Make any decisions based on this information at your own risk.