In 2020, nearly 100 lawsuits alleging breach of fiduciary duty were filed. With the number of 401(k) lawsuits on the rise targeting plans both large and small, sponsors are well-advised to consider taking additional measures to mitigate fiduciary risk where practicable. Here are a few to consider.

-

- Create and follow an investment policy statement (IPS). While not an ERISA requirement, an IPS is considered a best practice according to Department of Labor (DOL) guidance. Among other things, it outlines how the organization will maintain and follow prudent processes for selecting and monitoring investments and oversee the performance of third-party providers. However, be advised that failure to follow IPS provisions can also expose an organization to increased risk, so careful crafting of IPS language is extremely important.

-

- Outsource fiduciary responsibilities. While a 3(21) fiduciary acts in an advisory capacity, plan sponsors can hire a 3(38) fiduciary to maintain full authority and discretion over investments and take on the liability for managing them on a regular basis. Sponsors, however, must still conform to ERISA standards and follow a prudent process when engaging a 3(38) fiduciary (including monitoring them on an ongoing basis.)

-

- Obtain fiduciary liability insurance. This type of coverage is designed to protect companies from investment mismanagement claims and fiduciary legal liability. Such policies can protect both the organization as well as named fiduciaries, covering legal costs in the event of a 401(k) lawsuit. With the recent escalation of litigation, fiduciary liability insurance costs have also been on the rise, along with imposed limitations in coverage.

-

- Meet the safe harbor requirements of ERISA Section 404(c). This provision offers a “safe harbor” which if met relieves plan sponsors and fiduciaries from liability for losses arising from participant-directed investment. But to qualify, the plan must satisfy several requirements pertaining to matters such as investment options, plan design and administration, as well as participant disclosures. Luckily the majority of these responsibilities are taken care of by top tier recordkeepers and/or third-party administrators.

-

- Take advantage of qualified default investment alternative (QDIA) protections. In Section 624 of the Pension Protection Act of 2006, the DOL established the QDIA safe harbor that allows for default investments to be made on behalf of participants who fail to make investment elections. QDIAs can include a target date fund, balanced fund or professionally managed account. Other regulatory requirements must also be satisfied to enjoy safe harbor relief from fiduciary liability for QDIAs, including the use of prudent QDIA selection criteria, participant notification, and regular monitoring of investment performance.

-

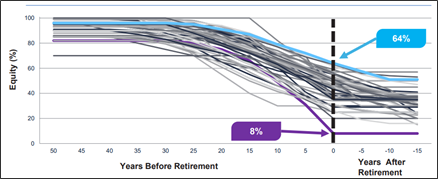

Create a separate process to select and monitor your target date fund (or other QDIA). Not one Target Date Fund (TDF) series is the same. They are complex investments with large differences in risk, glidepath (how and when they reduce risk), expenses, underlying funds, and objectives (as seen to the right, equity allocations can vary by as much as 56%). As a best practice the Department of Labor states it is important for fiduciaries to understand the differences between TDFs and create a process to ensure best fit for the unique characteristics of their employees. As a part of this process, they recommend the following best practices:

Create a separate process to select and monitor your target date fund (or other QDIA). Not one Target Date Fund (TDF) series is the same. They are complex investments with large differences in risk, glidepath (how and when they reduce risk), expenses, underlying funds, and objectives (as seen to the right, equity allocations can vary by as much as 56%). As a best practice the Department of Labor states it is important for fiduciaries to understand the differences between TDFs and create a process to ensure best fit for the unique characteristics of their employees. As a part of this process, they recommend the following best practices:

- Align TDFs with your employee demographics (age, income, savings rate, amount already saved, other retirement plans to name a few)

- Understand the underlying investments and how the investment mix changes over time

- Review the fund’s fees and investment expenses

- Consider custom or non-proprietary options

- Develop effective employee communications

- Document the process

- Engage an independent expert if you do not have one already

-

- Understand and monitor plan fees. As a plan fiduciary, it is your duty to know and understand the costs for operating the plan, who pays them, and to ensure that the fees are fair and reasonable for services rendered. The normal plan fees that you will see are recordkeeping and administration, third party administrator (if your plan is unbundled), advisor, and investment expenses. One place where I often see plan sponsors go wrong is they and/or their advisor will only look at total plan cost when benchmarking the plan and not at each individual service provider (recordkeeping, TPA, Advisor, Investments). As a best practice you/your advisor should be taking the following steps to ensure fee reasonableness:

- Independently benchmark fees on an annual basis

- Request for Information (aka price check) every two to three years. This is where multiple providers are asked to provide current recordkeeping pricing on your plan. This allows you to get a strong price on current market pricing without having to perform a full RFP (Request for Proposal).

- Request for Proposal should be performed every three to five years depending on plan growth and market changes. In this process you are performing a competitive bid process on pricing, service offering, and overall value and fit of the service provider.

- Understand and monitor plan fees. As a plan fiduciary, it is your duty to know and understand the costs for operating the plan, who pays them, and to ensure that the fees are fair and reasonable for services rendered. The normal plan fees that you will see are recordkeeping and administration, third party administrator (if your plan is unbundled), advisor, and investment expenses. One place where I often see plan sponsors go wrong is they and/or their advisor will only look at total plan cost when benchmarking the plan and not at each individual service provider (recordkeeping, TPA, Advisor, Investments). As a best practice you/your advisor should be taking the following steps to ensure fee reasonableness:

-

- Document, document, document. Keep detailed records of the prudent processes your company follows, from investment selection to fee benchmarking to ongoing fiduciary education and training. This documentation can strengthen your case in the event of a lawsuit.

Don’t assume your plan is too small to be vulnerable to litigation risk. Creating these layers of protection can help mitigate fiduciary liability and reduce the risk of a future lawsuit due to the breach of a fiduciary duty.

Sources

https://www.investmentnews.com/401k-lawsuits-explode-2020-200121

https://sponsor.fidelity.com/pspublic/pca/psw/public/library/manageplans/invest_policy_considerations.html

https://money.usnews.com/financial-advisors/articles/guide-to-fiduciary-liability-insurance

https://401kspecialistmag.com/4-key-steps-plan-sponsors-can-take-to-guard-against-401k-lawsuits/

https://www.investmentnews.com/fiduciary-liability-unclear-when-selecting-and-monitoring-default-retirement-investments-65247

target-date-retirement-funds.pdf (dol.gov)