As equities continue their bullish run into 2017, there have been a few common questions that have continued to surface in conversations with our clients and professional partners. “What will happen to interest rates?” and “How will my bond portfolio be impacted if interest rates rise?” There is a high expectation that Janet Yellen and the Federal Reserve are planning to raise the Federal Funds rate (interest rates at which banks can borrow) in 2017.

We have seen little movement in interest rates since the housing crisis caused the Federal Reserve to drop rates to historic lows in March 2009. However, because of the economic recovery, a decrease in unemployment, and increasing inflation expectations, it is widely expected that the Federal Reserve will make two to three 0.25% interest rate hikes in 2017 (the federal funds rate is at 0.75%).

Role of the Federal Reserve

Congress created the Federal Reserve to provide the nation with a safer and more stable financial system. Throughout history, free market societies have gone through boom-and-bust cycles. While everyone enjoys good economic times, the downturns are usually painful for most Americans. To make economic downturns less painful and shorter, the Federal Reserve can manipulate interest rates and the money supply to stimulate consumer demand.

From a high level perspective, when the economy is growing too fast, and is in danger of overheating, the Fed can set rising interest rates to make it more difficult for borrowers to get loans, or, they can sell treasury bonds to decrease the money supply. If the economy is in a slump, the Fed can act in the opposite manner, lowering interest rates to make it easier for consumers to borrow money, and can also purchase treasury bonds to increase the money supply.

Our Client’s Portfolios – Defense is Offense

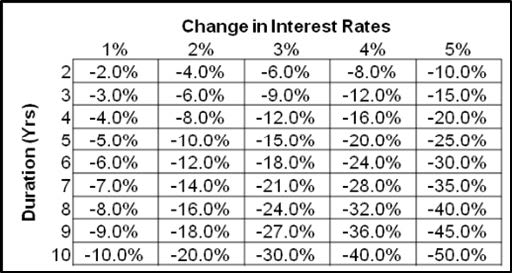

The main concern most investors have is how their portfolio is designed to handle a rising interest rates environment. For clients that hold bonds, this can be explained as duration. Bond duration is an approximate measure of a bond’s price sensitivity to changes in interest rates. For example, if a bond has a duration of 6 years, (meaning they will receive their investment back in approximately 6 years) and interest rates rise by 1%, their bond will shed about 6% of its paper value.

If the bond is held until maturity, the bonds face value will be returned to the investor and the apparent paper loss is recovered. However, if an investor needs to sell during that time, they will realize the 6% loss. It is important to note that holders of a bond will continue to receive interest payments based upon the original terms of the bond. Below is a chart that outlines approximate changes in bond prices in relation to their duration.

At Voisard Asset Management Group, we currently maintain a defensive position within our bond portfolio by assuming a short duration target. The Barclays Aggregate Bond Index duration is currently around 5.8 years, while our portfolio duration is at 3.3 years for clients. We believe that being short duration is a prudent hedge against interest rate risk in a rising rate environment.

At Voisard Asset Management Group, we currently maintain a defensive position within our bond portfolio by assuming a short duration target. The Barclays Aggregate Bond Index duration is currently around 5.8 years, while our portfolio duration is at 3.3 years for clients. We believe that being short duration is a prudent hedge against interest rate risk in a rising rate environment.