Market Performance Overview

- Domestic equities continued their upward trajectory, with the S&P 500 up 10.6% YTD

- Emerging market equities continued downward, ending the quarter -7.7% YTD.

- Developed international markets had a slight uptick in performance, but remain -1.4% YTD.

- Domestic bonds were even over the past quarter, remaining down -1.6% YTD.

- Foreign bonds saw early gains erased in the third quarter, finishing -0.9% YTD

Growth, Jobs, and Yes…Increased Interest Rates Once Again!

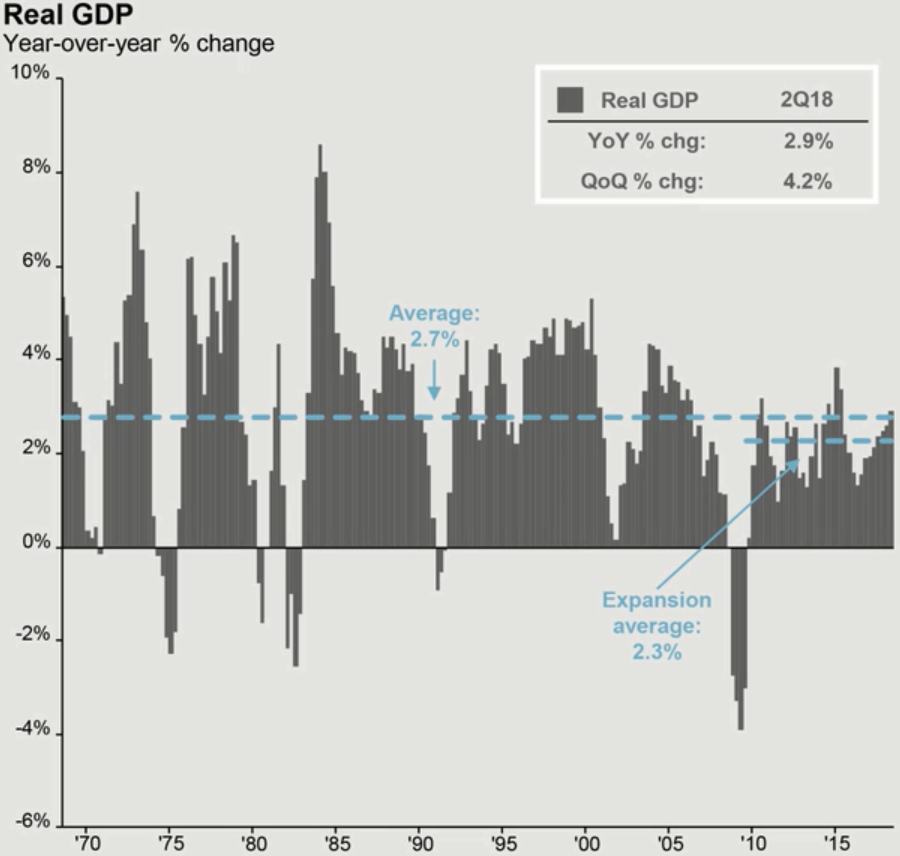

Economic growth continues to surge in 2018. Throughout this expansion, the U.S. economy hasbeen more of a tortoise than a hare, however the tortoise appears to have quickened its pace in 2018. Real GDP growth is roughly 3% year-over-year, with reasons for the acceleration clear. Significant tax cuts for both consumers and businesses have helped spur economic growth along with a reduction in the current U.S. trade deficit. We expect to see growth maintain a close to 3% year-over-year pace into the first half of 2019.

However, by the middle of 2019, as this expansion enters its 11th year, its tortoise like qualities are likely to reassert themselves, with growth slowing to roughly 2% year-over-year. This is likely to occur due to higher interest rates creating headwinds for the housing market, a lack of pent up demand for consumer durable goods, fading effects from fiscal stimulus and a chronic lack of workers, causing businesses to postpone activity or transfer it overseas.

The Federal Reserve is continuing to increase interest rates gradually. So far this year, we have seen three rate hikes, with the outlook calling for another rate hike by year end and three additional interest rate hikes in 2019. While this may bode well for savers, conditions are looking worse for borrowers with variable-rate debt, such as credit cards or home equity lines of credit. The Federal Reserve continues to maintain its forecast of raising interest rates due to the achievement of their long-term goals. We have long-term growth up 3% year-over-year (long-term target is 1.8%), inflation of 2.2% (long-term target is 2.0%) and unemployment of 3.9%, while the Fed thinks optimally it should be around 4.5%. Having met and exceeded each long-term target, the Federal Reserve is continuing to raise rates to prevent an overheating economy.

Domestic Equity Recap

Domestic equities have continued to perform well, and the S&P 500 has steadily corrected first quarter struggles to end quarter three up 10.6% YTD. For investors, the ride thus far in 2018 has not been smooth, as volatility has continued as predicted. While volatility has increased since 2017, investors sitting on the sidelines have missed out on another quarter of positive returns. The Trump administration continues its America first agenda which has contributed heavily to the volatility we have seen this year. While there has been some impact domestically, most of the increased volatility has come from International equities. Valuations appear to remain in line with historical prices as earnings have supported increased stock prices in 2018.

While the current bull market has been strong, it is important for investors to recognize that a low interest rate environment combined with a long bull market limits potential portfolio returns going forward. It is also important to note that with the U.S. and global economies growing, opportunities remain across the spectrum of global financial markets. While the bull market in equities is old, there is no particular expiration date.

International Equity Recap

International returns were mixed in Q3 of 2018, with developed markets rebounding slightly, but still down -1.4% YTD. Emerging markets continued their slide and are down -7.7% YTD. The dollar strengthened in the third quarter of 2018, putting pressure on international investments that traded in U.S. denominations. In addition to a strengthening dollar, we saw escalated trade-war concerns between the U.S. and China, as well as budget issues in Italy.

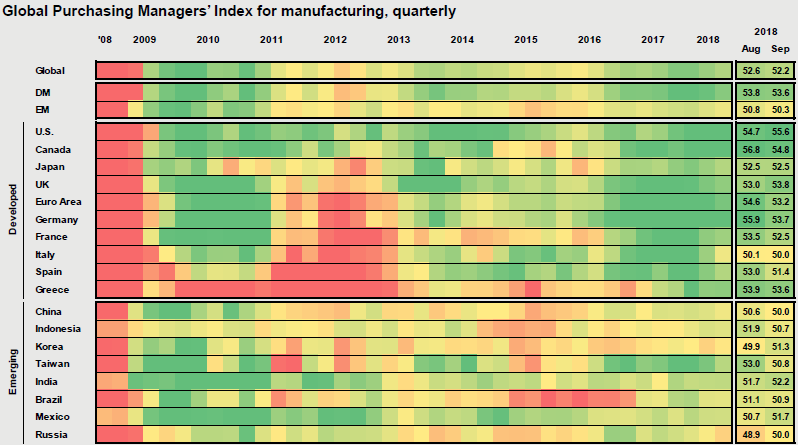

While this year has been difficult for international equities, we stand firm to our commitment to a diversified portfolio and are steadfast to our convictions regarding international investments. Based on current valuations, the case for international equities remains strong during what has been a disappointing year thus far. In addition to valuations, we also keep an eye on the Global Purchasing Manager’s Index (PMI), which indicates acceleration or deceleration in manufacturing and service sectors abroad. The heat map below indicates whether PMI is expanding (green) or retracting (red), with a score of 50 being neutral. As you can see in the chart below, the Global PMI across many countries remains strong.

As you can see, much of the yellow colors (neutral) are in the lower right third of the chart. This explains part of the poor returns YTD for emerging markets. While neutral PMI is not a bad thing, the lack of expansion has hurt emerging market equity returns so far this year.

Even though the case for international remains strong, international equities have faced strong headwinds in 2018. The Trump administration seems committed to renegotiating trade deals, providing uncertainty to many foreign markets. We expect to see this volatility continue until trade negotiations finish and the markets have a better idea of the implications of the new agreements in moving forward.

Fixed Income Recap

At the end of quarter three, domestic bonds reached -1.6% YTD. We expect the headwinds of rising interest rates to continue, as The Federal Reserve has indicated it will continue raising interest rates. Additionally, the Federal Reserve has continued reducing their balance sheet by not repurchasing maturing bonds and allowing them to flow back to the markets. The tapering of the balance sheet ultimately has the same impact as raising interest rates, thus increasing bond yields.

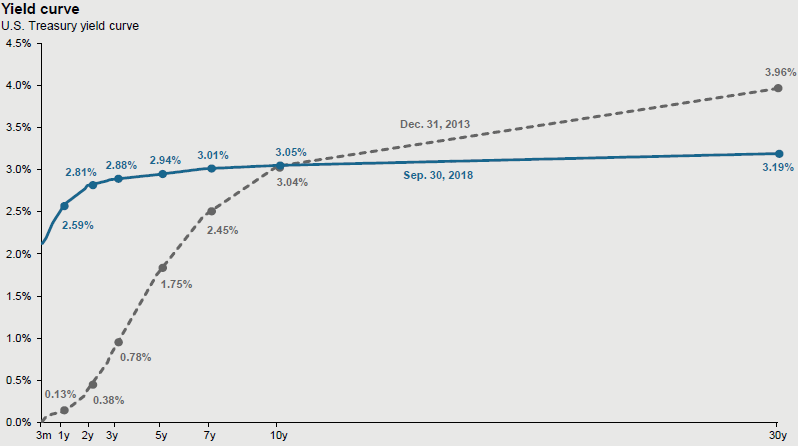

We recently wrote an article regarding how continued Fed tightening in a low inflation economy could lead to an inverted yield curve. Some investors are worried that an inverted yield curve could lead to a recession, as an inverted curve has often occurred prior to past recessions. While this is true, ten years of unprecedented monetary policy and quantitative easing programs may be distorting the curve. We are also not sure that an inverted yield curve would harm the economy, as it could boost demand by pushing up consumer income from short-term accounts while limiting the rise in mortgage rates. Due to the shape of the yield curve and the current bond market environment, we believe credit risk is more favorable than duration risk, which our current fixed income portfolio reflects. We will continue to monitor the appropriateness of our fixed income strategy if bonds approach more normal valuations and interest rates continue to rise.

International fixed income saw a slight rebound, but remains negative YTD, returning -0.9%. The dollar continued its reversed course from Q1, seeing increased value as compared to other currencies. Additionally, the European Central Bank has stood by its outlined plans to end its bond buying program by the end of 2018. While this does not mean that they are entering a phase of monetary tightening, it does suggest an end to the “easy money” policies of the past. This in turn has dampened international bond returns as investors begin to prepare for an eventual tightening policy.

Remaining 2018 Outlook

Heading toward the finish line in 2018, U.S. investors are continuing to embrace U.S. stocks based on strong corporate profits and economic indicators. Growth should begin to stabilize as we near the end of 2018 and enter 2019 due to inventories, government spending, and fiscal stimulus through tax reform. Unemployment is continuing its downward trajectory and inflation remains calm for the time being. While we don’t expect these things to change in 2018, we will want to keep a close eye on them as we move into 2019.

Looking forward to 2019 and beyond, we still think the global economy and current valuations justify a diversified approach to long term investing. As interest rates and equity prices rise, it will become increasingly important for investors keep a balanced approach to investing. The sun is still shining for equity investors, but as the expansion and bull markets continue to age, it will be important to ensure your portfolio is properly diversified among appropriate sectors and asset classes.

Overall, we are confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be, which is prudently managing our diversified portfolios to achieve long-term, risk adjusted returns

Please do not hesitate to reach out to our team of professionals should you have any questions or concerns about your portfolio. We continue to stand ready to assist you with your financial planning and investment management needs.

2018 Quarterly Commentary Q3

Contributed by: Beth Parks

Market Performance Overview

Growth, Jobs, and Yes…Increased Interest Rates Once Again!

Economic growth continues to surge in 2018. Throughout this expansion, the U.S. economy hasbeen more of a tortoise than a hare, however the tortoise appears to have quickened its pace in 2018. Real GDP growth is roughly 3% year-over-year, with reasons for the acceleration clear. Significant tax cuts for both consumers and businesses have helped spur economic growth along with a reduction in the current U.S. trade deficit. We expect to see growth maintain a close to 3% year-over-year pace into the first half of 2019.

However, by the middle of 2019, as this expansion enters its 11th year, its tortoise like qualities are likely to reassert themselves, with growth slowing to roughly 2% year-over-year. This is likely to occur due to higher interest rates creating headwinds for the housing market, a lack of pent up demand for consumer durable goods, fading effects from fiscal stimulus and a chronic lack of workers, causing businesses to postpone activity or transfer it overseas.

The Federal Reserve is continuing to increase interest rates gradually. So far this year, we have seen three rate hikes, with the outlook calling for another rate hike by year end and three additional interest rate hikes in 2019. While this may bode well for savers, conditions are looking worse for borrowers with variable-rate debt, such as credit cards or home equity lines of credit. The Federal Reserve continues to maintain its forecast of raising interest rates due to the achievement of their long-term goals. We have long-term growth up 3% year-over-year (long-term target is 1.8%), inflation of 2.2% (long-term target is 2.0%) and unemployment of 3.9%, while the Fed thinks optimally it should be around 4.5%. Having met and exceeded each long-term target, the Federal Reserve is continuing to raise rates to prevent an overheating economy.

Domestic Equity Recap

Domestic equities have continued to perform well, and the S&P 500 has steadily corrected first quarter struggles to end quarter three up 10.6% YTD. For investors, the ride thus far in 2018 has not been smooth, as volatility has continued as predicted. While volatility has increased since 2017, investors sitting on the sidelines have missed out on another quarter of positive returns. The Trump administration continues its America first agenda which has contributed heavily to the volatility we have seen this year. While there has been some impact domestically, most of the increased volatility has come from International equities. Valuations appear to remain in line with historical prices as earnings have supported increased stock prices in 2018.

While the current bull market has been strong, it is important for investors to recognize that a low interest rate environment combined with a long bull market limits potential portfolio returns going forward. It is also important to note that with the U.S. and global economies growing, opportunities remain across the spectrum of global financial markets. While the bull market in equities is old, there is no particular expiration date.

International Equity Recap

International returns were mixed in Q3 of 2018, with developed markets rebounding slightly, but still down -1.4% YTD. Emerging markets continued their slide and are down -7.7% YTD. The dollar strengthened in the third quarter of 2018, putting pressure on international investments that traded in U.S. denominations. In addition to a strengthening dollar, we saw escalated trade-war concerns between the U.S. and China, as well as budget issues in Italy.

While this year has been difficult for international equities, we stand firm to our commitment to a diversified portfolio and are steadfast to our convictions regarding international investments. Based on current valuations, the case for international equities remains strong during what has been a disappointing year thus far. In addition to valuations, we also keep an eye on the Global Purchasing Manager’s Index (PMI), which indicates acceleration or deceleration in manufacturing and service sectors abroad. The heat map below indicates whether PMI is expanding (green) or retracting (red), with a score of 50 being neutral. As you can see in the chart below, the Global PMI across many countries remains strong.

As you can see, much of the yellow colors (neutral) are in the lower right third of the chart. This explains part of the poor returns YTD for emerging markets. While neutral PMI is not a bad thing, the lack of expansion has hurt emerging market equity returns so far this year.

Even though the case for international remains strong, international equities have faced strong headwinds in 2018. The Trump administration seems committed to renegotiating trade deals, providing uncertainty to many foreign markets. We expect to see this volatility continue until trade negotiations finish and the markets have a better idea of the implications of the new agreements in moving forward.

Fixed Income Recap

At the end of quarter three, domestic bonds reached -1.6% YTD. We expect the headwinds of rising interest rates to continue, as The Federal Reserve has indicated it will continue raising interest rates. Additionally, the Federal Reserve has continued reducing their balance sheet by not repurchasing maturing bonds and allowing them to flow back to the markets. The tapering of the balance sheet ultimately has the same impact as raising interest rates, thus increasing bond yields.

We recently wrote an article regarding how continued Fed tightening in a low inflation economy could lead to an inverted yield curve. Some investors are worried that an inverted yield curve could lead to a recession, as an inverted curve has often occurred prior to past recessions. While this is true, ten years of unprecedented monetary policy and quantitative easing programs may be distorting the curve. We are also not sure that an inverted yield curve would harm the economy, as it could boost demand by pushing up consumer income from short-term accounts while limiting the rise in mortgage rates. Due to the shape of the yield curve and the current bond market environment, we believe credit risk is more favorable than duration risk, which our current fixed income portfolio reflects. We will continue to monitor the appropriateness of our fixed income strategy if bonds approach more normal valuations and interest rates continue to rise.

International fixed income saw a slight rebound, but remains negative YTD, returning -0.9%. The dollar continued its reversed course from Q1, seeing increased value as compared to other currencies. Additionally, the European Central Bank has stood by its outlined plans to end its bond buying program by the end of 2018. While this does not mean that they are entering a phase of monetary tightening, it does suggest an end to the “easy money” policies of the past. This in turn has dampened international bond returns as investors begin to prepare for an eventual tightening policy.

Remaining 2018 Outlook

Heading toward the finish line in 2018, U.S. investors are continuing to embrace U.S. stocks based on strong corporate profits and economic indicators. Growth should begin to stabilize as we near the end of 2018 and enter 2019 due to inventories, government spending, and fiscal stimulus through tax reform. Unemployment is continuing its downward trajectory and inflation remains calm for the time being. While we don’t expect these things to change in 2018, we will want to keep a close eye on them as we move into 2019.

Looking forward to 2019 and beyond, we still think the global economy and current valuations justify a diversified approach to long term investing. As interest rates and equity prices rise, it will become increasingly important for investors keep a balanced approach to investing. The sun is still shining for equity investors, but as the expansion and bull markets continue to age, it will be important to ensure your portfolio is properly diversified among appropriate sectors and asset classes.

Overall, we are confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be, which is prudently managing our diversified portfolios to achieve long-term, risk adjusted returns

Please do not hesitate to reach out to our team of professionals should you have any questions or concerns about your portfolio. We continue to stand ready to assist you with your financial planning and investment management needs.

Beth Parks

Share this post with your friends