Too often we hear people referring to health savings accounts (HSAs) as accounts for people who are not disciplined enough to maintain cash reserves for unforeseen medical expenses.

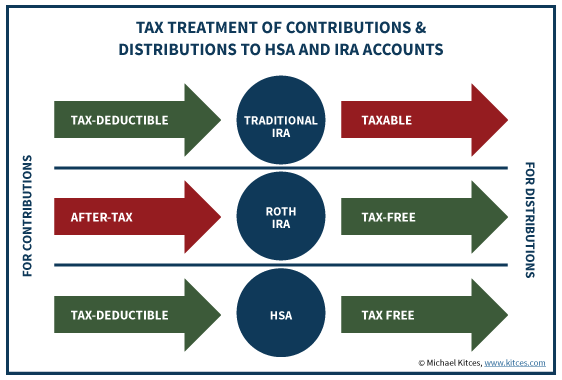

In contrast, HSAs offer the most beneficial tax treatment under the current tax code. They take advantage of a triple tax benefit: Tax-deductible contributions, tax-free growth, and tax-free distributions (when distributed for qualified health expenses). As outlined in the illustration below, this tax treatment is more favorable than other well-known retirement accounts, including Traditional IRAs and Roth IRAs.

Who Can Contribute to an HSA?

To contribute to an HSA, you must have a High Deductible Health Plan (HDHP). In 2021, a HDHP is defined as a health plan that has a minimum deductible of $1,400 for individuals or $2,800 for families. In addition, you must not be enrolled in Medicare and cannot be claimed as a dependent on someone else’s tax return. These limits remain unchanged for 2022.

What are Eligible Expenses?

Eligible expenses are defined by IRS publication 502. Essentially, an HSA distribution can be used for anything that is listed as a medical or dental expense. A common list of qualified medical expenses has been provided by HSAbank, and can be helpful in determining if an expense is a qualifying expense. The list is more inclusive than you may think and covers many items that are utilized on a day-to-day basis.

How Much Can I Contribute?

For 2021, the maximum contribution is $3,600 for those on a single health insurance plan and $7,200 for those on a family plan (individuals over the age of 55 can contribute an extra $1,000). This limit is increasing slightly for 2022 and will go up to $3,650 individual coverage, and $7,300 for family coverage.

How Long Can I Contribute?

For most individuals, contributions are allowed up until the month that you turn 65 (as enrollment in Medicare makes an individual ineligible to contribute).

Taxes and Penalties for Non-Qualified Distributions

If non-qualified distributions are made prior to age 65, the entire distribution will be included in your taxable income. In addition to being taxed as income, a 20% penalty is owed on the amount of the non-qualified distribution. However, if a non-qualified distribution is taken after age 65, the distribution is taxable, but will not be subject to the 20% penalty. Since there is no penalty, this ends up acting like an IRA, which is tax deferred until withdrawn. This provides a way for someone to contribute beyond the traditional limits of a 401k and IRA.

Conclusion

Contributing to an HSA account is a great way to have Uncle Sam offset a portion of your medical expenses. Assuming a federal tax rate of 24% and a state income tax rate of 4.25%, your tax savings will total $282.50 for every $1,000 paid from your HSA.

If you are eligible to contribute to an HSA, make sure you are taking advantage of this triple tax benefit.