The breaking news of Russia invading Ukraine has dominated headlines over the last few days. While we have understood for several months that an invasion was a very realistic possibility, Thursday felt like a dark day as we watched it unfold. You are likely being inundated with information on this conflict, so we wanted to zoom out to provide a longer-term perspective regarding recent market movements and the potential future market reaction.

While the media headlines would lead us to believe that an invasion like this is “unprecedented,” we have seen similar scenarios play out. We are most certainly not minimizing the seriousness of this cataclysm or the human toll it will most definitely take, rather pointing out historical market reactions to global crisis and conflicts.

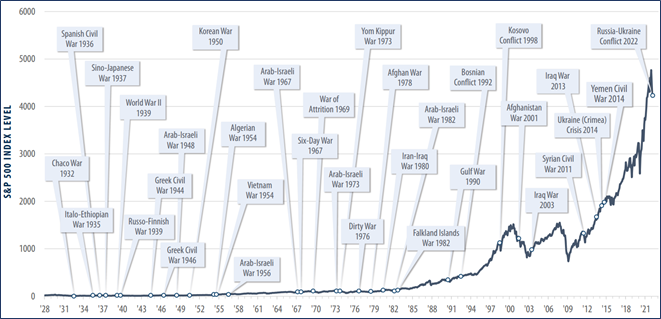

The chart below outlines the major wars and conflicts that the world has seen since 1932. Uncertainty like we are experiencing right now often temporarily shapes market movements, but the market has been resilient over the long-term.

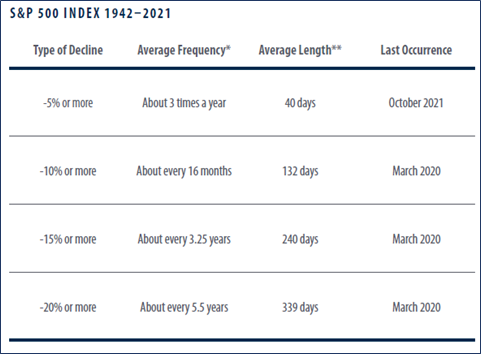

Like you, our preference would be to see the market only move in one direction – up. History has shown us that this will never be the case, so we have built our portfolios to withstand unpredictable times like these. In fact, declines of 10% or more occur just about every year. Outlined below, the chart shows the historical frequency of declines in the market since 1942.

While market declines are never comfortable, it is necessary to withstand them to achieve the long-term returns investors are seeking. The invasion of Ukraine is a new and serious situation, but the market has seen crisis like this before, and will unfortunately see crisis like this again. If you are a client of our firm, we have created your portfolio to withstand times such as these. If you have any questions, please reach out to our team as we would welcome the conversation.