Recently, we have seen costs to obtain higher education increase dramatically. In the past 20 years, the average tuition and fees at private Universities have jumped 144%, out-of-state tuition and fees at public Universities have risen 171%, and in-state tuition and fees at public Universities has grown the most, increasing 211%. Subsequently, taking on debt for education costs is often the only way for many Americans to afford a college degree.

A 529 plan is an investment account to help save for education expenses and is considered one of the most efficient ways to do so. These plans provide a way for families to save for education costs free from federal and state income taxes. Also, some people may qualify for a state income tax deduction for contributions made to a 529 plan. In Michigan, contributions are deductible for income tax purposes up to $5,000 per year for a single filer and $10,000 per year for joint filers.

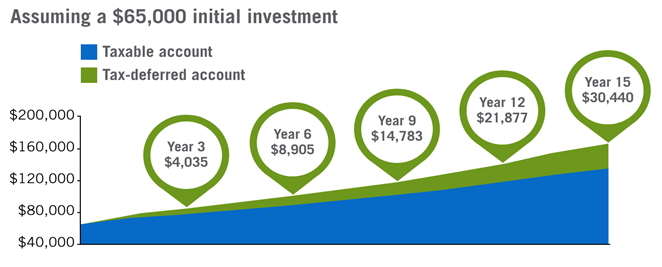

The graph below illustrates the difference between a 529 plan growing tax free vs a traditional investment account with the same monthly contributions.

(Photo Credit: CollegeAccess)

What Expenses Can I Pay with a 529 Plan?

Qualified expenses for a 529 plan are defined as costs that are used to cover education. In other words, distributions can only be for educational purposes such as tuition, college books & supplies, and college room & board. A list of all qualified expenses has been provided by Saving For College, and can help identify what expenses qualify.

Contributions

Each state operates its own 529 plan and makes the rules for their plan, so maximum balance limits per beneficiary vary across states (Michigan’s limit is $500,000). The IRS doesn’t specify a limit at the federal level for contributions to a 529 plan. Therefore, many 529 plans offer much higher limits than most people will ever need. Although the contribution limits vary at the state level, contributions are considered gifts for the purpose of federal income taxes. For 2022, a gift up to $16,000 per beneficiary, per donor, will qualify for the annual gift tax exclusion. Although, an individual could contribute more under a provision allowing for a donor to front load up to 5 years’ worth of annual exclusions. For example, one could donate $80,000 (5 x $16,000), without the donation being a taxable gift.

Distributions and Penalties

An owner of a 529 plan can withdraw any amount whenever they would like. However, only qualified expenses will be tax free. Any portion taken out of a 529 plan for a non-qualified expense is subject to income taxes and a penalty of 10% on the portion of the distribution attributable to gains. If the beneficiary of the account does not go to college or use the entirety of the account, the balances can be transferred to another eligible family member (siblings, cousins, parents, aunts, uncles, spouse, children or in-laws), and will thereby avoid any adverse tax consequences.

Conclusion

Setting up a 529 plan is a great first step toward planning for education costs. Not only does it help prepare for future expenses, but it also provides a tax-advantaged way to save for education; there is potential for state income tax deductions, contributions grow tax-free, and withdrawals are non-taxable if they are for qualified expenses.

If you have any questions about education planning, or planning for your financial future in general, please feel free to reach out to our team of professionals at Voisard Asset Management Group. We stand ready to assist.