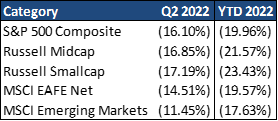

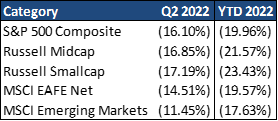

Market Performance Overview

- Domestic equities were negative in Q2, with large cap stocks finishing -16.10%.

- Foreign equities were negative in Q2, returning -14.51% in developed markets and -11.45% in emerging markets.

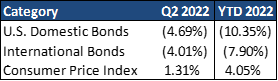

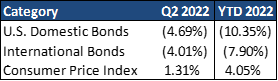

- Domestic bonds were negative in Q2, returning -4.69% for the quarter.

- Foreign bonds were negative in Q2, finishing the quarter at -4.01%.

__________________________________________________________________________________________________

Economic Update

This year has been a very difficult one for investors thus far, as losses have occurred in both the stock and bond markets. Investors have experienced many challenges this year, including Russia’s brutal invasion of Ukraine, China’s zero COVID policy, and the highest inflation rate since the early 1980s. In response, the Federal Reserve (Fed) has turned much more hawkish, raising interest rates by 0.75% in June and promising further rate increases in the months ahead, with a .75% increase expected to come in July. High inflation and Fed tightening have in turn led to rapidly rising mortgage rates and a sharp decline in consumer sentiment and stock prices. On the positive side, the impact of COVID-19 on the economy continues to fade, and consumer balance sheets appear to be much stronger today than at the start of the COVID pandemic. For investors, concerns need to be assessed relative to more attractive valuations and a rational view of the risk of recession and the economic and policy landscape it could leave in its wake.

As we enter the second half of the year, there is a growing danger that the U.S. economy could slip into a recession (defined as two consecutive quarters with a decline in GDP). On the positive side, spending has picked up in pandemic impacted areas such as travel, restaurants, leisure, and entertainment. That said, there are several factors slowing economic momentum. The most important is fiscal drag, with the federal deficit likely to fall from 12.4% of GDP last fiscal year to less than 4% of GDP this year. This is the single largest decline as a percentage of GDP since the demobilization following the end of WWII. This reflects the end to stimulus checks, enhanced unemployment benefits, enhanced child tax credits, and a host of other programs that were supporting the income and spending of lower income households. In addition, the housing sector has been battered by more than a 2.5% surge in 30-year mortgage rates, while U.S. exports are being impeded by a more than 8.0% rise in the dollar since the start of the year. This, along with the lapse in consumer confidence in the face of fast rising food and energy prices and a slumping stock market, threatens to slow the economy in the second half of the year, with a rising risk that the U.S. could fall into recession. The labor market continues to be a bright spot in an otherwise gloomy environment, with the unemployment rate remaining at 3.6% for the third consecutive month in May, just 0.1% above its 50-year low in 2019. There continues to be massive excess demand for labor, with roughly 5.45 million more job openings than unemployed workers in May. This excess demand should fade over the next few months, reflecting slowing economic momentum and diminished business confidence.

__________________________________________________________________________________________________

Equity Recap

Following a spectacular 2021, in which S&P 500 operating earnings-per-share (EPS) rose by 70%, profits are growing much more slowly in 2022. U.S. equities slumped into a bear market in the first half of 2022, retreating -16.10% for the quarter, as investors worried about inflation, aggressive Federal Reserve tightening and the threat of recession. In the first quarter, operating EPS rose just 4.2% year-over-year and analysts now expect a less than 8% gain for full-year 2022.

first half of 2022, retreating -16.10% for the quarter, as investors worried about inflation, aggressive Federal Reserve tightening and the threat of recession. In the first quarter, operating EPS rose just 4.2% year-over-year and analysts now expect a less than 8% gain for full-year 2022.

The S&P 500 forward P/E ratio is now below its 25-year average of roughly 16.9x. This drawdown should set investors up for better returns in the long run, particularly if today’s stressful environment is eventually replaced by one reminiscent of the last decade, with slow growth, low inflation, low interest rates and high profitability. However, higher interest rates will likely continue to cause pressure on valuations across financial markets, leaving U.S. value stocks and international equities best positioned to outperform.

__________________________________________________________________________________________________

Fixed Income Recap

High inflation, falling unemployment and the Fed’s much more hawkish stance led to a sharp backup in bond yields in the second quarter of 2022  with U.S. and international bonds retreating -4.69% and -4.01% respectively. A rapidly improving labor market and persistent inflationary pressures have pushed the Federal Reserve (Fed) to adopt a much more hawkish stance. At its June meeting, the Fed increased the federal funds rate by 0.75%, following increases of 0.25% and 0.50% in March and May, respectively. In addition, the Summary of Economic Projections indicated a median expectation, among FOMC members, of cumulative further increases of 1.75% this year and 0.5% next year, bringing the federal funds rate to a range of 3.25%-3.50% by the end of 2022 and 3.75%-4.00% by the end of 2023. On quantitative tightening, the Fed is also ramping up the pace of reduction of their massive bond holdings to up to $95 billion/month by September.

with U.S. and international bonds retreating -4.69% and -4.01% respectively. A rapidly improving labor market and persistent inflationary pressures have pushed the Federal Reserve (Fed) to adopt a much more hawkish stance. At its June meeting, the Fed increased the federal funds rate by 0.75%, following increases of 0.25% and 0.50% in March and May, respectively. In addition, the Summary of Economic Projections indicated a median expectation, among FOMC members, of cumulative further increases of 1.75% this year and 0.5% next year, bringing the federal funds rate to a range of 3.25%-3.50% by the end of 2022 and 3.75%-4.00% by the end of 2023. On quantitative tightening, the Fed is also ramping up the pace of reduction of their massive bond holdings to up to $95 billion/month by September.

Notably, the Fed expects inflation will fall towards its 2% target over the next few years. In its Summary of Economic Projections, the Fed forecasts annual core PCE inflation will fall from its current 4.9% to 4.3% by 4Q22, 2.7% by 4Q23 and 2.3% by 4Q24. While futures markets now roughly agree with the Fed’s forecasts of the federal funds rate for the rest of 2022, they expect the Fed to ease policy starting next spring, reflecting the risk that a too-aggressive Fed may tip the economy into recession.

__________________________________________________________________________________________________

2022 Outlook & Beyond

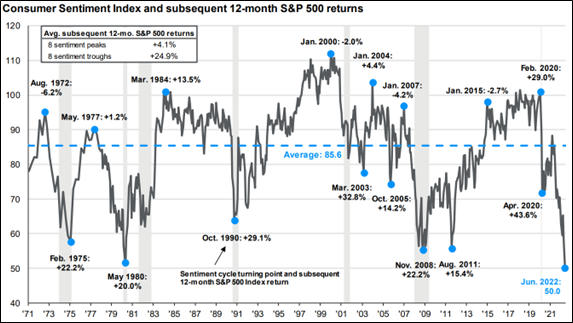

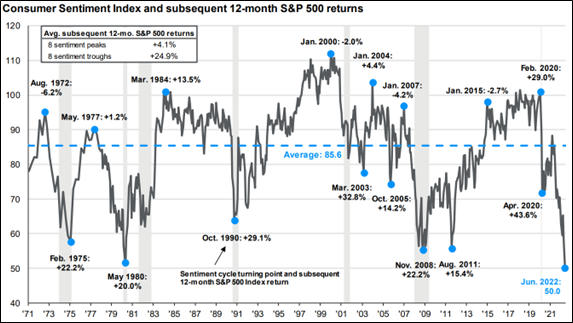

For many Americans, the first half of 2022 has been very disappointing with the Omicron variant prolonging the pandemic, sharply rising inflation and interest rates, falling portfolio balances, and the shock of Russia’s brutal invasion of Ukraine. These factors, combined with a divisive political environment, have driven consumer sentiment down to its lowest level on record.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets like stocks. However, history suggests that trying to time markets in this way is a mistake. The chart below shows consumer sentiment over the past 50 years with 8 distinct peaks and troughs noted and how much the S&P 500 gained or lost in the 12 months following. On average, buying at a confidence peak returned 4.1% while buying at a trough returned 24.9%.

Importantly, this is not to suggest that U.S. stocks will return anything like 24.9% in the year ahead, as many other factors will determine that outcome. However, it does suggest that when planning for 2022 and beyond, investors should focus on fundamentals and valuations rather than investing based on how they feel about the world.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

*Charts, graphs, market performance data and commentary sourced from J.P. Morgan Asset Management.

2022 Quarterly Commentary Q2

Contributed by: Brandon Bauer, CFP®

Market Performance Overview

__________________________________________________________________________________________________

Economic Update

This year has been a very difficult one for investors thus far, as losses have occurred in both the stock and bond markets. Investors have experienced many challenges this year, including Russia’s brutal invasion of Ukraine, China’s zero COVID policy, and the highest inflation rate since the early 1980s. In response, the Federal Reserve (Fed) has turned much more hawkish, raising interest rates by 0.75% in June and promising further rate increases in the months ahead, with a .75% increase expected to come in July. High inflation and Fed tightening have in turn led to rapidly rising mortgage rates and a sharp decline in consumer sentiment and stock prices. On the positive side, the impact of COVID-19 on the economy continues to fade, and consumer balance sheets appear to be much stronger today than at the start of the COVID pandemic. For investors, concerns need to be assessed relative to more attractive valuations and a rational view of the risk of recession and the economic and policy landscape it could leave in its wake.

As we enter the second half of the year, there is a growing danger that the U.S. economy could slip into a recession (defined as two consecutive quarters with a decline in GDP). On the positive side, spending has picked up in pandemic impacted areas such as travel, restaurants, leisure, and entertainment. That said, there are several factors slowing economic momentum. The most important is fiscal drag, with the federal deficit likely to fall from 12.4% of GDP last fiscal year to less than 4% of GDP this year. This is the single largest decline as a percentage of GDP since the demobilization following the end of WWII. This reflects the end to stimulus checks, enhanced unemployment benefits, enhanced child tax credits, and a host of other programs that were supporting the income and spending of lower income households. In addition, the housing sector has been battered by more than a 2.5% surge in 30-year mortgage rates, while U.S. exports are being impeded by a more than 8.0% rise in the dollar since the start of the year. This, along with the lapse in consumer confidence in the face of fast rising food and energy prices and a slumping stock market, threatens to slow the economy in the second half of the year, with a rising risk that the U.S. could fall into recession. The labor market continues to be a bright spot in an otherwise gloomy environment, with the unemployment rate remaining at 3.6% for the third consecutive month in May, just 0.1% above its 50-year low in 2019. There continues to be massive excess demand for labor, with roughly 5.45 million more job openings than unemployed workers in May. This excess demand should fade over the next few months, reflecting slowing economic momentum and diminished business confidence.

__________________________________________________________________________________________________

Equity Recap

Following a spectacular 2021, in which S&P 500 operating earnings-per-share (EPS) rose by 70%, profits are growing much more slowly in 2022. U.S. equities slumped into a bear market in the first half of 2022, retreating -16.10% for the quarter, as investors worried about inflation, aggressive Federal Reserve tightening and the threat of recession. In the first quarter, operating EPS rose just 4.2% year-over-year and analysts now expect a less than 8% gain for full-year 2022.

first half of 2022, retreating -16.10% for the quarter, as investors worried about inflation, aggressive Federal Reserve tightening and the threat of recession. In the first quarter, operating EPS rose just 4.2% year-over-year and analysts now expect a less than 8% gain for full-year 2022.

The S&P 500 forward P/E ratio is now below its 25-year average of roughly 16.9x. This drawdown should set investors up for better returns in the long run, particularly if today’s stressful environment is eventually replaced by one reminiscent of the last decade, with slow growth, low inflation, low interest rates and high profitability. However, higher interest rates will likely continue to cause pressure on valuations across financial markets, leaving U.S. value stocks and international equities best positioned to outperform.

__________________________________________________________________________________________________

Fixed Income Recap

High inflation, falling unemployment and the Fed’s much more hawkish stance led to a sharp backup in bond yields in the second quarter of 2022 with U.S. and international bonds retreating -4.69% and -4.01% respectively. A rapidly improving labor market and persistent inflationary pressures have pushed the Federal Reserve (Fed) to adopt a much more hawkish stance. At its June meeting, the Fed increased the federal funds rate by 0.75%, following increases of 0.25% and 0.50% in March and May, respectively. In addition, the Summary of Economic Projections indicated a median expectation, among FOMC members, of cumulative further increases of 1.75% this year and 0.5% next year, bringing the federal funds rate to a range of 3.25%-3.50% by the end of 2022 and 3.75%-4.00% by the end of 2023. On quantitative tightening, the Fed is also ramping up the pace of reduction of their massive bond holdings to up to $95 billion/month by September.

with U.S. and international bonds retreating -4.69% and -4.01% respectively. A rapidly improving labor market and persistent inflationary pressures have pushed the Federal Reserve (Fed) to adopt a much more hawkish stance. At its June meeting, the Fed increased the federal funds rate by 0.75%, following increases of 0.25% and 0.50% in March and May, respectively. In addition, the Summary of Economic Projections indicated a median expectation, among FOMC members, of cumulative further increases of 1.75% this year and 0.5% next year, bringing the federal funds rate to a range of 3.25%-3.50% by the end of 2022 and 3.75%-4.00% by the end of 2023. On quantitative tightening, the Fed is also ramping up the pace of reduction of their massive bond holdings to up to $95 billion/month by September.

Notably, the Fed expects inflation will fall towards its 2% target over the next few years. In its Summary of Economic Projections, the Fed forecasts annual core PCE inflation will fall from its current 4.9% to 4.3% by 4Q22, 2.7% by 4Q23 and 2.3% by 4Q24. While futures markets now roughly agree with the Fed’s forecasts of the federal funds rate for the rest of 2022, they expect the Fed to ease policy starting next spring, reflecting the risk that a too-aggressive Fed may tip the economy into recession.

__________________________________________________________________________________________________

2022 Outlook & Beyond

For many Americans, the first half of 2022 has been very disappointing with the Omicron variant prolonging the pandemic, sharply rising inflation and interest rates, falling portfolio balances, and the shock of Russia’s brutal invasion of Ukraine. These factors, combined with a divisive political environment, have driven consumer sentiment down to its lowest level on record.

When investors feel gloomy and worried about the outlook, their natural tendency is to sell risk assets like stocks. However, history suggests that trying to time markets in this way is a mistake. The chart below shows consumer sentiment over the past 50 years with 8 distinct peaks and troughs noted and how much the S&P 500 gained or lost in the 12 months following. On average, buying at a confidence peak returned 4.1% while buying at a trough returned 24.9%.

Importantly, this is not to suggest that U.S. stocks will return anything like 24.9% in the year ahead, as many other factors will determine that outcome. However, it does suggest that when planning for 2022 and beyond, investors should focus on fundamentals and valuations rather than investing based on how they feel about the world.

If you are a client of our firm, we created your portfolio to withstand times such as these. If you are not a client and have not stress tested and designed a plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

*Charts, graphs, market performance data and commentary sourced from J.P. Morgan Asset Management.

Brandon Bauer, CFP®

Share this post with your friends