Sorry to disappoint, but we are not talking about Private Equity. In this instance, we are referring to the price-to-earnings ratio of stocks. Simply put, the P/E ratio is the price of a stock relative to a company’s earnings per share. The current P/E ratio of companies you may know include Amazon (53.22x), Nvidia (74.37x), Tesla (43.98x), General Electric (54.89x), Ford (12.51x), and Google at (26.75x). Is a high P/E ratio good or bad? Let’s take a closer look at what it all means.

What is Normal?

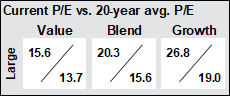

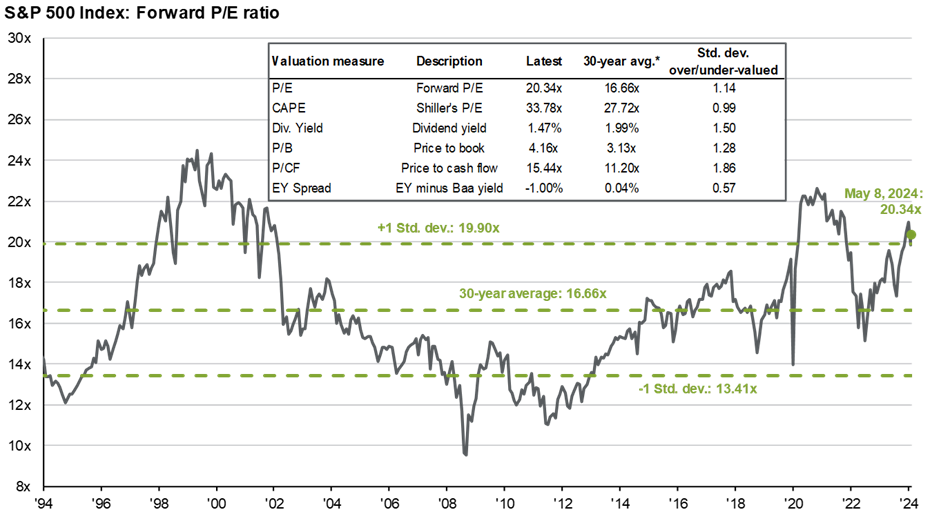

It is often said that historical performance isn’t an indicator of future results; unfortunately, it’s all we have. It’s like driving down the road but only being able to look in the review mirror to determine where to go. When looking at the P/E ratio, historical context does matter. The current forward-looking P/E ratio for the S&P 500 is 20.3x, while the 20-year average is 15.6x. This equates to a premium of 30.1% above the 30-year average. If we separate out large company growth and large company value stocks, we can see if one category drives this premium. Large company value stocks have a P/E ratio of 15.6x, while their 20-year average is 13.7x. This equates to a premium of 13.8% above the 30-year average. On the large company growth side, these stocks have a P/E ratio of 26.8x, while the 20-year average is 19.0. This equates to a premium of 41.0% above the 20-year average.

determine where to go. When looking at the P/E ratio, historical context does matter. The current forward-looking P/E ratio for the S&P 500 is 20.3x, while the 20-year average is 15.6x. This equates to a premium of 30.1% above the 30-year average. If we separate out large company growth and large company value stocks, we can see if one category drives this premium. Large company value stocks have a P/E ratio of 15.6x, while their 20-year average is 13.7x. This equates to a premium of 13.8% above the 30-year average. On the large company growth side, these stocks have a P/E ratio of 26.8x, while the 20-year average is 19.0. This equates to a premium of 41.0% above the 20-year average.

It is important to note that this is an average for only the S&P 500, not mid or small-cap stocks. That said, the story of growth stocks trading at higher levels relative to value stocks rings true through mid, small, and international stocks.

What To Do?

Market performance remains concentrated, as the largest stocks in the index have continued their dominant run. In both absolute terms and relative to history, international markets look attractively priced compared to U.S. stocks. Although valuations appear stretched, there are still attractive opportunities beneath the surface, and an active approach can help investors identify those companies with high-quality earnings and attractive valuations. Investors may find it helpful to have a manager on their side willing to sort through the noise and strategically tilt their portfolio toward sectors with attractive valuations. The simple index approach, while serving its purpose over the past decade, may not be as dominant as it has been.

Summary

Voisard Asset Management Group is always looking for ways to reduce our clients’ risk by utilizing the specifics of their situation to take advantage of market conditions. Each circumstance is unique and requires an individualized analysis to determine the optimal strategy. As is customary, individuals should consult with their professional advisors to ensure appropriate risk is being taken within their investment portfolios. Ultimately, our objective is to position our clients to give them the best potential to achieve their goals while working to reduce risk along the way.