Introduction:

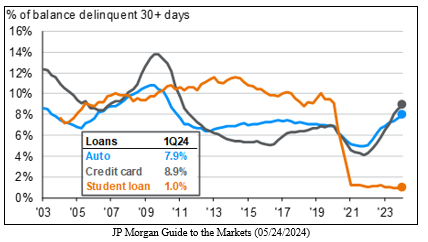

Economic commentary suggests a strong consumer, but are wallets really feeling full? Inflation seems to be easing, yet consumer behavior tells a different story. Savings rates are far below average (3.8% vs 8.5%), credit card and car loan delinquencies are on the rise, and consumer sentiment has dipped below pre-pandemic lows. Today, we will explore practical strategies to maximize savings and achieve financial goals despite a challenging economic climate.

Savings Opportunities:

Paying yourself first is a crucial step. Automating your savings to occur simultaneously with the day you get paid will ensure that a portion of your income is consistently set aside without having to think about it or being used for other items. Another effective strategy is when you get a pay raise, shift that raise to your 401k if you have a little room in the budget and aren’t already maximizing this account. It may also be worthwhile to explore High-Yield savings accounts for your cash emergency fund. These currently offer better interest rates than standard bank savings accounts, allowing your money to grow more efficiently over time.

Another critical step that can be used to maximize savings is to reduce expenses. Start by making small yet manageable changes to your day-to-day routine. For example, food costs can be cut down significantly by eating at home more often and bringing your lunch to work. Additionally, revisit your subscriptions and cancel those no longer used or necessary. To gain further control over your finances, we recommend establishing a monthly budget to provide insights into your spending patterns and highlight areas for change. Several methods exist to track your expenses effectively. Traditional methods include using a pen and paper or creating a spreadsheet. There are several budgeting apps that can be downloaded on your phone to help track spending in a convenient way.

For long-term financial health, it’s essential to have a clear and effective strategy. Another critical step is to focus on paying down debt, which provides a compelling dual benefit. It directly reduces the interest incurred while increasing your disposable income. We recommend prioritizing debt to pay down first based on the highest interest rate. This is especially important during high-interest rate times such as now, as it frees up additional cash for necessary purchases and increases savings contributions for retirement or future goals.

In addition to managing debt, tax planning is another important component of your financial plan. By exploring various tax-saving opportunities, you can optimize your hard-earned income, allowing you to contribute more towards retirement and reach your financial goals more efficiently. We recommend that any tax strategy be discussed with your accountant prior to implementation.

Conclusion:

At Voisard Asset Management Group, we are committed to helping our clients achieve their financial goals through personalized guidance via a comprehensive, holistic plan. Our dedicated team works closely with our clients to develop a customized roadmap, ensuring your plan is aligned with your financial goals. We leverage our expertise to optimize your financial portfolio and provide ongoing support and accountability, adapting your strategy to market fluctuations or changes in client circumstances. If you have questions about your financial situation, reach out to our team, which remains ready and available to assist.