The Federal Reserve (Fed) manages monetary policy and regulates the financial system. As part of its role, the Fed sets the federal funds rate, the interest rate banks charge each other for overnight loans. Several factors, including inflation, unemployment, economic growth, and the financial system’s stability, influence the Fed’s decisions on interest rates. On September 18, 2024, the Fed cut the federal funds rate by 50 basis points, or 0.50%, to 4.75% – 5.00%, marking its first rate cut since March 2020. This cut was primarily due to the following factors:

- Inflation Progress: The Fed noted that inflation had been trending downward and was closer to its target of 2%.

- Balancing Risks: The Fed assessed that the risks of achieving its goals of maximum employment and price stability were roughly balanced.

- Economic Uncertainty: The economic outlook was uncertain, and the Fed wanted to address potential risks to both sides of its dual mandate.

This decision marked a significant shift in monetary policy. The Fed had been raising interest rates for several months to combat inflation. The rate cut signaled a recognition that the economy was cooling down and that inflation was under control.

What Normally Happens to Stocks and Bonds When the Fed Rate Hike Cycle Ends?

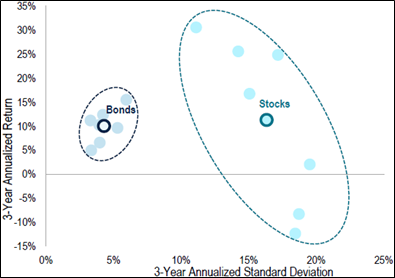

As an investor, it would be prudent to look at what happens to your portfolio after a Fed rate hiking cycle ends and interest rates begin to move in the opposite direction. While past performance doesn’t guarantee future results, if you look at average annualized returns three years following the end of each of the past seven interest rate cuts (1984, 1987, 1989, 1995, 2000, 2006, 2018), you may be surprised to see what occurred. Both stocks and bonds averaged double-digit returns! However, it is important to point out that while bonds never saw negative returns over those seven cycles, stocks did finish substantially negative in two of the seven cycles.

performance doesn’t guarantee future results, if you look at average annualized returns three years following the end of each of the past seven interest rate cuts (1984, 1987, 1989, 1995, 2000, 2006, 2018), you may be surprised to see what occurred. Both stocks and bonds averaged double-digit returns! However, it is important to point out that while bonds never saw negative returns over those seven cycles, stocks did finish substantially negative in two of the seven cycles.

Conclusion

While the end of Federal Reserve interest rate hike cycles has generally been positive for investors, it’s essential that your portfolio is specifically designed to withstand a variety of situations beyond just a Federal Reserve interest rate cycle. If you have questions about your portfolio, maybe it’s time for us to talk.