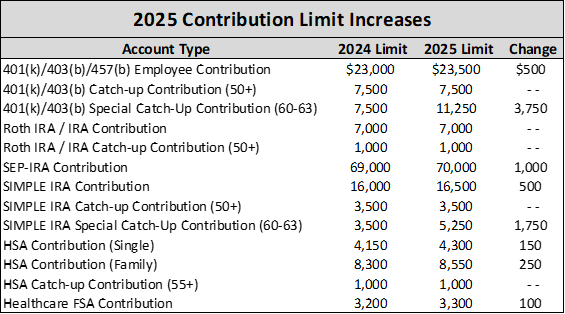

The IRS has released the updated contribution limits for 2025. While not every limit was changed, some adjustments were made that may impact your situation. If you were maxing out contributions for tax-advantaged accounts in 2024, you might not be on pace to maximize contributions for 2025. It is important to note that while these are the maximum amounts, there are eligibility requirements that also must be met. If you are unsure if you are eligible, please consult a trusted professional.