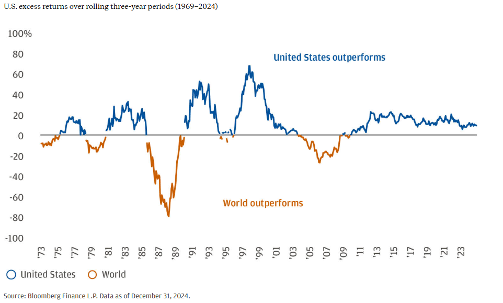

Domestic markets have outperformed international markets since the 2008 financial crisis. However, since the start of 2025, domestic markets have struggled, leading to outperformance in international markets. Current situations prove the importance of diversification across both international and domestic markets. Let’s how the S&P 500 compares to international stocks, considering factors like valuation metrics, dividend yields, and the impact of currency fluctuations. In this article, we will use the ACWI ex-US index to represent international stocks as it contains broad exposure to both developed and emerging market countries.

Valuations

Over the past 20 years, the S&P 500’s P/E ratio has been, on average, 18% higher than that of  international stocks. As of March 21, 2025, the S&P 500 currently boasts a P/E ratio of 20.4x, while the international market index has a P/E ratio of 13.8x. Despite recent outperformance, global markets are currently trading at a 31.3% discount to U.S. markets. While this fact alone can turn heads, there are other factors to analyze that may also benefit international markets.

international stocks. As of March 21, 2025, the S&P 500 currently boasts a P/E ratio of 20.4x, while the international market index has a P/E ratio of 13.8x. Despite recent outperformance, global markets are currently trading at a 31.3% discount to U.S. markets. While this fact alone can turn heads, there are other factors to analyze that may also benefit international markets.

Dividend Yield

Another factor to consider when evaluating an investment is the dividend yield. This is the annual income you will earn for every dollar invested. On average, over the past 20 years, international stocks have yielded higher dividends than US stocks. As of March 19, 2025, the dividend yield of the ACWI ex-US is 2.7%, while the dividend yield of the S&P 500 is 1.27%. Over the next year, the ACWI ex-US is forecasted to have a dividend yield greater than that of the S&P 500.

Currency Risks & Opportunities

Fluctuations in the value of the U.S. dollar affect the returns on international investments. If the dollar strengthens, profits earned internationally are worth less when converted from the local currency to the USD. Conversely, a weaker dollar can enhance returns when converted. The dollar reached multi-year highs in September 2022 and has recently undergone a correction. Therefore, international investors should consider currency movements when evaluating international investments.

Summary

Valuations matter. While the S&P 500 has provided excellent returns over the last decade, its current valuation and lower dividend yield suggest future returns may not be as high as past returns. Don’t let recency bias be the sole factor in determining how to invest. Objectively, international markets currently offer lower valuations and higher dividend yields than the S&P 500. However, investing in international markets also entails additional risks, including currency fluctuations and political instability in certain regions. Voisard Asset Management Group makes a concerted effort to track trends, identify areas where opportunities may exist in portfolios, and execute strategies without attempting to be market timers. If you have any questions about your portfolio, we’d be happy to have a brief conversation.