As an employee, one of the biggest benefits of participating in an employer-sponsored retirement plan is the employer’s matching contribution (if offered). Our goal for our clients is to assist them in maximizing the tax benefits of participating in the plan, while at the same time, maximizing the employer match.

We have found over the course of client conversations that many individuals are not getting the full match even though they are maxing out their retirement plan contributions annually. The commonality between the conversations is that each of these individuals was unaware of how their employer calculates the wages that are eligible for the match.

All 401(k) plans are structured differently, but many make a matching contribution on a per-pay-period basis. If your 401(k) plan operates this way, you would be missing out on the employer match for every pay period that you do not contribute to the plan. Consider the example below:

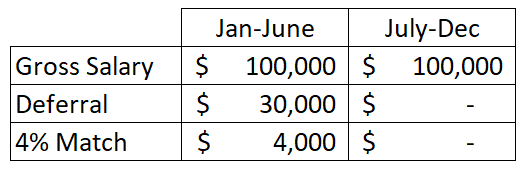

Mike (age 52) earns $200,000 per year. He makes the maximum annual contribution to the plan ($30,000 for participants aged 50 and over), by July 1st every year. His employer offers a 4% match, giving Mike the potential of receiving $8,000 into his 401k from his employer’s match each year. However, because he maximizes his contribution by July 1st, his full year match looks like this:

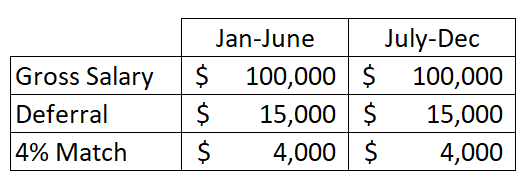

If the plan does not have a “true-up” calculation at the end of the year, Mike will be missing out on $4,000 of the company match each year. To fix this, he can simply spread his contributions out evenly over the course of the year. That small change would then shift the match to look like this:

If your 401(k) plan has a true-up provision in it, you are fine to frontload contributions. If not, you have likely been missing out on part of the employer match that has been available to you.

We hope this helps in evaluating your annual 401k contributions but if you have any additional questions, please do not hesitate to reach out to our team of experts.