Saving for college can seem daunting, but with the right strategies and planning, you can help ensure your loved one has the financial resources needed to pursue their academic goals. Here are some key steps to consider:

- Start Early:

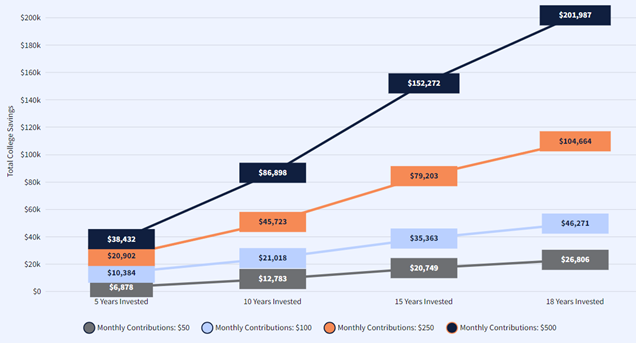

When should you start saving for your loved one’s college? In short, the sooner, the better. The earlier you start, the sooner you can take advantage of the compounding effect of time on your investment. Even small contributions made consistently over a long period can accumulate significantly.

Take a look at the effects of saving for college early in the chart below. It clearly shows that the easiest way to accumulate larger balances is to start saving and investing early.

2. Choose a Savings Vehicle:

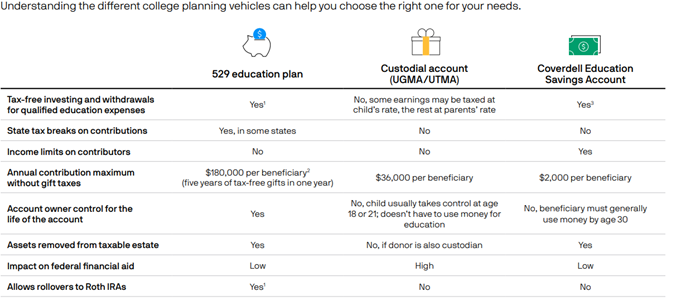

Several options are available for college savings, each with its own advantages and limitations:

- 529 plans: These tax-advantaged investment accounts offer various benefits, including state tax deductions for contributions (for Michigan residents who elect to use the Michigan Education Savings Plan), tax-free growth, and tax-free withdrawals for qualified educational expenses.

- Coverdell Education Savings Accounts (ESAs): Similar to 529 plans, ESAs offer tax advantages for contributions, growth, and tax-free qualified withdrawals. However, they have lower contribution limits and different investment options compared to 529 plans. Due to the lower contribution limits, the usage of ESAs has largely been reduced in favor of using a 529 savings plan.

- Custodial accounts (UTMA/UGMA): These accounts allow you to invest on behalf of a minor, but the assets become the unrestricted possession of the child when they reach the age of majority (typically 18 or 21, depending on the state). Earnings in these accounts are generally taxed at the minor’s income tax rate, which can have tax advantages depending on their income level.

- Traditional savings or brokerage accounts: While these do not offer tax advantages specifically for education, they can still be a viable option for building a college fund, especially if you need easy access to the funds. There are no limits on what the funds can be used for and no penalties for using the funds for an objective other than college.

Source: JP Morgan Chase

3. Research and Compare Options:

Consider factors like fees, investment options, contribution limits, tax benefits, and flexibility when choosing the best savings vehicle for your situation.

4. Develop a Savings Plan:

Determine how much you think you will need to save and establish a realistic college savings goal. Consider your income, expenses, and the desired timeframe for saving. If you aren’t sure where to start, please feel free to reach out to us. We would be happy to help you assess your goals and create a proper savings plan.

5. Be Consistent with Contributions:

Once you have developed a college savings plan, set up automatic contributions from your paycheck or bank account to ensure consistent saving and avoid the temptation to delay or skip contributions.

6. Explore Additional Funding Options:

As your child gets closer to college, you can begin to look at alternative ways to finance college, such as:

- Scholarships and grants: Research scholarships and grants you might qualify for based on academic merit, financial need, community involvement, or other factors.

- Federal student loans: Federal student loans generally offer lower interest rates and more favorable repayment terms than private loans.

- Work-study programs: These programs allow students to work part-time on campus to earn money to help cover college costs.

7. Involve your child (if applicable):

Engage your child in the college savings process. Discuss their educational goals and the cost of college. Talk about the importance of saving and involve them in budgeting and planning discussions.

8. Seek professional guidance:

If you need help navigating the complexities of college savings, consider consulting a financial advisor to discuss your options and develop a personalized strategy.

Remember, saving for college is a long-term commitment. By starting early, making consistent contributions, and exploring various funding options, you can help ensure your loved one has the necessary resources to achieve their educational aspirations.