As of September 27th, the Bloomberg U.S. Aggregate Bond index is down -15.09% year-to-date and investors are wondering what is happening to their “safe” bond portfolio. If you own bonds, you may be confused when you look at your investment statement. As we understand bonds, we pay par value, receive promised interest over the term, and then receive our initial investment back assuming they don’t default, right? A common sentiment recently is “How are bonds negative? I thought the bond portion of my portfolio was safe!”

What is Happening to Bond Portfolios?

It is important to understand the relationship between bonds and interest rates. As interest rates rise, so do bond yields. This is good for people that are looking to purchase new bonds. This is not good for investors that already own bonds because their bonds are yielding less than what they could earn today on new bonds. This causes the value of existing bonds to fall. Therefore, when interest rates rise, the value of existing bonds fall.

A very basic example may help to better understand the relationship between interest rates and bonds. On August 1 of 2022, you could purchase a 2-year Treasury bond (Bond A) for $1,000 and receive 2.90% or $29 per year until the bond matures, at which point you receive your initial investment of $1,000 plus $58 in interest earned along the way. Pretty good, right? On September 22nd of the same year, you could buy a 2-year Treasury bond (Bond B) and receive 4.11% or $41 per year. At maturity, you would receive the initial investment of $1,000 plus $82 in interest along the way. Rhetorical question, which bond would you prefer to own?

Bond A will earn $24 less than Bond B over the next 2 years. Would you be willing to pay $1,000 for Bond A when you know that it will make $24 less than Bond B? No, you would ask for a discount on Bond A to make up for the lack of interest earned. As a result, Bond A should be worth about $975 compared to Bond B at $1,000 to make up for less interest earned, right?

For bond investors, seeing paper losses when looking at their bond portfolios now makes sense! These paper losses will gradually decrease as the existing bonds (Bond A) mature and their principal is returned. The only way they would not see their principal returned would be if the company defaults.

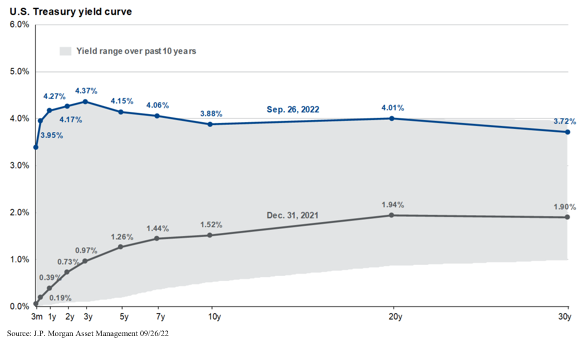

If you look at the yield curve below, the pace at which interest rates have risen thus far in 2022 is unprecedented. This dramatic shift in less than a year’s time is why bondholders have seen such large paper losses within their bond portfolios.

Is There a Silver Lining?

As the Federal Reserve continues implementing interest rate hikes throughout this year and into next year, we do see a silver lining. As displayed in the example earlier, higher interest rates mean more income generation for the bond holder. If you hold your current bonds to maturity, you will receive your principal back and the paper loss will be erased. Once you receive the principal back in cash, you will be able to reinvest those funds into bonds offering higher interest rates, increasing the overall return of your bond portfolio.

As a firm, we are aware of the uncomfortable times that investors are facing. Fortunately, as we assess the fixed income landscape, we see indications of a more normalized bond market moving forward. If you have further questions about the fixed income space or if there is any other topic that is concerning you, do not hesitate to reach out. We are always open to a conversation!