The College Board conducts an annual survey that provides valuable insights into average college costs in the United States. Here is a breakdown of their key findings for the 2023-2024 academic year:

Published Tuition (Sticker) Prices, annually:

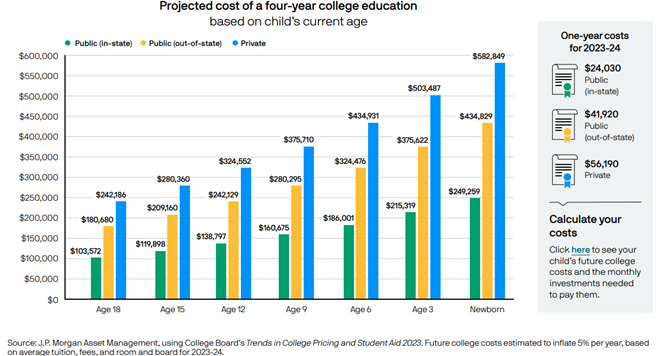

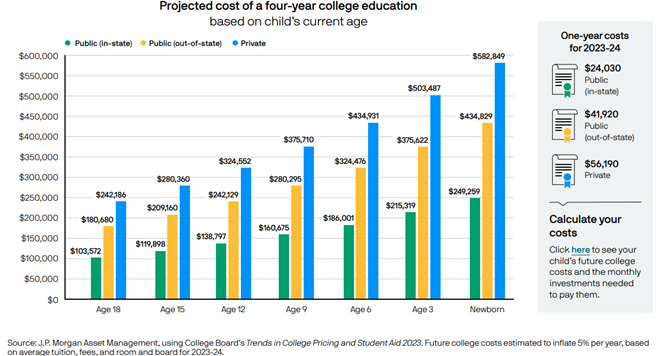

Once we have estimated the future value of college, we can begin to work on investment assumptions. Assuming an annual 7% rate of return on invested assets, it would take an annual contribution of roughly $7,000 from the time a child is born through age 18 to accumulate enough funds to pay for four years of public in-state tuition. Given the much higher cost of private education, it would take an annual contribution of roughly $17,000 to accumulate enough to pay for the estimated $582,000 sticker price of a four-year private degree.

This is an oversimplified example but should give you a good idea of the starting point when creating a college savings plan. Other considerations include savings vehicle selected (and subsequent tax implications), possible scholarships or grants that would reduce the sticker price, options for student loans, and determining how much of the college costs you intend to fund. Additionally, some clients elect to continue contributions through college, which gives them four additional years to contribute towards the expenses. While this does not sound like a big difference, that slight change in expectation can alter the annual contribution amount significantly.

Given that these inputs can (and will) change over time, regardless of where you start, it is important to review the plan as the years go by. If assumptions are found to be far enough from reality, we can pivot the plan as needed based on preferences, actual returns / inflation rates, and desired funding levels.

If you would like to create or review an individualized college savings plan, please feel free to reach out to us as we would be happy to create a customized plan with you.

Once we have estimated the future value of college, we can begin to work on investment assumptions. Assuming an annual 7% rate of return on invested assets, it would take an annual contribution of roughly $7,000 from the time a child is born through age 18 to accumulate enough funds to pay for four years of public in-state tuition. Given the much higher cost of private education, it would take an annual contribution of roughly $17,000 to accumulate enough to pay for the estimated $582,000 sticker price of a four-year private degree.

This is an oversimplified example but should give you a good idea of the starting point when creating a college savings plan. Other considerations include savings vehicle selected (and subsequent tax implications), possible scholarships or grants that would reduce the sticker price, options for student loans, and determining how much of the college costs you intend to fund. Additionally, some clients elect to continue contributions through college, which gives them four additional years to contribute towards the expenses. While this does not sound like a big difference, that slight change in expectation can alter the annual contribution amount significantly.

Given that these inputs can (and will) change over time, regardless of where you start, it is important to review the plan as the years go by. If assumptions are found to be far enough from reality, we can pivot the plan as needed based on preferences, actual returns / inflation rates, and desired funding levels.

If you would like to create or review an individualized college savings plan, please feel free to reach out to us as we would be happy to create a customized plan with you.

- Public four-year in-state: $11,260 (up 2.5% from 2022-2023)

- Public four-year out-of-state: $29,150 (up 3.0% from 2022-2023)

- Private nonprofit four-year: $41,540 (up 4.0% from 2022-2023)

Once we have estimated the future value of college, we can begin to work on investment assumptions. Assuming an annual 7% rate of return on invested assets, it would take an annual contribution of roughly $7,000 from the time a child is born through age 18 to accumulate enough funds to pay for four years of public in-state tuition. Given the much higher cost of private education, it would take an annual contribution of roughly $17,000 to accumulate enough to pay for the estimated $582,000 sticker price of a four-year private degree.

This is an oversimplified example but should give you a good idea of the starting point when creating a college savings plan. Other considerations include savings vehicle selected (and subsequent tax implications), possible scholarships or grants that would reduce the sticker price, options for student loans, and determining how much of the college costs you intend to fund. Additionally, some clients elect to continue contributions through college, which gives them four additional years to contribute towards the expenses. While this does not sound like a big difference, that slight change in expectation can alter the annual contribution amount significantly.

Given that these inputs can (and will) change over time, regardless of where you start, it is important to review the plan as the years go by. If assumptions are found to be far enough from reality, we can pivot the plan as needed based on preferences, actual returns / inflation rates, and desired funding levels.

If you would like to create or review an individualized college savings plan, please feel free to reach out to us as we would be happy to create a customized plan with you.

Once we have estimated the future value of college, we can begin to work on investment assumptions. Assuming an annual 7% rate of return on invested assets, it would take an annual contribution of roughly $7,000 from the time a child is born through age 18 to accumulate enough funds to pay for four years of public in-state tuition. Given the much higher cost of private education, it would take an annual contribution of roughly $17,000 to accumulate enough to pay for the estimated $582,000 sticker price of a four-year private degree.

This is an oversimplified example but should give you a good idea of the starting point when creating a college savings plan. Other considerations include savings vehicle selected (and subsequent tax implications), possible scholarships or grants that would reduce the sticker price, options for student loans, and determining how much of the college costs you intend to fund. Additionally, some clients elect to continue contributions through college, which gives them four additional years to contribute towards the expenses. While this does not sound like a big difference, that slight change in expectation can alter the annual contribution amount significantly.

Given that these inputs can (and will) change over time, regardless of where you start, it is important to review the plan as the years go by. If assumptions are found to be far enough from reality, we can pivot the plan as needed based on preferences, actual returns / inflation rates, and desired funding levels.

If you would like to create or review an individualized college savings plan, please feel free to reach out to us as we would be happy to create a customized plan with you.