A couple of weeks ago, President Trump was declared the presidential election winner and will start his second term in office in January. After winning a narrow majority in the House and a three-seat majority in the Senate, the country will have a unified government with one party having majority rule in all three areas. For this article, we will discuss at a very high level some of the expected policies from the new administration, the state of the markets and economy, and how we invest for clients.

Policy Outlook

On the campaign trail, President Trump highlighted certain policy areas he would focus on if elected president. These included tax cuts, immigration reform, tariffs, and government deregulation. Here, we will briefly discuss his policies and the potential impacts on the economy.

Tax Cuts – The new administration has proposed extending the 2017 Tax Cuts and Jobs Act, which was set to expire at the end of 2025. This would lower marginal tax rates for individuals and extend favorable depreciation rules for companies. He has also proposed reducing the corporate tax rate from 21% to 15%. In the near term, these policies could boost economic growth and corporate earnings, although adding significantly to the federal deficit.

Tariffs – President Trump has proposed tariffs of 10% across the board along with tariffs of 60% on goods from China. Roughly 38% of goods are imported from countries with whom the U.S. has a free trade agreement, most notably Canada and Mexico, which bar unilateral tariff increases. If we exclude these countries, the average tariff rate on imported goods would rise from roughly 3.0% today to 11.8%. Dr. David Kelly of JP Morgan assumes that because of negotiations with trade partners, business pressures, and foreign suppliers and importers eating some of the costs, the average price of imported goods would rise around 4.5% in the second quarter of 2025.

Immigration – This administration’s tougher stance on immigration includes increased deportation of undocumented immigrants and more restrictive immigration rules. These policies could reduce the number of participants in the labor force, resulting in a tighter labor market. This could also hinder growth as having fewer workers weighs on economic output.

Deregulation – President Trump has proposed cutting regulations substantially across the board. The financial services, energy, and pharmaceutical industries are expected to be key winners from these changes. At the same time, the proposed policies could present headwinds for the clean energy sector.

It is important to highlight that there is quite a bit of uncertainty around the exact path of government policy in the future. Given the various groups involved in decision-making, the changes that are eventually enacted may differ from campaign trail proposals.

Current Economic Picture

Economic indicators show that the economy is in a relatively good place. GDP growth has been above trend for the last couple of quarters, and unemployment is low compared to historical averages. Inflation has come down dramatically from a couple of years ago, and consumer confidence remains high.

The current economic situation has given the Federal Reserve leeway to start lowering interest rates, with the focus shifting more towards supporting the economy from bringing down inflation. Taking a step back, current risks include high valuations for U.S. stocks, the potential for inflation pressures, and an uncertain political environment.

Our Approach

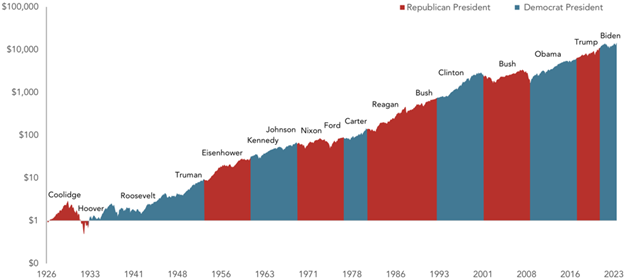

Over time, making investment decisions based solely on which political party is in office has been challenging to follow and often leads to missed opportunities. On average, the stock market sees strong long-term returns regardless of who is in office. It is important to remember that there are many factors that impact markets and any one of these factors could easily have more influence on market returns than recent political activity.

Market Returns Over Political Cycles

Hypothetical growth of a dollar invested in the S&P 500: January 1926-December 2023

Source: Dimensional Fund Advisors.

As we think about the markets and the economy, we return to the long-term approach that has served us well over the past decades. When we construct portfolios, we tailor them to each client’s situation and balance various risks. We use more stable assets such as bonds and cash to protect against market downturns and are prepared for near-term cash needs. At the same time, we focus on growth assets such as stocks to protect over the long term against inflation and longevity risk. It is important to remember that while a presidential term is 4 years, your investment time horizon is often decades.

In the face of any uncertainty, we remain confident in our approach to investing. Over time, we update how we implement our strategy and adjust as we see opportunities to improve prospective returns for our clients. In a time when emotions may run high, it is important to separate feelings from data and not let the headlines pull your investments off track. Having the discipline to follow a long-term investment approach through market ups and downs and changing political environments is one of the key benefits we provide to our clients.