The stock market has long been a preferred avenue for investors aiming to grow their wealth, outpace inflation, and achieve financial goals. However, the journey isn’t a straight upward trajectory; the market experiences fluctuations and volatility that can challenge even the most seasoned investors.

It’s important to clarify that volatility does not equate to risk. Volatility refers to the natural price swings in the stock market, influenced by factors such as economic uncertainty, investor sentiment, speculation, and individual company performance. While these fluctuations can cause discomfort, they are an inherent feature of investing and should not be viewed as a signal to panic.

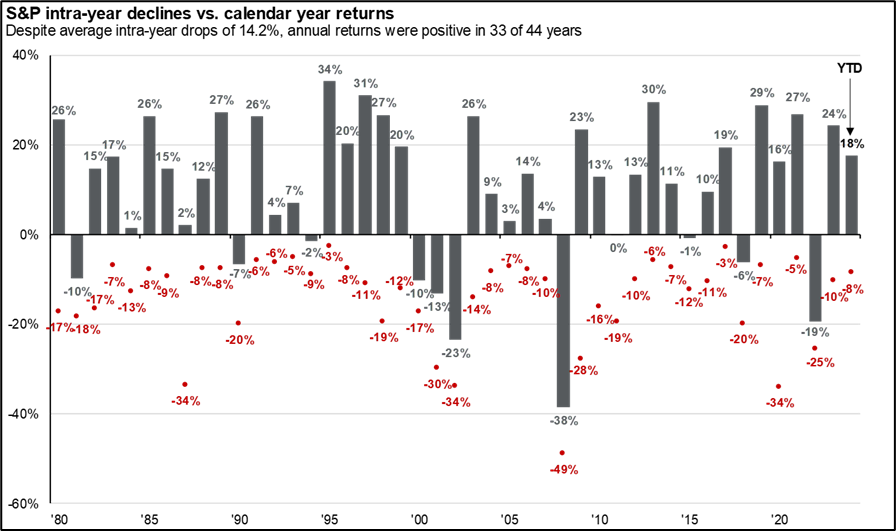

Despite short-term market volatility, historical data demonstrates a long-term upward trend in stock market performance. For instance, while the average intra-year decline for the S&P 500 is 14.2%, the market has often posted positive annual returns, even during economic downturns like the COVID-19 pandemic or the Great Recession. This resilience highlights the importance of maintaining perspective during heightened market volatility.

When investing, you must consider both your time horizon and risk tolerance. Your time horizon – the time you intend to hold your investments – is crucial in determining your portfolio’s structure. A longer time horizon allows more time for the market to recover from downturns, making investors less susceptible to short-term volatility. On the other hand, those with shorter time horizons (five years or less) may want to prioritize more stable, less volatile assets, such as bonds, to preserve capital. Understanding the difference between your ability to handle risk (financial capacity) and your appetite for risk (emotional tolerance) is vital in crafting an investment strategy.

When investing, there are two types of risk: systematic and unsystematic. Systematic risk affects the entire market, from inflation to political events or natural disasters. This type of risk is unavoidable, as it impacts all investments. To mitigate systematic risk, investors can adjust their risk tolerance, focus on long-term strategies, or align their portfolios with their comfort level. However, these approaches do not fully protect against market downturns. Unsystematic risk is specific to individual companies or industries and can be minimized through diversification. By spreading investments across various assets, such as different companies, sectors, or asset classes, you reduce the effect of poor performance in one area on your overall portfolio. If one investment underperforms, the others may balance the loss, creating a more stable return.

A disciplined, unemotional approach to investing is essential. Reacting to short-term market fluctuations based on fear or speculation can lead to poor decision-making and missed opportunities. Instead, focusing on fundamental analysis – examining a company’s financial health, earnings potential, and market position – can provide a clearer long-term perspective. By maintaining this focus, investors can better navigate market volatility and capitalize on long-term growth.

While stock market volatility can be unsettling, adopting a long-term investment strategy and focusing on core principles such as time horizon, diversification, and discipline can help build a resilient portfolio. This approach may mitigate risk and position investors to achieve their financial goals. Staying committed to your strategy, even during market turbulence, is critical to unlocking the potential rewards that long-term investing can offer. If you have questions about your portfolio or need guidance on financial planning, feel free to contact our team. We’re here to help you stay on track toward your financial goals.