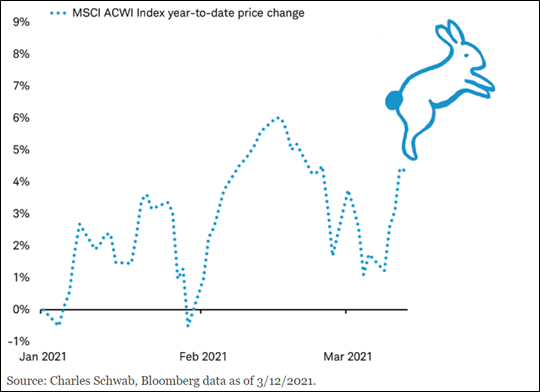

We all have a general idea of what “Bull” and “Bear” markets mean, but what have we been seeing in 2021? Are we in a bear or bull market? How would we categorize the lows that seem to bounce right back up and the market highs that can go right back down the very next day? There is a term that has been coined in recent years to describe this; It’s referred to as a “Bunny Market” as it hops around. It’s not quite a bear or bull market.

The dramatic swings have prompted questions of whether the bull market we have been experiencing in recent years is on its last legs? In the short term, the debate hinges on the economy. As long as there is no clear evidence of an imminent recession in the United States, it is harder for stock markets to turn decisively downward. In the environment today, there are many conflicting factors that are causing confused investor sentiment. There has been great progress with vaccine distribution, stimulus monies pumped into the economy, and re-opening of businesses, which gives hope to investors that things will return to “normal” soon. On the other hand, the rise in interest rates, swings in COVID 19 cases, government restrictions, and worries over the potential withdrawal of central bank stimulus cannot be ignored.

Higher interest rates increase the cost of borrowing, which in turn discourages business from investing in equipment, capacity, and employment. This reduction in spending can slow growth of the American economy, earnings, and employment. Currently, the 10-year treasury has risen about one percentage point in the past 8 months from last summer’s all-time lows. This, coupled with business optimism and expansion, can support the argument that slight increases in interest rates can be supported by the rising demand. While we are most likely not seeing the beginning of a bear market, it feels much less bullish than we experienced in quarters 2-4 of 2020.

With that being said, the market is still reflecting the jitters of investors over the unprecedented circumstances we have had to overcome and learn to work with. There are conflicting factors that are persuading market movements in the short-term. Although this can test our patience, the sharp movements that are becoming a pattern are all the more reason to stick to your plan and ride the waves out to calmer waters. Remember, volatility is not risk, it simply tests whether your allocation matches your ability to handle such periods over time.