Market Performance Overview

- Domestic equities took a breather, with the S&P 500 losing -0.8% in the first quarter of the year.

- Forward Price-to-Earnings ratios for U.S. equities moved lower due to strong analyst estimates and the moderate market pullback.

- Foreign equities saw mixed results, as developed markets were down -1.4% and emerging markets were up 1.5%.

- Domestic bonds were negative and will continue to face headwinds in 2018 due to expected future rate increases.

- Foreign bonds were among the few assets classes that posted positive returns in the first quarter.

Taxes, Tariffs and Trade

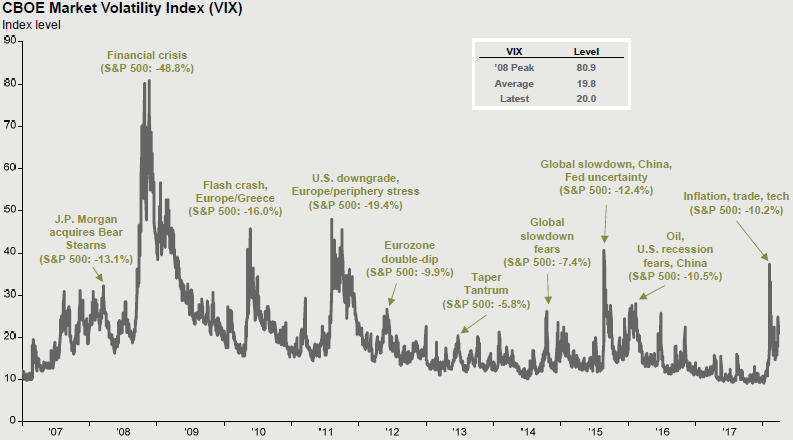

The start to 2018 saw continued market volatility. As we wrote in our February 14 article “Getting Back to Normal,” volatility is back and it isn’t going away. On average, the market sees intra-year declines of 10% or more annually, and declines of at least 5% five times per year. Thus far in 2018, we have already seen 1 drop of at least 10% and 4 drops of at least 5%. While this may not be the end of this trend in 2018, history tells us that this type of volatility is normal. The chart to the right shows us the Volatility Index (VIX), the reasons for the spikes in volatility, and the subsequent market returns. As you will notice, it is common for there to be uncertainty in the markets.

Much of the recent volatility has been caused by investor fears concentrated on tariffs and on a potential trade war with China. As of April 1st, China has slapped tariffs on 128 U.S. products as a retaliation to the United States’ announcement of a new tariff on aluminum and steel imports. Chinese President Xi Jinping and U.S. President Donald Trump have metaphorically begun shooting holes in a boat that they are both currently aboard. While this conflict has not escalated into an all-out trade war yet, it has escalated tension between the U.S. and China. If the current trade protectionism turns into a trade war, we would expect further increases in market volatility.

The Tax Cuts and Jobs Act, which passed in December, has reduced the corporate tax rate from 35% to 21%. This will undoubtedly provide a direct boost to corporate profits. Analyst estimates for S&P 500 profits in 2018 shot north due to the tax cut, thus effectively lowering the forward price-to-earnings ratio of the S&P 500 Index from 18.5x to 16.4x. This essentially means that domestic stocks became cheaper relative to expected future earnings.

Domestic Equity Recap

The domestic equity run finally ended after 9 consecutive positive quarters. The S&P 500 saw a modest decline of 0.8% for the quarter. For investors, this felt worse than it was due to the approximate 10 % decline from January 26th through February 8th. Additionally, valuations saw a 12% decline for the quarter via the forward price-to-earnings ratio (P/E) of the S&P 500, which is currently 16.4x. While many investors assume this was a result of the recent market correction, they are only partially correct. The decline in valuations is also a direct result of increased analyst estimates of future corporate profits.

In our year-end 2017 commentary, we discussed that corporate profits were continuing to grow at all-time highs and had the potential to grow at a faster rate over the next few years based on the new tax law. Per S&P consensus analyst estimates, corporate profits are expected to increase 25% year over year from 2017 to 2018, and then steady out in 2019.

Corporate profits, coupled with lower forward P/E ratios, point toward positive U.S. equity returns in 2018, despite the recent increase in volatility. Remember, patient investors tend to weather the storm better than those who are impatient and panic when volatility comes knocking.

International Equity Recap

International returns were mixed in Q1 of 2018, with developed markets giving up -0.9% and emerging markets yielding positive returns of 2.5%. The dollar continued to fall and it appears this may continue into 2018. While we have seen some weakness in the dollar throughout 2017 and into 2018, the dollar continues to remain near the upper end of its 5-year range.

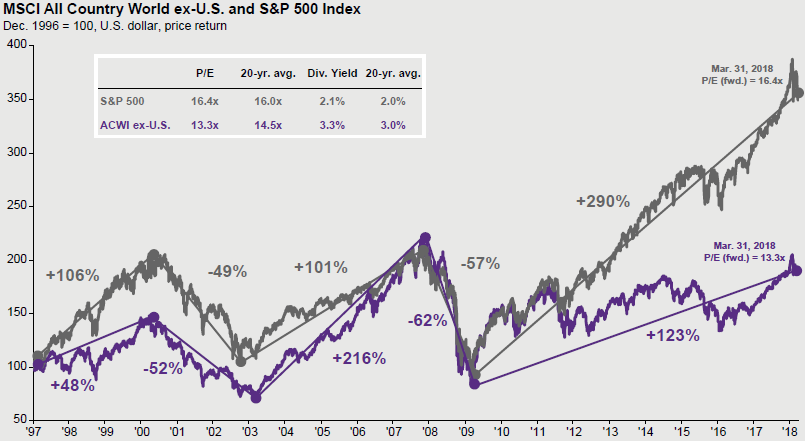

Based on valuations, the case for international equities remains strong. Many investors who were not invested in U.S. equities over the past decade feel as though they have missed the boat. This may be true. However, there is good news: there is another boat in the harbor that hasn’t pulled away yet. International equity valuations have experienced sideways growth since the early 2000’s. The U.S. saw the same sideways growth from the late 90’s through 2011 and really only jumped over the past 6 years. International expansions are younger with more room to run compared to U.S. equities. With this said, we continue to stand firm on our stance that investors should devote a portion of their equity portfolio to international investments. Our increased allocation to international equities within client portfolios provides additional diversification and will allow us to participate in the expected future gains presented by the attractive valuations and positive outlook for international equities.

Based on valuations, the case for international equities remains strong. Many investors who were not invested in U.S. equities over the past decade feel as though they have missed the boat. This may be true. However, there is good news: there is another boat in the harbor that hasn’t pulled away yet. International equity valuations have experienced sideways growth since the early 2000’s. The U.S. saw the same sideways growth from the late 90’s through 2011 and really only jumped over the past 6 years. International expansions are younger with more room to run compared to U.S. equities. With this said, we continue to stand firm on our stance that investors should devote a portion of their equity portfolio to international investments. Our increased allocation to international equities within client portfolios provides additional diversification and will allow us to participate in the expected future gains presented by the attractive valuations and positive outlook for international equities.

Domestic Fixed Income Recap

Domestic bonds began the first quarter of 2018 returning -1.5%. It is important to note that many bond interest payments have not yet been made, therefore making this number slightly deceiving. Domestic bonds are expected to continue to face headwinds in 2018 as The Federal Reserve has indicated it will raise interest rates 2-3 more times in 2018. They will also continue to reduce the size of their balance sheet, allowing bonds to flow back to the markets. The tapering of the balance sheet ultimately has the same impact as raising interest rates, thus increasing bond yields.

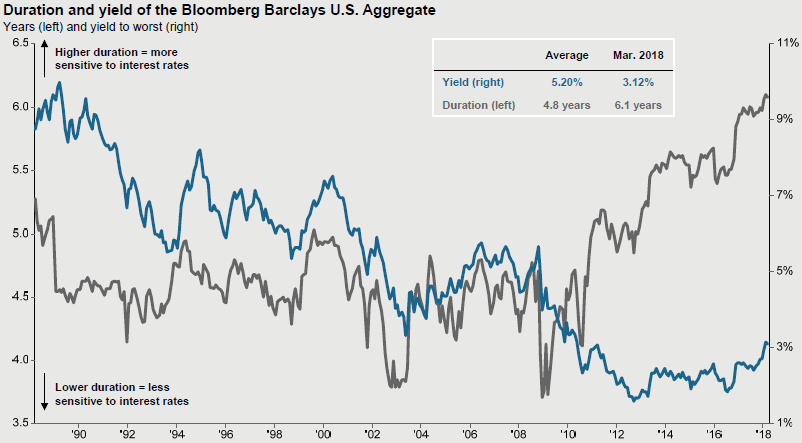

An area for fixed income investors to keep an eye on is the duration of their bond portfolio. Duration is an approximate measure of a bond’s price sensitivity to changes in interest rates. As you can see from the chart below, the higher the duration of a bond, the more sensitive a bond will be to interest rates. Voisard Asset Management Group has implemented a defensive portfolio of bond assets as the return for investing in longer term bonds doesn’t outweigh the potential risks associated with a rising rate environment. As a result, we have reduced our bond portfolio duration to 3.4 years while the benchmark’s (Barclays U.S. Aggregate Bond) duration is 6.1 years. We continue to maintain a defensive position within our bond portfolio by assuming a short duration target. We believe that positioning your bond portfolio to be shorter in duration is a prudent hedge against interest rate risk in a rising rate environment.

International Fixed Income Recap

International fixed income had a much better start to 2018 than domestic bonds, returning approximately 2.3%. The falling dollar has helped returns thus far in 2018. We need to continue to monitor inflation this year. Inflation could tilt the central banks into a more aggressive tightening mode, thus requiring international bond investors to be more favorably compensated for the risks they are presumably taking. An international bond portfolio is diversified across countries at differing points in the rate cycle—some raising, some lowering, some holding steady—to decrease idiosyncratic interest rate risk. This provides another element of reducing the interest rate risk that is present in domestic bonds.

Remaining 2018 Outlook

Heading into 2018, economic indicators still show a healthy economy that can continue its trend upward. Growth should accelerate and stabilize through the end of 2018 due to inventories, government spending, and fiscal stimulus through tax reform. Stronger investment spending, and an improving global economy, should also create tailwinds. Unemployment is continuing its downward trajectory and inflation remains calm. Additionally, with over 40% of S&P 500 revenues coming from abroad, a weaker dollar should boost foreign sales, particularly in 2018.

The weakness in inflation in 2017 appears to have been largely transitory; and inflation looks set to gradually edge up through 2018, helped by a weaker dollar, higher oil prices, and tightening labor and housing markets. That said, the use of information technology around the world has empowered buyers of goods and services. As a powerful structural force, this has placed downward pressure on inflation globally in recent history. This force will likely remain in 2018 and beyond, which should temper the rise of inflation moving forward.

Although the economy appears to be moving in the right direction, uncertainty remains regarding future tariffs and a potential trade war. A trade war could hurt businesses exporting goods and could increase prices of imports. This could have a negative impact on U.S. consumers and businesses alike, and has the potential to create a more challenging path for economic growth. While a trade war is certainly a possibility, we remain optimistic about the global economy, and believe trade tensions will ease in the coming months.

Overall, we are confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty, keeping our focus where it should be: prudently managing our diversified portfolios to achieve long-term, risk adjusted returns.

2018 Quarterly Commentary Q1

Contributed by: Beth Parks

Market Performance Overview

Taxes, Tariffs and Trade

The start to 2018 saw continued market volatility. As we wrote in our February 14 article “Getting Back to Normal,” volatility is back and it isn’t going away. On average, the market sees intra-year declines of 10% or more annually, and declines of at least 5% five times per year. Thus far in 2018, we have already seen 1 drop of at least 10% and 4 drops of at least 5%. While this may not be the end of this trend in 2018, history tells us that this type of volatility is normal. The chart to the right shows us the Volatility Index (VIX), the reasons for the spikes in volatility, and the subsequent market returns. As you will notice, it is common for there to be uncertainty in the markets.

Much of the recent volatility has been caused by investor fears concentrated on tariffs and on a potential trade war with China. As of April 1st, China has slapped tariffs on 128 U.S. products as a retaliation to the United States’ announcement of a new tariff on aluminum and steel imports. Chinese President Xi Jinping and U.S. President Donald Trump have metaphorically begun shooting holes in a boat that they are both currently aboard. While this conflict has not escalated into an all-out trade war yet, it has escalated tension between the U.S. and China. If the current trade protectionism turns into a trade war, we would expect further increases in market volatility.

The Tax Cuts and Jobs Act, which passed in December, has reduced the corporate tax rate from 35% to 21%. This will undoubtedly provide a direct boost to corporate profits. Analyst estimates for S&P 500 profits in 2018 shot north due to the tax cut, thus effectively lowering the forward price-to-earnings ratio of the S&P 500 Index from 18.5x to 16.4x. This essentially means that domestic stocks became cheaper relative to expected future earnings.

Domestic Equity Recap

The domestic equity run finally ended after 9 consecutive positive quarters. The S&P 500 saw a modest decline of 0.8% for the quarter. For investors, this felt worse than it was due to the approximate 10 % decline from January 26th through February 8th. Additionally, valuations saw a 12% decline for the quarter via the forward price-to-earnings ratio (P/E) of the S&P 500, which is currently 16.4x. While many investors assume this was a result of the recent market correction, they are only partially correct. The decline in valuations is also a direct result of increased analyst estimates of future corporate profits.

In our year-end 2017 commentary, we discussed that corporate profits were continuing to grow at all-time highs and had the potential to grow at a faster rate over the next few years based on the new tax law. Per S&P consensus analyst estimates, corporate profits are expected to increase 25% year over year from 2017 to 2018, and then steady out in 2019.

Corporate profits, coupled with lower forward P/E ratios, point toward positive U.S. equity returns in 2018, despite the recent increase in volatility. Remember, patient investors tend to weather the storm better than those who are impatient and panic when volatility comes knocking.

International Equity Recap

International returns were mixed in Q1 of 2018, with developed markets giving up -0.9% and emerging markets yielding positive returns of 2.5%. The dollar continued to fall and it appears this may continue into 2018. While we have seen some weakness in the dollar throughout 2017 and into 2018, the dollar continues to remain near the upper end of its 5-year range.

Domestic Fixed Income Recap

Domestic bonds began the first quarter of 2018 returning -1.5%. It is important to note that many bond interest payments have not yet been made, therefore making this number slightly deceiving. Domestic bonds are expected to continue to face headwinds in 2018 as The Federal Reserve has indicated it will raise interest rates 2-3 more times in 2018. They will also continue to reduce the size of their balance sheet, allowing bonds to flow back to the markets. The tapering of the balance sheet ultimately has the same impact as raising interest rates, thus increasing bond yields.

An area for fixed income investors to keep an eye on is the duration of their bond portfolio. Duration is an approximate measure of a bond’s price sensitivity to changes in interest rates. As you can see from the chart below, the higher the duration of a bond, the more sensitive a bond will be to interest rates. Voisard Asset Management Group has implemented a defensive portfolio of bond assets as the return for investing in longer term bonds doesn’t outweigh the potential risks associated with a rising rate environment. As a result, we have reduced our bond portfolio duration to 3.4 years while the benchmark’s (Barclays U.S. Aggregate Bond) duration is 6.1 years. We continue to maintain a defensive position within our bond portfolio by assuming a short duration target. We believe that positioning your bond portfolio to be shorter in duration is a prudent hedge against interest rate risk in a rising rate environment.

International Fixed Income Recap

International fixed income had a much better start to 2018 than domestic bonds, returning approximately 2.3%. The falling dollar has helped returns thus far in 2018. We need to continue to monitor inflation this year. Inflation could tilt the central banks into a more aggressive tightening mode, thus requiring international bond investors to be more favorably compensated for the risks they are presumably taking. An international bond portfolio is diversified across countries at differing points in the rate cycle—some raising, some lowering, some holding steady—to decrease idiosyncratic interest rate risk. This provides another element of reducing the interest rate risk that is present in domestic bonds.

Remaining 2018 Outlook

Heading into 2018, economic indicators still show a healthy economy that can continue its trend upward. Growth should accelerate and stabilize through the end of 2018 due to inventories, government spending, and fiscal stimulus through tax reform. Stronger investment spending, and an improving global economy, should also create tailwinds. Unemployment is continuing its downward trajectory and inflation remains calm. Additionally, with over 40% of S&P 500 revenues coming from abroad, a weaker dollar should boost foreign sales, particularly in 2018.

The weakness in inflation in 2017 appears to have been largely transitory; and inflation looks set to gradually edge up through 2018, helped by a weaker dollar, higher oil prices, and tightening labor and housing markets. That said, the use of information technology around the world has empowered buyers of goods and services. As a powerful structural force, this has placed downward pressure on inflation globally in recent history. This force will likely remain in 2018 and beyond, which should temper the rise of inflation moving forward.

Although the economy appears to be moving in the right direction, uncertainty remains regarding future tariffs and a potential trade war. A trade war could hurt businesses exporting goods and could increase prices of imports. This could have a negative impact on U.S. consumers and businesses alike, and has the potential to create a more challenging path for economic growth. While a trade war is certainly a possibility, we remain optimistic about the global economy, and believe trade tensions will ease in the coming months.

Overall, we are confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty, keeping our focus where it should be: prudently managing our diversified portfolios to achieve long-term, risk adjusted returns.

Beth Parks

Share this post with your friends