2017 turned out to be a great year for investors as stock markets soared domestically and around the world. Interest rates remained low, providing plenty of liquidity for those that sought to borrow. Inflation and wage growth remained at near historic lows despite tightening labor markets and falling unemployment. Market volatility remained extremely low throughout the uncertainties faced in 2017. We saw political unrest in Washington, increasing threats of potential war with North Korea and hurricanes along the east and southern coasts while fires broke out all along the southwest coastal line in southern California.

The Tax Cuts and Jobs Act, which passed in December, should provide fiscal stimulus domestically. While there will be winners and losers created by the change in tax law, tax bills will be reduced on an overall basis which should continue to spur consumer spending. Tax brackets for corporations were reduced from 35% to 21%, a move that will provide a direct boost to corporate profits. In addition, the repatriation tax holiday should bring cash held internationally back to the U.S. By Goldman Sachs’ estimates, S&P 500 companies hold $920 billion of untaxed cash overseas, and they estimate that $250 billion of that would be repatriated. Once repatriation occurs, our expectation is that the funds will be put to use either by investing the funds in the corporation, increasing dividends, or by executing share buybacks; all of which would be beneficial to equity investors. The attached summary titled “The Hunt for Loopholes Begins” will help shed some additional light into some of the anticipated tax changes in 2018.

Domestic Equity Recap

Domestic equities continued their run in the fourth quarter of 2017, making it the 9th consecutive positive quarter for the S&P 500. Valuations continued to rise and are sitting above historical averages. The forward price-to-earnings ratio (P/E) of the S&P 500 is currently 18.2x, while the current 25-year average hovers around 16.0x. As mentioned in our last quarterly commentary, the P/E ratio has an impact on expect future returns. One should expect that as current valuations move higher, expected future returns will shift lower (and vice versa).

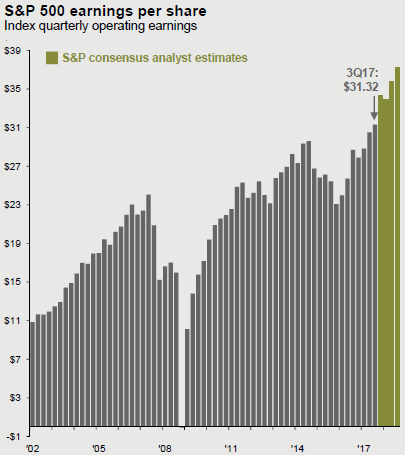

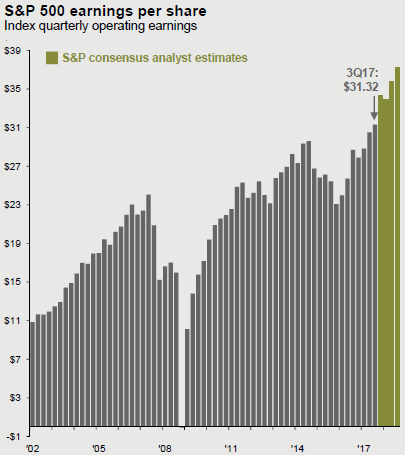

Another important consideration is expected corporate profits. Corporate profits are continuing to grow at all-time highs and have the potential to grow at a faster rate over the next few years based on the new tax law. The repatriation tax holiday should also allow companies to improve their earnings if foreign cash is repatriated and put to work. Low unemployment, increasing wages, and the reduction in individual income taxes also provides a tailwind for corporate profits as consumers are expected to have additional disposable income in 2018.

International Equity Recap

International returns continue to be bolstered by the falling dollar and strong manufacturing growth in both developed and emerging markets. Even though we have seen some weakness in the dollar throughout 2017, the dollar continues to remain near the upper end of its 5-year range. There continues to be a strong case for international equities as the dollar may continue to fall as we enter 2018.

In addition, international equity valuations remain more attractive than domestic equities which also provides room for stronger returns moving forward. With this said, we continue to stand firm on our stance that investors should devote a solid portion of their equity portfolio internationally. Our increased allocation to international equities provides additional diversification and will allow us to participate in the expected future gains presented by the attractive valuations and positive outlook for international equities.

Domestic Fixed Income Recap

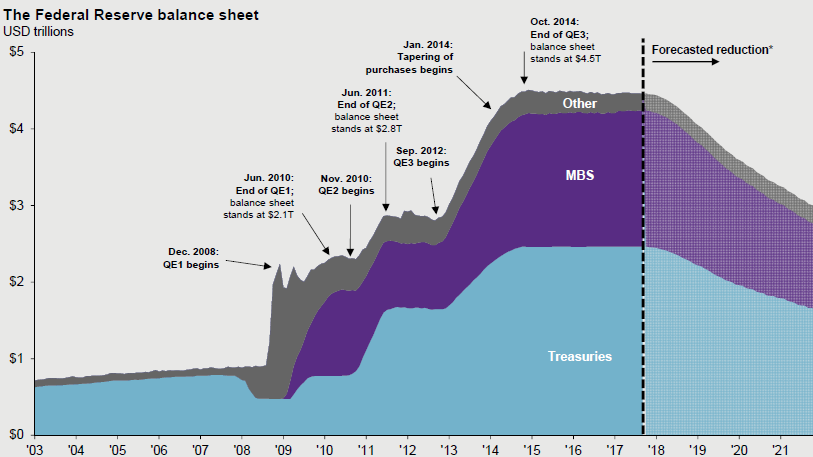

Domestic bonds were sluggish in the fourth quarter of 2017, returning approximately 0.40%. In 2017, domestic bonds returned approximately 3.5% and are expected to continue to face strong headwinds due to the likely rising interest rate environment in 2018. The Federal Reserve has indicated it will raise interest rates 3-4 more times in 2018 and continue with their balance sheet tapering efforts. The balance sheet tapering by the Federal Reserve began in October of 2017 with a $10 billion per month roll off in the central bank’s holdings. The amount allowed to roll off will rise every three months until the amount reaches $50 billion per month. The tapering of the balance sheet ultimately has the same impact as raising interest rates, resulting in higher bond yields.

As mentioned in the last few quarterly commentaries, Voisard Asset Management Group has implemented a defensive portfolio of bond assets as the return for investing in longer term bonds doesn’t outweigh the potential risks associated with a rising rate environment. We continue to maintain a defensive position within our bond portfolio by assuming a short duration target. We believe that being short duration is a prudent hedge against interest rate risk in a rising rate environment.

International Fixed Income Recap

International fixed income had a great 2017, returning approximately 6.5%. The falling dollar has provided most of the positive 2017 returns. One thing that we need to watch out for over the next year is inflation. Inflation could tilt the central banks into a more aggressive tightening mode, thus requiring international bond investors to be more favorably compensated for the risks they are presumably taking. An international bond portfolio is diversified across countries at differing points in the rate cycle—some raising, some lowering, some holding steady—to decrease idiosyncratic interest rate risk. This provides another element of reducing the interest rate risk that is present in domestic bonds.

2018 Outlook

As investors, we are always pleased in years in which we experience favorable returns like we saw in 2017, but we should remember that historical returns are not always so favorable. Heading into 2018, economic indicators still show a healthy economy that can continue its trend upward. Unemployment is continuing its downward trajectory and inflation remains calm. The more perplexing question centers on rates of growth from here. Equity market performance in the coming year should hinge on three variables: earnings, inflation and interest rates. Earnings are a function of economic growth and we expect that the healthy pace of economic growth seen in the second half of 2017 can continue into this year. Additionally, we expect global economic momentum to continue in 2018, which, combined with low levels of inflation in the developed world and a gradual normalization of monetary policy, is a positive backdrop for international equities. As monetary policy is normalized around the developed world, yields should move gradually higher, pointing to the need for flexibility in fixed income investing.

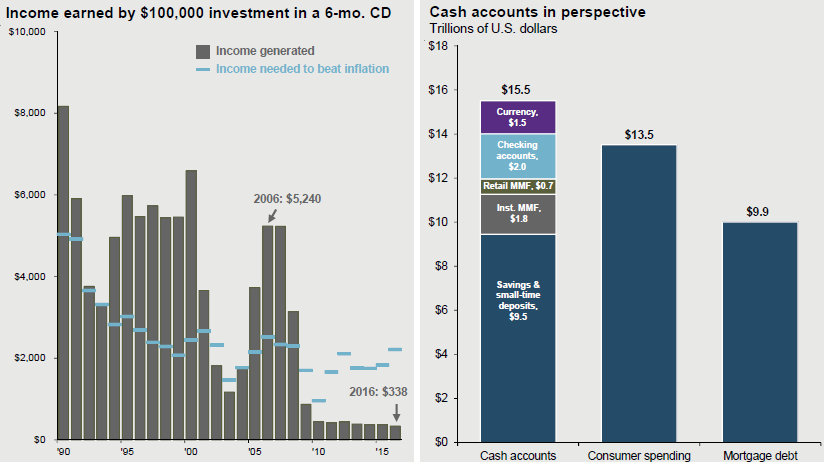

Heading into 2018, it is important to remember some time-tested principles for successful long-term investing, the first being that cash isn’t always king. There is a lot of cash at this point sitting on the sidelines that is not even keeping up with inflation, as seen in the charts below. In other words, too much cash is essentially dead money in your pocket.

The second time-tested principle of diversification is essential. Diversification smooth returns over time and allows investors to more easily stomach years that aren’t as favorable. This being said, we understand that down years are not easy for anybody. The third time-tested principle is to harness the power of compounding and don’t let volatility derail your plan. Remember, volatility is not risk, but often leads investors into making foolish short-term decisions that rarely pan out in the long-term.

Overall, we remain confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be, which is prudently managing our diversified portfolios to achieve long-term, risk adjusted returns.

2017 Quarterly Commentary Q4

Contributed by: Beth Parks

Market Performance Overview

2017 Market Recap

2017 turned out to be a great year for investors as stock markets soared domestically and around the world. Interest rates remained low, providing plenty of liquidity for those that sought to borrow. Inflation and wage growth remained at near historic lows despite tightening labor markets and falling unemployment. Market volatility remained extremely low throughout the uncertainties faced in 2017. We saw political unrest in Washington, increasing threats of potential war with North Korea and hurricanes along the east and southern coasts while fires broke out all along the southwest coastal line in southern California.

The Tax Cuts and Jobs Act, which passed in December, should provide fiscal stimulus domestically. While there will be winners and losers created by the change in tax law, tax bills will be reduced on an overall basis which should continue to spur consumer spending. Tax brackets for corporations were reduced from 35% to 21%, a move that will provide a direct boost to corporate profits. In addition, the repatriation tax holiday should bring cash held internationally back to the U.S. By Goldman Sachs’ estimates, S&P 500 companies hold $920 billion of untaxed cash overseas, and they estimate that $250 billion of that would be repatriated. Once repatriation occurs, our expectation is that the funds will be put to use either by investing the funds in the corporation, increasing dividends, or by executing share buybacks; all of which would be beneficial to equity investors. The attached summary titled “The Hunt for Loopholes Begins” will help shed some additional light into some of the anticipated tax changes in 2018.

Domestic Equity Recap

Domestic equities continued their run in the fourth quarter of 2017, making it the 9th consecutive positive quarter for the S&P 500. Valuations continued to rise and are sitting above historical averages. The forward price-to-earnings ratio (P/E) of the S&P 500 is currently 18.2x, while the current 25-year average hovers around 16.0x. As mentioned in our last quarterly commentary, the P/E ratio has an impact on expect future returns. One should expect that as current valuations move higher, expected future returns will shift lower (and vice versa).

Another important consideration is expected corporate profits. Corporate profits are continuing to grow at all-time highs and have the potential to grow at a faster rate over the next few years based on the new tax law. The repatriation tax holiday should also allow companies to improve their earnings if foreign cash is repatriated and put to work. Low unemployment, increasing wages, and the reduction in individual income taxes also provides a tailwind for corporate profits as consumers are expected to have additional disposable income in 2018.

International Equity Recap

International returns continue to be bolstered by the falling dollar and strong manufacturing growth in both developed and emerging markets. Even though we have seen some weakness in the dollar throughout 2017, the dollar continues to remain near the upper end of its 5-year range. There continues to be a strong case for international equities as the dollar may continue to fall as we enter 2018.

In addition, international equity valuations remain more attractive than domestic equities which also provides room for stronger returns moving forward. With this said, we continue to stand firm on our stance that investors should devote a solid portion of their equity portfolio internationally. Our increased allocation to international equities provides additional diversification and will allow us to participate in the expected future gains presented by the attractive valuations and positive outlook for international equities.

Domestic Fixed Income Recap

Domestic bonds were sluggish in the fourth quarter of 2017, returning approximately 0.40%. In 2017, domestic bonds returned approximately 3.5% and are expected to continue to face strong headwinds due to the likely rising interest rate environment in 2018. The Federal Reserve has indicated it will raise interest rates 3-4 more times in 2018 and continue with their balance sheet tapering efforts. The balance sheet tapering by the Federal Reserve began in October of 2017 with a $10 billion per month roll off in the central bank’s holdings. The amount allowed to roll off will rise every three months until the amount reaches $50 billion per month. The tapering of the balance sheet ultimately has the same impact as raising interest rates, resulting in higher bond yields.

As mentioned in the last few quarterly commentaries, Voisard Asset Management Group has implemented a defensive portfolio of bond assets as the return for investing in longer term bonds doesn’t outweigh the potential risks associated with a rising rate environment. We continue to maintain a defensive position within our bond portfolio by assuming a short duration target. We believe that being short duration is a prudent hedge against interest rate risk in a rising rate environment.

International Fixed Income Recap

International fixed income had a great 2017, returning approximately 6.5%. The falling dollar has provided most of the positive 2017 returns. One thing that we need to watch out for over the next year is inflation. Inflation could tilt the central banks into a more aggressive tightening mode, thus requiring international bond investors to be more favorably compensated for the risks they are presumably taking. An international bond portfolio is diversified across countries at differing points in the rate cycle—some raising, some lowering, some holding steady—to decrease idiosyncratic interest rate risk. This provides another element of reducing the interest rate risk that is present in domestic bonds.

2018 Outlook

As investors, we are always pleased in years in which we experience favorable returns like we saw in 2017, but we should remember that historical returns are not always so favorable. Heading into 2018, economic indicators still show a healthy economy that can continue its trend upward. Unemployment is continuing its downward trajectory and inflation remains calm. The more perplexing question centers on rates of growth from here. Equity market performance in the coming year should hinge on three variables: earnings, inflation and interest rates. Earnings are a function of economic growth and we expect that the healthy pace of economic growth seen in the second half of 2017 can continue into this year. Additionally, we expect global economic momentum to continue in 2018, which, combined with low levels of inflation in the developed world and a gradual normalization of monetary policy, is a positive backdrop for international equities. As monetary policy is normalized around the developed world, yields should move gradually higher, pointing to the need for flexibility in fixed income investing.

Heading into 2018, it is important to remember some time-tested principles for successful long-term investing, the first being that cash isn’t always king. There is a lot of cash at this point sitting on the sidelines that is not even keeping up with inflation, as seen in the charts below. In other words, too much cash is essentially dead money in your pocket.

The second time-tested principle of diversification is essential. Diversification smooth returns over time and allows investors to more easily stomach years that aren’t as favorable. This being said, we understand that down years are not easy for anybody. The third time-tested principle is to harness the power of compounding and don’t let volatility derail your plan. Remember, volatility is not risk, but often leads investors into making foolish short-term decisions that rarely pan out in the long-term.

Overall, we remain confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be, which is prudently managing our diversified portfolios to achieve long-term, risk adjusted returns.

Beth Parks

Share this post with your friends