Are interest rates going up? Investors have always known that interest rates cannot sit near zero forever, but most have become accustomed to it with the 10-year Treasury rate sitting well beneath 3% for most of the last decade. More recently, we have seen declines in rates that have pushed bond yields toward all-time lows. This decline in rates has been a nice tailwind for investors as bond prices move inversely to interest rates. In other words, as interest rates fall, bond prices rise.

Consider the following example. If you own a bond that pays an interest rate of 4%, and a drop in rates causes new bonds to pay 3%, your bond is inherently more valuable. If investors can only buy new bonds at the market rate of 3%, they would certainly be willing to pay more for your bond that is paying 4%. While this is a simplified example of how bonds work, this is largely how investors have fared over the last several decades.

These last few months have been different as we have seen bond yields begin to creep higher from their 2020 lows. From October 1, 2020 to March 6, 2021, we have seen the ten-year bond yield increase from .7% to 1.6%, more than doubling in this short period of time. As a result, we have seen bond prices drop to reflect this increase in rates.

What has caused the increase in interest rates? As the U.S. continues to work its way back from the Coronavirus pandemic, the government has flooded the economy with cash. Stimulus packages have pumped trillions of dollars into the economy to keep us out of a deep recession. Because of this, there is an expectation that inflation will begin to rise at a more rapid rate in the coming years. The market has starting pricing in the expectation of higher inflation and therefore, we have subsequently seen the rise in the 10-year Treasury.

Wondering if interest rates are going up in 2021? While no one can be certain which way rates will go next, we do know that bonds continue to play an important role in our client’s portfolios. While bonds are not always free from negative returns, they are much less volatile than stocks, and will continue to provide ballast to portfolios and insulation from swings in the equity markets. We would love to see consistent positive returns every year, however we know that historically this doesn’t always happen.

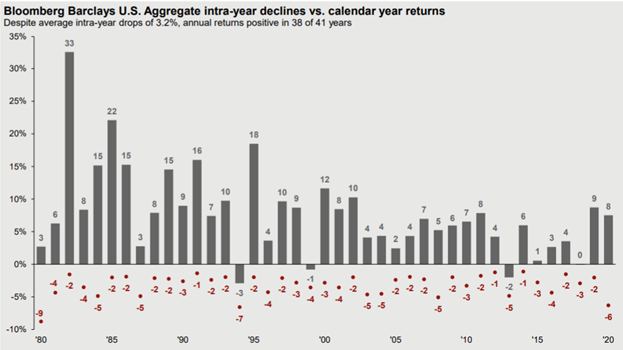

The chart below shows this when looking at the U.S. Aggregate bond index returns since.

The gray bars highlight the actual annual return of the index for the calendar year, dating back to 1980. While most years have been positive, we have seen negative and flat annual returns in the past. Additionally, the little red dots outline the intra-year decline from peak to trough of the index. So even though most years have ended positive for bond funds, investors must weather some volatility and negative returns during the year. While we don’t enjoy seeing negative returns part way through a year, we know that staying the course will provide investors with the positive long-term returns they are accustomed to seeing.

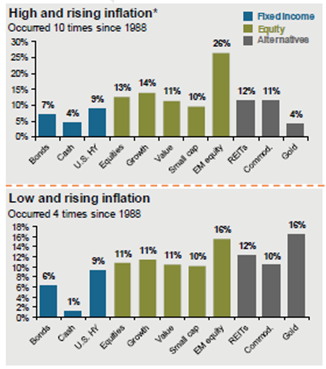

If you are concerned about interest rates going up and what this may do to your stock and bond portfolio, the following charts are instructive. These two charts, published by JP Morgan as of 12/31/20, outline what has occurred in high and rising inflation environments and low and rising inflation environments. The reference to “high” or “low” is relative to the median consumer price index for urban consumers from 1988-2020. This period of time spans 33 years and averaged 2.5% year over year.

As you can see, while we have experienced both high and low periods of inflation 14 times since 1988, this has generally not created negative returns for bond assets. In fact, both bond and stock indexes have been generally positive during these periods of time.

If you have questions about the structure of your portfolio assets and how it is currently positioned, please do not hesitate to reach out to our team of professionals.