Social Security faces long-term funding challenges–as you’ve likely heard– but the benefits aren’t disappearing. While it’s true that the program faces long-term funding challenges, it’s important to understand that even without immediate reforms, the program will still cover most payouts for decades. Continue reading to learn more about the current state of Social Security and potential solutions to ensure its longevity.

Current State of Social Security

Each year, federal agencies report on the current and projected future health of the Social Security system. According to the latest report, here are the key facts:

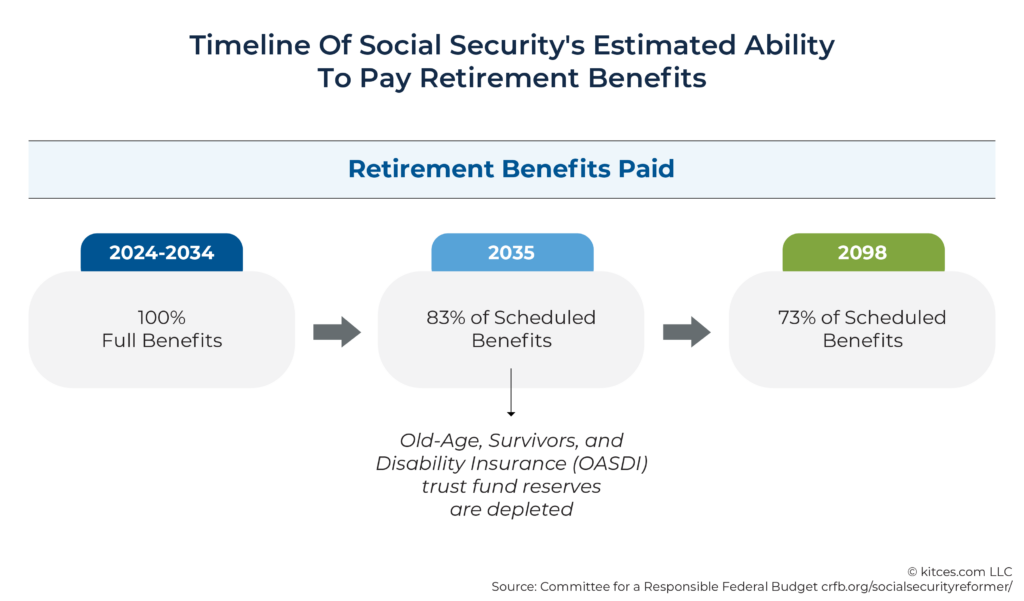

- The Federal Old-Age and Survivors Insurance (OASI) trust fund, which helps pay Social Security retirement benefits, is projected to be depleted in 2033 if no legislative action is taken.

- The Disability Insurance (DI) trust fund, which covers federal disability benefits, could be used to cover Social Security retirement benefits. These combined funds (OASDI) would be depleted in 2035.

When 2035 rolls around, this does not mean Social Security retirement benefits will suddenly disappear, and here’s why.

- While the OASDI trust fund helps fund Social Security retirement benefits, the majority of funding comes from FICA taxes–or payroll taxes.

- Even if the OASDI trust fund were depleted in 2035, it is projected that payroll tax revenue would still be able to fund 83% of benefits.

- This percentage decreases over time, however, it is projected that in 2098, 73% of scheduled benefits will still be funded by payroll tax revenue.

Key takeaway: if nothing is done to address the current state of Social Security, the worst-case scenario is that approximately 80% of Social Security benefits would be paid until the end of the century.

Potential Solutions

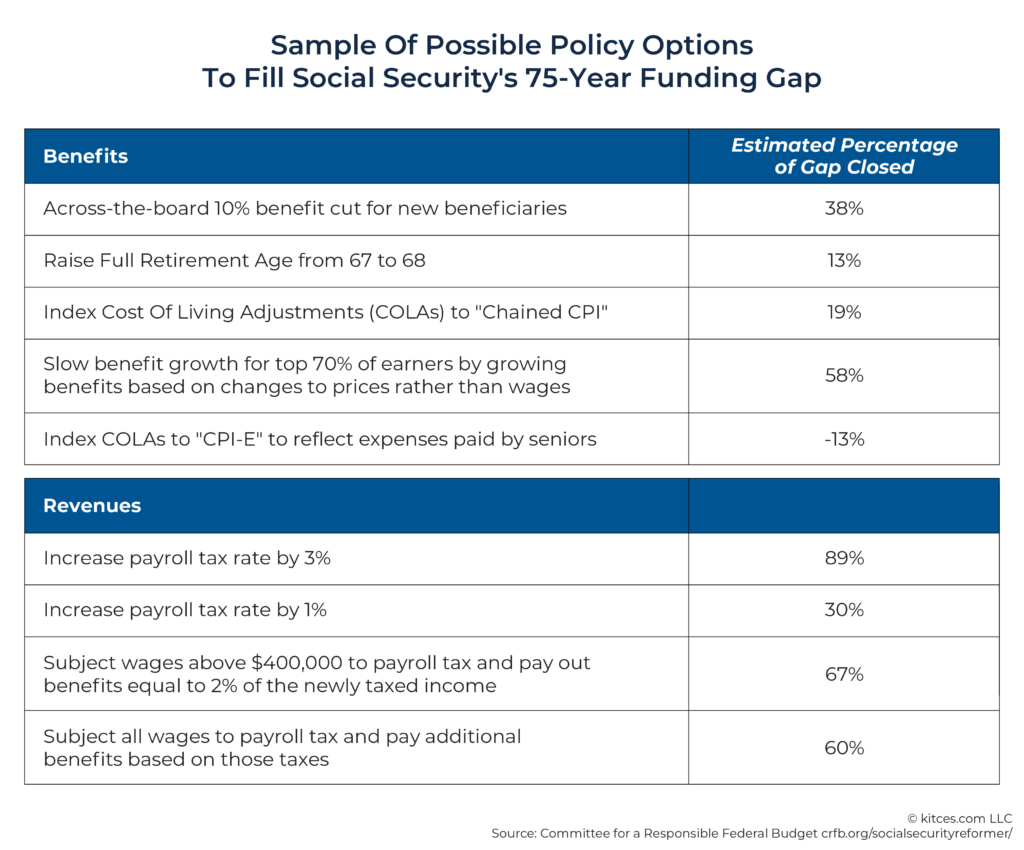

Paying 73% of benefits by 2098 is the worst-case scenario, and there is still time to enact policies to shrink the gap and ensure Social Security recipients receive their full benefits for years to come. The table below shows potential policy changes and their impact on the funding gap. Overall, implementing policies on the revenue side of the equation is likely simpler than altering beneficiaries’ current or anticipated benefits.

While the list of potential policy changes to Social Security is endless, a few things remain true.

- Even if nothing is done, your Social Security benefits will not disappear.

- Policymakers have time to develop strategies to ensure benefits are paid for years to come.

The biggest questions remain: which route do they choose to go? And when do they make the changes?

What We’re Doing

Voisard Asset Management Group monitors policy changes closely to help clients understand exactly how these changes or lack thereof may impact their financial future.