A tax sunset refers to a situation in which provisions of the tax code are set to expire at a set future date. More specifically, the tax provisions of the Tax Cuts and Jobs Act (TCJA) of 2017 are scheduled to expire at the end of 2025. This means that some notable features of individual and estate tax planning that people have become accustomed to are en route to expiration. The impending sunset has left many taxpayers wondering, “How do I prepare for this?”

Estate and Gift Tax

High net worth individuals are concerned about the estate and gift tax provision changes. The current exemption is $12.92 million individually and $25.84 million for couples. In 2026, exemptions may drop to $6.8 million individually and $14 million for couples. This potential reduction poses estate tax challenges for many.

What to Consider

- Review your estate plan with your attorney to determine what planning opportunities may be available.

- Individuals with taxable estates approaching, or above $12.92 million ($25.84 million for couples) should consider taking advantage of the current, higher limits.

- Explore estate planning strategies such as annual gifting, 529 plan accelerated gifts, dynasty trusts, charitable strategies, or life insurance trusts.

Income Taxes

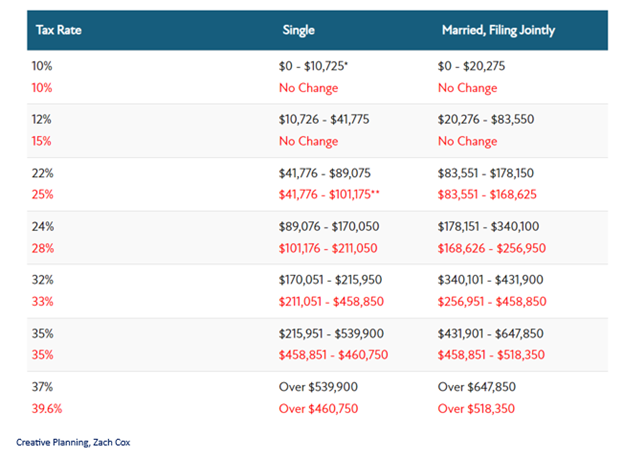

Income tax provision expirations will affect most taxpayers. In 2025, tax brackets revert to pre-TCJA levels, raising effective rates. The top bracket will increase from 37% to 39.6%. Lower brackets, like the 12% bracket, will rise to 15%. These changes assume the 2017 TCJA’s expiration.

What to Consider

- Converting traditional IRA assets to a Roth IRA prior to 2026 to lock in current rates.

- Diversifying assets by tax status to provide more flexibility in managing your tax bill.

- Utilizing gifting and other strategies to reduce your taxable income.

Conclusion

The future is unknown. But it is important to have a flexible plan in place that allows you to adapt to different potential outcomes. Due to the complexity of the impending tax sunset, we recommend you remain in communication with your accountant and/or attorney for guidance as things progress. If you have any additional questions, our team of professionals here at Voisard Asset Management Group would be happy to assist.