Homeownership is often seen as the American dream, a symbol of stability and financial security. But beyond the initial excitement of house hunting lies the reality of upfront and ongoing expenses that can surprise first-time buyers. This article delves into the true cost of buying and owning a home, helping you make informed decisions before taking the plunge.

Breakdown of Potential Home Costs

Downpayment

Traditionally, a 20% down payment was considered ideal. Today, depending on your loan type and qualifications, it can range from 3% to 20%. A larger down payment lowers your loan amount, reducing your monthly mortgage payment and the total interest paid over the loan term. A smaller down payment, particularly those below 20%, requires you to obtain private mortgage insurance, increasing your monthly cost of owning the home. The average cost of private mortgage insurance ranges from 0.46% to 1.50% of the original loan amount annually and depends heavily on your credit score.

Upfront Costs

While the down payment grabs most of the attention, closing costs add a significant chunk to the initial financial outlay. These fees, ranging from 2% to 5% of the purchase price, cover loan origination charges, title searches, appraisals, and establishing escrow. Factor in potential home inspection fees, and you’re looking at a hefty sum on top of the down payment.

Ongoing Expenses

Once you settle in, the monthly bills start rolling in. Property taxes are a major expense, varying based on location and home value. The average property tax rate nationwide is 1.0% of a home’s value and increases to an average of 1.32% for the state of Michigan according to the US Census Bureau 2022 American Community Survey. Homeowner’s insurance protects your investment, and its cost depends on factors like your home’s size, location, and rebuild value. You’ll also be responsible for utilities like electricity, gas, water/sewer, garbage collection, and potentially internet and cable.

Maintenance and Repairs

Owning a home means becoming your own landlord, responsible for upkeep and repairs. Budget for regular maintenance like lawn care, gutter cleaning, and chimney inspections. Unexpected breakdowns, like a failing furnace or leaky roof, can be costly. Setting aside money for a home maintenance fund can ease the financial burden when these issues arise. A good estimate for annual home maintenance and repair costs is 1% to 2% of the home’s value.

HOA Fees and Special Assessments

For those living in planned communities, homeowner’s association (HOA) fees are a monthly expense that cover common area maintenance and amenities. Occasionally, HOAs may levy special assessments for unforeseen repairs or upgrades, adding to your costs.

Real Life Example

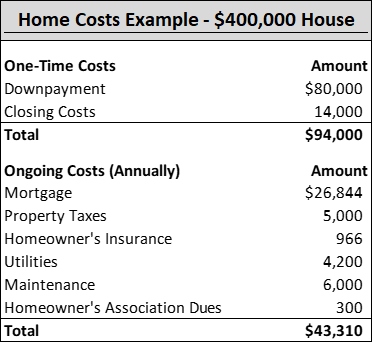

Now that we have broken down and explained the typical costs of buying and owning a home, let’s look at an example to better understand how this plays out in the real world. Below is a real example of the upfront costs and ongoing expenses for an individual who purchased a $400,000 home last year. Please keep in mind that this is one person’s experience and that many of these expenses depend on various situation-specific factors.

The homeowner above had a strong desire to avoid private mortgage insurance and, therefore, made a 20% downpayment, which resulted in an $80,000 outflow. After adding closing costs, this homeowner had to come up with $94,000 just to cover upfront costs. After the upfront costs, the homeowner spent $43,310 on home-related expenses in their first full year of owning the home. These costs are often surprising to home buyers, which is why it is important to be aware of them before making one of the largest decisions of your life.

Conclusion

You can make informed financial decisions by understanding the true cost of homeownership. Carefully analyze your budget, considering not just the monthly mortgage payment but also ongoing expenses and potential maintenance costs. Remember, homeownership is a long-term commitment, and financial preparedness is key to turning the dream of owning a home into a reality. If you have questions about your financial preparedness, reach out to our team, which remains ready and available to assist.