Market movements and consumer sentiment tend to go hand in hand. When markets are riding high, consumers have a rosy outlook on the economy and on future expected returns. As markets fall, consumer sentiment also tumbles as they begin to feel pessimistic about the outlook and on the future direction of the markets. Ironically, the lower consumer sentiment tends to get, the rosier the outlook tends to be for future stock returns.

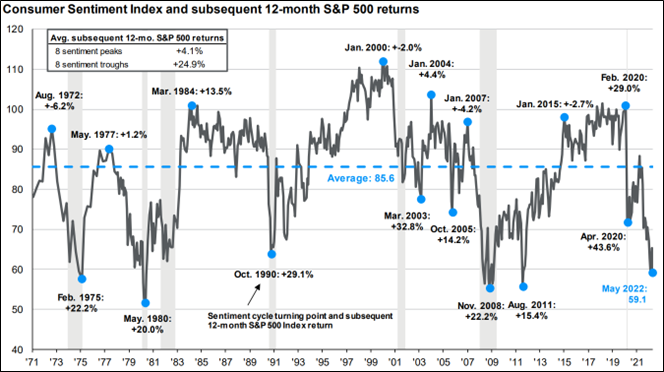

The chart below outlines the consumer sentiment index since 1971. The gray line indicates how consumer sentiment rose and fell over the course of the years. The blue dots indicate the peaks and troughs of sentiment. In other words, they mark the points where investors were the most optimistic and pessimistic about the economy and future returns.

It is evident that stock returns have been highest in the 12-month period directly following consumer sentiment troughs. On average, we have seen returns of 24.9% in the 12 months after the lowest point in consumer sentiment. Conversely, average returns following the peak of consumer sentiment have averaged 4.1%.

There are two important observations here. First, the expected future return of the market is positive whether we are at a peak in sentiment or a trough. Second, the lower the consumer sentiment (and the worse things look), the better future returns have been. The moral of the story is that holding onto your investments through periods of time like we are experiencing today should yield strong results in the future.

While we can never be certain when we have hit a low, we do know that we are certainly a lot closer today than we were 12 months ago. It might be a bumpy ride, but the buy and hold investor will once again see markets rise, and consumer sentiment will bounce back right along with it.