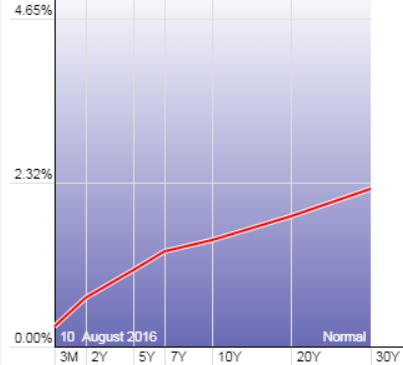

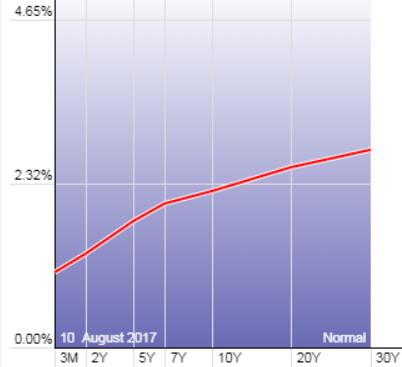

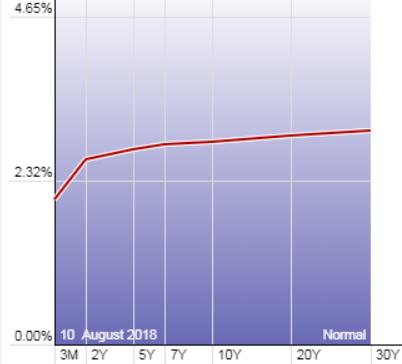

If you pay attention to the yield curve, you noticed an interesting change over the last two years – it has flattened substantially! Before we go into what this could mean for the economy, let’s talk about what the curve represents. The curve is a graph that charts the interest rate you will receive in purchasing government treasury bonds of differing maturities.

The interest rate is charted along the y-axis, and the time before they repay you is represented by the x-axis. In a normal yield curve, you will see the line slope upward. This means that they will pay you higher interest rates if you lend your money to the government for longer periods of time. This makes sense, as we would expect to earn a higher interest rate for lending funds for a longer time.

Why Do We Care About the Yield Curve?

The reason we care about the curve is actually simple. The curve has historically reflected the market’s sense of the economy. If it is upward sloping, the market thinks things will be good or better. Once the curve inverts, it reflects the opposite sentiment. This has become a key market indicator as the curve has inverted prior to the past seven recessions.

What Does It Mean?

As you can see from the graphs above, although the yield curve has been flattening, it does not invert. It is important to note that even if it becomes inverted, an inverted yield curve does not cause a recession. Inversion is usually a signal of a bigger symptom: the Federal Reserve driving short-term rates too high and an over-tightening of monetary policy. Based on current market conditions, this does not appear to be the case. Economic growth is at its highest point in years, and the Fed has appeared slow in raising interest rates.

Because of these factors, it is our belief that long-term interest rates will continue to rise, bringing us back to a more normal yield curve. However, even if the opposite occurs, and we enter a recession, our portfolios are well suited to handle the market’s volatility. Some investors will try to time the market if an inversion occurs, but market timing usually leads to missed opportunities and poor returns. Therefore we believe our clients should stay the course and stick to their individualized financial plan through market turmoil. Given the potential for uncertainty ahead, it becomes even more important to ensure that you have a well-constructed, diversified portfolio to weather any market storm.