For as long as the stock market and investing has existed, people have been trying to time the market. While a few have been successful, many have led themselves astray. Many investors want a consistent 10% annual return while simultaneously wanting to miss 100% of downside risk. It just doesn’t happen! Long story short, investors that attempt to time the market often sacrifice material returns and accomplish the opposite of their desired results.

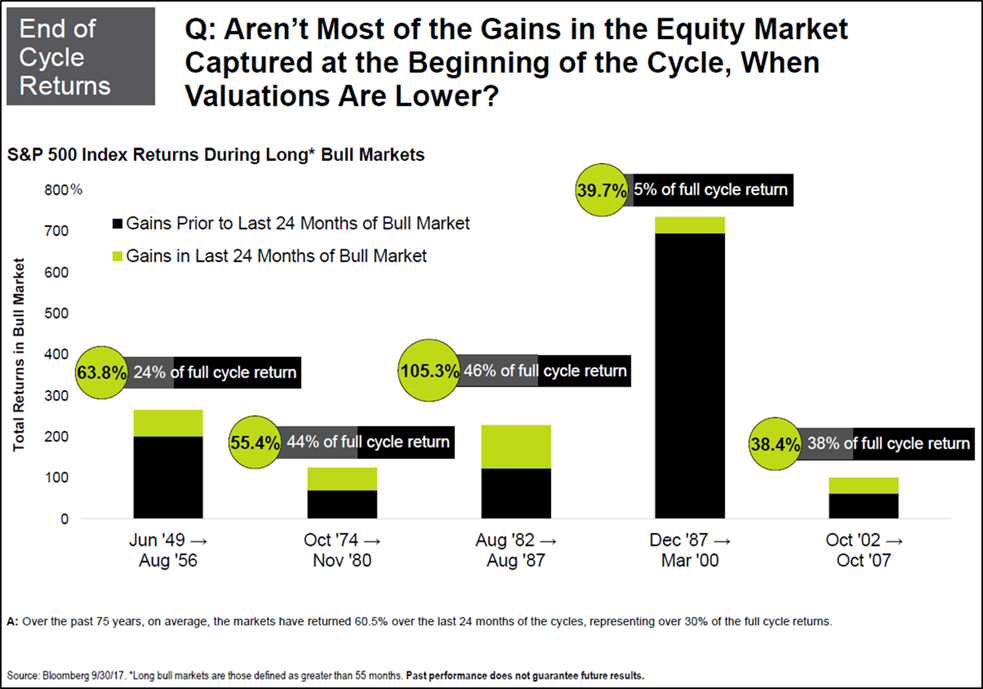

If you look at the current stock market valuation, it’s fair to say that the market is fully valued. Some may think they capture most gains when valuations are lower and therefore think exiting the market now is a wise decision. However, if you look at previous bull markets (those lasting over 55 months), much of the gains are made in the last 24 months of the cycle.

On average, over the past 75 years, the markets have returned 60.3% during the last 24 months of bull market cycles, representing over 30% of full cycle returns. We are not implying that we are in the last 24 months of the current bull market – we are pointing out that exiting the market prior to the peak stock market valuation can cost investors a sizable chunk of returns. History shows that it has been exceptionally hard to time the peaks and troughs of the market.

If current valuations worry you, reviewing your financial goals and current asset allocation is a prudent decision. History has proven that allowing emotions to influence investment decisions over facts leads to poor financial decisions, translating to worse outcomes in the long run. Let us step in and take emotions out of the equation!