Over the last 10 years, the S&P 500 produced an annualized return of 12.48%. During that same period, the MSCI EAFE (representing 21 developed countries) 10-year annualized return was just 4.96%. This dramatic out-performance by U.S. markets leaves many investors asking themselves why they would hold any international investments. As we hit the midway point of 2023, this feeling may need to be reassessed, as several key factors suggest a changing of the tides. Ultimately, the era of the S&P 500 out-performance may be coming to an end.

Historical Trends

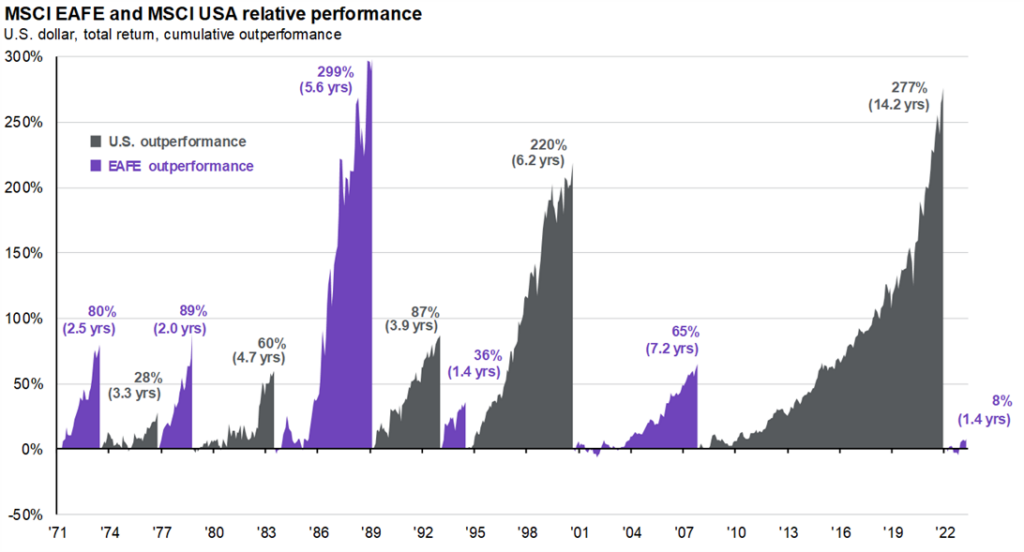

The chart below shows the last 50 years of alternating out-performance of U.S. and international equities. Where the chart is gray, we have seen U.S. stock out-performance, while purple indicates international stock out-performance. Over the past 15 years, U.S. equities outperformed international equities by a whopping 269%. Coming out of the Great Financial Crisis of 2008-2009, we have seen loose monetary policy domestically and favorable valuations, which both contributed to massive growth opportunities.

J.P. Morgan Asset Management 05/23/2023

As outlined below, we believe there are four major catalysts that may cause the out-performance to favor international markets in the future.

-

Valuations

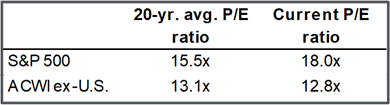

Despite recent declines in equity markets, current international valuations still remain more attractive than their U.S. counterpart. According to the chart below, U.S. equities (S&P 500) continue to trade above their 20-year average, while international equities (ACWI ex-US) are trading below their 20-year average. Putting the chart in simpler terms, if you put the same lemonade stand in the U.S. and in Europe, you would pay $18.00 for a dollar of earnings in the U.S. and only $12.80 for that same dollar of earnings in Europe.

-

U.S. Dollar

The U.S. dollar functions as the world’s dominant reserve currency and has done so since World War II. When investing, a strong U.S. dollar weighs on returns received from international investments because the profits earned by companies abroad in local currencies are converted back to U.S. dollars. The greater the dollar, the less companies receive for their local currency. The U.S. dollar peaked in September of 2022 and has begun to recede, largely due to economic uncertainty and continued interest rate hikes by the Federal Reserve. This downward trend of the U.S. dollar is projected to continue throughout 2023 as the dollar remains near multi-decade highs.

-

Macroeconomic Shift

A macroeconomic shift in monetary policy may also favor international equities. The era of “free money” or zero-interest rate debt has ended for almost every country, causing the cost of servicing debt to rise as a whole. This change adversely affects growth companies, as they tend to utilize debt to grow. Value companies generally have cleaner balance sheets and better cash flow, which they use to grow their business. As the cost of debt increases, growth companies become less profitable. When factoring this in to the macroeconomic landscape, 47% of international sectors are tilted toward value, whereas only 27% of U.S. sectors are value-tilted. As a result, an investment allocation tilt toward value companies may be beneficial as growth companies navigate the new interest rate landscape.

-

Dividend Yield?

A final piece signaling potential international out-performance can be found when comparing U.S. and International equity dividend yields. Yield can be defined as the income return from interest and particularly dividends in this instance on an investment. In May of 2023, the dividend yield of the MSCI All Country World ex-US index was 1.6% greater than the S&P 500. Any time additional yield can be picked up from an investment, it increases the potential overall return of the investment.

What does it mean for You?

While the economic outlook in 2023 may be uncertain, a well-diversified portfolio is the key to weathering uncertainty. Given current valuations, the value of the U.S. dollar, macroeconomic trends and potential dividend yields, we see international equities as a key component inside a diversified portfolio.

Voisard Asset Management Group makes a concerted effort to track trends, find areas where there may be opportunities in portfolios and execute without trying to be market timers. If you have any questions about your portfolio, we would be happy to have a simple conversation.