Market Performance 2023 Overview and Investment Strategies

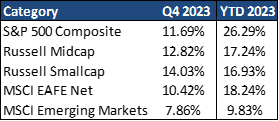

- Domestic equities were positive in 2023, with large cap stocks finishing +26.29%, mid cap stocks finishing +17.24%, and small cap stocks finishing +16.93%.

- Foreign equities were positive in 2023, returning +18.24% in developed markets and +9.83% in emerging markets.

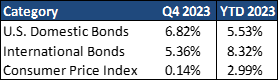

- Domestic bonds were positive in 2023, returning +5.53%.

- Foreign bonds were positive in 2023, returning +8.32%.

__________________________________________________________________________________________________

Economic Update on Market Performance 2023

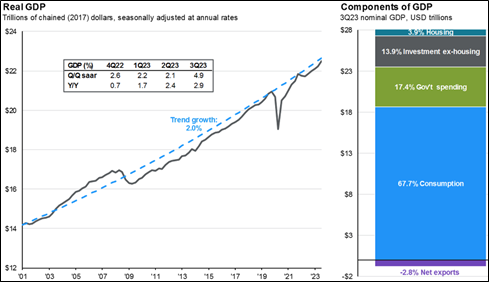

At the start of 2023, many investors and economists worried that 2023 would be a challenging year for the economy and markets. Instead, 2023 turned out to be a year of surprising resilience. Growth accelerated to 5.2% during the third quarter while inflation continued to slide down towards the Fed’s 2% target. Looking ahead, the economy should slow in 2024, but a soft landing still looks possible. With fading tailwinds in consumer and business spending, slower momentum does leave the economy more vulnerable to any type of a shock, should it occur.

Business spending held up better than expected last year despite tighter lending standards, supported by increased spending on intellectual property with greater emphasis on building and integrating artificial intelligence capabilities. Tailwinds from AI spending as well as federal government support for semiconductor manufacturing should persist in 2024. Consumers have remained resilient, supported by a tight labor market and rising real wages. That said, there are some signs of weakness. While revolving credit as a share of disposable income does not look overextended, delinquencies are rising, and younger households are showing signs of increased financial stress.

The Housing Market

The housing market appears to have stabilized, albeit at low levels, as tight housing supply and steadying mortgage rates are signaling that the worst is behind us. Trade should be a mild drag on the economy as a still-strong dollar and sluggish global growth weigh on exports. Meanwhile, government spending growth should slow as gridlock in Washington limits further stimulus.

Federal Rate Hikes

After raising rates by a cumulative 5.25% over the last two years, it seems the Federal Reserve has likely finished with rate hikes. At its December meeting, the Fed decided to keep rates steady, signaling that rates have reached their peak. Despite this, the Fed actively resists the idea of early rate cuts, suggesting a risk that rates may stay high for an extended period. The Federal Reserve gains further confidence from subdued job growth and slowing wages, indicating inflation is gradually moving towards their 2% goal. Even with the Fed’s tightening, equity markets experienced notable gains with low volatility last year. Bond markets, in contrast, faced significant challenges with high interest rate volatility and supply imbalances, exacerbated as the Fed reduced its bond purchases.

__________________________________________________________________________________________________

Equity Recap

After a very challenging year for investors and investment strategies in

2022, U.S. equities rallied in 2023, largely recovering their losses in the prior year. This performance is owed to a combination of better-than-expected consumer spending, resilient corporate profits, and enthusiasm around the advancements in AI. However, equity market performance 2023 was not experienced across the board, with the largest stocks in the index by marketcap accounting for the majority of gains. We have seen gains across all major sub-asset classes in equities, with the S&P 500 being the clear leader thus far in 2023 up +26.29%, followed by developed international stocks at +18.24%.

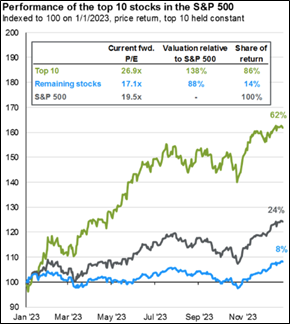

Since the start of 2023, the top 10 stocks in the S&P 500 by market cap have accounted for roughly 90% of price returns, leaving them about 1.4 times more expensive than the broader market. Meanwhile, the remaining stocks are only up by low single digits and are trading more in line with historical valuations. Index concentration is not a new phenomenon, as the weight of the top 10 stocks in the S&P 500 has been rising since 2016.

The earnings contribution from those stocks, however, hasn’t kept pace and hardly budged last year despite strong price appreciation. The fact that the top 10 stocks make up a third of the index but only account for a fifth of index earnings suggests significant mispricing in the stock market, specifically in the growth side of the S&P 500 names. In environments like these, active management is best suited to identify those companies with sustainable, high-quality earnings that are being overlooked by the markets.

Global Equity Recap

Taking a quick trip around the globe, Japanese equities had a very strong year, rising roughly 16% in dollar terms, as an improved interest rate backdrop and corporate governance reform propelled new enthusiasm from investors. Elsewhere, promising fiscal reforms and strong economic momentum bolstered the case for Indian equities, which similarly rose over 16%. In Europe, markets also saw strong performance in the first half of the year as the end of negative interest rates supported banks and economic activity stabilized from Russia-induced energy shortages. Although the global growth backdrop looks set to slow, there are still strong opportunities outside of the U.S. for long-term investors, and at more attractive valuations. Indeed, international equities continue to trade at a steep discount of over 30% compared to U.S. equities, near 20-year lows. International equities also currently offer greater income, with dividend yields at 1.8% above that of U.S. equities.

Combine an attractive entry point with structural tailwinds, attractive relative fundamentals and a weakening dollar, and the year ahead could be a much more favorable environment for U.S. based investors

investing overseas looking to diversify their investment strategies and add exposure to important global secular trends and themes.

__________________________________________________________________________________________________

Fixed Income Recap in Market Performance 2023 Commentary

Domestic fixed income saw an improvement in 2023 after an abysmal 2022, with U.S. bonds returning +5.53% in 2023. Policy tightening from the Fed has pushed yields on cash-like instruments to their most attractive levels in over a decade. With yields north of 5% and minimal risk, many investors have decided to allocate more heavily to cash. History shows that staying parked in cash after the peak in interest rates usually leaves money on the table. In the last 6 rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates. Following a peak in interest rates there has historically been a better asset than cash to deploy capital.

It appears the Fed is at the end of its hiking cycle, which will divert investor attention to the potential for rate cuts as opposed to rate hikes. If the economy avoids a recession in 2024, the Fed may be able to deliver mild cuts during the year. However, if the U.S. economy enters a recession, the Fed may be forced to cut rates rapidly. Both outcomes, however, should bode well for high-quality fixed income

investment strategies.

It is important to note that the bond market is priced very attractively as compared to its 25-year history. It was not long ago that the U.S. bond market was producing a 1.5% annual yield. The current opportunity presented in fixed income could pass rather quickly once the Fed begins lowering rates, and investors would be well served to take advantage of current yields.

__________________________________________________________________________________________________

Economic Outlook 2024 & Beyond

As investors look forward into 2024, geopolitical uncertainty remains elevated, and risks to the recent market rally remain in place. In an environment like this, it is important to take a diversified approach to

portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. History shows that investors have been well suited sticking to their

investment strategies to achieve the long-term returns they desire. If you are a client of our firm, we created your portfolio to withstand all types of markets, such as 2022. If you are not a client and have not stress tested your portfolio or do not have a well-designed plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you.

Charts, graphs, market performance 2023 data, and commentary sourced from J.P. Morgan Asset Management.

4th Quarter 2023 Commentary

Contributed by: Brandon Bauer, CFP®

Market Performance 2023 Overview and Investment Strategies

- Domestic equities were positive in 2023, with large cap stocks finishing +26.29%, mid cap stocks finishing +17.24%, and small cap stocks finishing +16.93%.

- Foreign equities were positive in 2023, returning +18.24% in developed markets and +9.83% in emerging markets.

- Domestic bonds were positive in 2023, returning +5.53%.

- Foreign bonds were positive in 2023, returning +8.32%.

__________________________________________________________________________________________________Economic Update on Market Performance 2023

At the start of 2023, many investors and economists worried that 2023 would be a challenging year for the economy and markets. Instead, 2023 turned out to be a year of surprising resilience. Growth accelerated to 5.2% during the third quarter while inflation continued to slide down towards the Fed’s 2% target. Looking ahead, the economy should slow in 2024, but a soft landing still looks possible. With fading tailwinds in consumer and business spending, slower momentum does leave the economy more vulnerable to any type of a shock, should it occur.The Housing Market

The housing market appears to have stabilized, albeit at low levels, as tight housing supply and steadying mortgage rates are signaling that the worst is behind us. Trade should be a mild drag on the economy as a still-strong dollar and sluggish global growth weigh on exports. Meanwhile, government spending growth should slow as gridlock in Washington limits further stimulus.Federal Rate Hikes

After raising rates by a cumulative 5.25% over the last two years, it seems the Federal Reserve has likely finished with rate hikes. At its December meeting, the Fed decided to keep rates steady, signaling that rates have reached their peak. Despite this, the Fed actively resists the idea of early rate cuts, suggesting a risk that rates may stay high for an extended period. The Federal Reserve gains further confidence from subdued job growth and slowing wages, indicating inflation is gradually moving towards their 2% goal. Even with the Fed’s tightening, equity markets experienced notable gains with low volatility last year. Bond markets, in contrast, faced significant challenges with high interest rate volatility and supply imbalances, exacerbated as the Fed reduced its bond purchases. __________________________________________________________________________________________________Equity Recap

Global Equity Recap

Taking a quick trip around the globe, Japanese equities had a very strong year, rising roughly 16% in dollar terms, as an improved interest rate backdrop and corporate governance reform propelled new enthusiasm from investors. Elsewhere, promising fiscal reforms and strong economic momentum bolstered the case for Indian equities, which similarly rose over 16%. In Europe, markets also saw strong performance in the first half of the year as the end of negative interest rates supported banks and economic activity stabilized from Russia-induced energy shortages. Although the global growth backdrop looks set to slow, there are still strong opportunities outside of the U.S. for long-term investors, and at more attractive valuations. Indeed, international equities continue to trade at a steep discount of over 30% compared to U.S. equities, near 20-year lows. International equities also currently offer greater income, with dividend yields at 1.8% above that of U.S. equities. Combine an attractive entry point with structural tailwinds, attractive relative fundamentals and a weakening dollar, and the year ahead could be a much more favorable environment for U.S. based investors investing overseas looking to diversify their investment strategies and add exposure to important global secular trends and themes. __________________________________________________________________________________________________Fixed Income Recap in Market Performance 2023 Commentary

Economic Outlook 2024 & Beyond

As investors look forward into 2024, geopolitical uncertainty remains elevated, and risks to the recent market rally remain in place. In an environment like this, it is important to take a diversified approach to portfolio management to mitigate unnecessary volatility or overexposure to a single risk factor. History shows that investors have been well suited sticking to their investment strategies to achieve the long-term returns they desire. If you are a client of our firm, we created your portfolio to withstand all types of markets, such as 2022. If you are not a client and have not stress tested your portfolio or do not have a well-designed plan to navigate through uncertain times, perhaps now is the time to do so. We stand ready and available to assist you. Charts, graphs, market performance 2023 data, and commentary sourced from J.P. Morgan Asset Management.Brandon Bauer, CFP®

Share this post with your friends