We understand developing a comprehensive financial plan may sound like an overwhelming task. But for successful investors, it’s the foundation on which to build, understand and achieve your goals. Having a written plan can increase confidence and result in more constructive financial behavior. People working with a financial planner who takes a holistic look at their needs, beyond just products and the portfolio, are likely better off than those working with a planner who takes a transactional approach of only offering investment advice.

The article below was published by our custodian, Charles Schwab.

5 Ways Financial Planning Can Help

By Rob Williams

Most of us know we should save money. But when it comes to actually doing it, people tend to fall into two camps: non-planners and planners. Non-planners typically save when they can, perhaps putting a small amount into a workplace retirement plan, hoping that everything will work out in the long run. Planners generally know what they’re saving for, how much they need to put away, and how long it will take them to reach their goals.

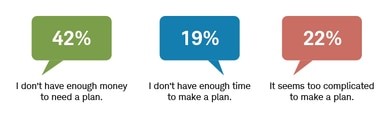

Does the first type sound more like you? If so, you’re not alone: Only 33% of Americans have a written financial plan, according to Schwab’s 2021 Modern Wealth Survey.1 Of the rest, almost half said they didn’t have enough money to make a plan worthwhile. Others said it was too complicated, or they didn’t have time to develop a plan.

We get it. In the rush of daily life, planning for anything more than a few days in advance can seem like a headache. It’s natural to wonder: Does financial planning really matter?

We think it does. Here are five reasons why:

-

A written financial plan increases confidence.

Sixty-five percent of people with a written financial plan say they feel financially stable, while only 40% of those without a plan feel the same level of comfort, according to the 2021 Modern Wealth Survey. Fifty-four percent of planners felt “very confident” they would reach their financial goals, compared with only 18% of non-planners.

-

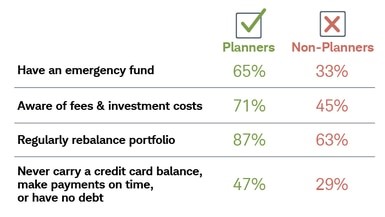

A financial plan can lead to better habits.

Financial planning isn’t just about investing, and in fact it can be misleading to calculate the benefits of each financial decision in dollars and cents. Many sound financial decisions are more easily explained in quality-of-life terms—such as the security that life insurance offers, or the peace of mind that having an emergency fund can provide. There are healthy money habits and there are good investing habits; a written financial plan can lead to both.

Americans who have a financial plan also have healthy money habits.

Source: 2021 Schwab Modern Wealth Survey

-

A financial plan can help even if you don’t have much money saved.

The most common reason cited for not having a plan is “I don’t have enough money.” This is a misconception. Planning even in small steps doesn’t take large sums of money to start.

In fact, financial planning can have a profound impact on lower-income households, by helping people improve their saving and budgeting habits. A written plan helps savers prioritize their goals and provides a way to measure success.

Source: 2021 Schwab Modern Wealth Survey

-

A financial plan can be tailored to help every personality type.

Schwab’s Modern Wealth Quiz can tell you what type of person you are with regard to financial planning, and can provide tips on taking the next steps toward your financial goals based on your personality type. In 2019, participants in the Modern Wealth Survey also took the Modern Wealth Quiz, and most of those who took the quiz were characterized as having a “Dreamer” planning personality type. To a Dreamer, life should be lived—not planned. Yet Dreamers may find that a bit of planning can significantly help them achieve the freedom to live the way they want.

What’s your financial personality type? Here are the six types, with the percentage of people surveyed in 2019 who matched them:

- Dreamer (43%): Dreamers are the free spirits of our world, who shake their head in confusion at all those who schedule their lives to the last detail.

- Improviser (18%): Improvisers are typically quite self-sufficient, with a deep desire for independence and doing things their own way.

- Organizer (11%): Admit it—you love lists. Categorizing and organizing everything from your sock drawer to your personal finances gives you a warm, fuzzy feeling.

- Architect (10%): A master of both creativity and logic, the Architect is the rare individual who not only imagines the future, but designs solutions to make it happen.

- Maverick (10%): Unafraid and unapologetic, Mavericks are those rare individuals who would rather reshape their world than try to fit in it.

- Philosopher (8%): Taken from the Greek word meaning “lover of wisdom,” Philosophers enjoy thinking about and solving problems.

5. A plan helps you create an investment portfolio.

A choice of investments, portfolio or financial products ideally are the result of a plan—they’re not the plan itself. That’s why the first of Schwab’s 7 Investing Principles is “Establish a financial plan based on your goals.” Investment products—like stocks and bonds—are the tools that are used to potentially realize the goal. They’re part of a larger puzzle. A financial plan can also include retirement, insurance, tax, and estate planning, as well as strategies—such as retiring early, or saving more—that are actions, not products. Effective planners use all these tools, with the financial plan as the playbook.

Working with a professional financial planner can help—with caveats.

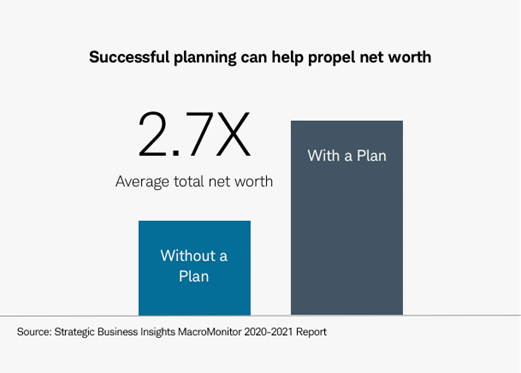

Research has shown that households that work with a professional financial planner were more likely to make better financial decisions than those without a planner, taking into account portfolio risk levels, savings habits, life insurance coverage, revolving credit card balances, and emergency savings.

In a study published in the Journal of Financial Planning, David M. Blanchett, Ph.D., CFA, CFP®, used six rounds of the triennial Federal Reserve Board’s Survey of Consumer Finances (from 2001 to 2016) to examine the results achieved by people using four information sources: financial planners; transactional financial advisors (such as a banker or broker); friends; or the internet.

“Households working with a financial planner were found to be making the best overall financial decisions, followed by those using the internet, while those working with a transactional adviser were making the worst financial decisions,” Blanchett wrote.

Not surprisingly, the type—and objective—of the financial planner matters. There are many types of planners and different types of planning engagements. The study didn’t use a certification or a designation to determine if an advisor was a financial planner, though those designations certainly can help. The survey asked respondents what type of service they received: Were the advisors providing more holistic planning services? Or less holistic and more transactional in nature? The advisors who provided more holistic services were called financial planners and, on average, led to a clearer planning process—and better outcomes.

Bottom line

A financial plan may sound like a chore. But for successful investors, it’s the foundation on which to build, understand and achieve your goals. Having a written plan can increase confidence and result in more constructive financial behavior. However, the potential value of financial advice may vary based on the nature of the planning engagement. People working with a financial planner who is taking a holistic look at their needs, beyond just products and portfolio, are likely better off than those working with a planner who takes a transactional approach.

As always, Voisard’s team of highly trained advisors stand ready to answer any questions you may have. It all starts with a simple conversation.

https://www.schwab.com/resource-center/insights/content/does-financial-planning-help