For any of you that have seen the movie Gladiator, Russell Crowe plays a captured prisoner named Maximus. There is a scene where he is forced to fight alongside other prisoners against the Romans in an arena designed for the entertainment of the citizens. After he and the other prisoners are released into the middle of the arena, it seems like an impossible task. Before the battle begins, Maximus tells his fellow prisoners that they must stick together and not break rank, as they are outnumbered and have a huge disadvantage.

The Romans enter the arena riding chariots, circling the gladiators grouped in the center of the arena. A few prisoners abandon the plan and go out to fight alone. The outcome for these lone prisoners is not positive, as they are immediately overcome by the Romans. Maximus and the remaining prisoners stuck to their plan and ended up holding off the Romans in their chariots to claim victory.

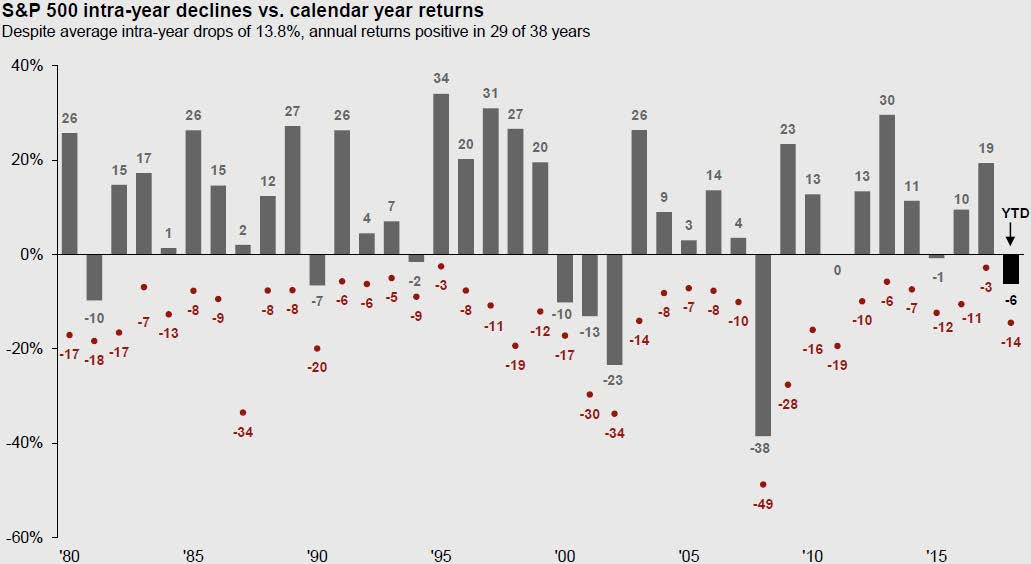

You are probably wondering what this has to do with wealth management. Well, the prisoner’s strategy to hold their position and follow the plan worked! This is similar to our strategy with our clients. When we put a plan in place, we help clients determine appropriate levels of risk given their assets and goals. This plan accounts for things like spending needs in retirement, returns and inflation. If we look at the U.S. stock market, it is down -6% year-to-date. It may feel like more because it has fallen nearly -14% since the beginning of October, known as an intra-year decline. While this isn’t comfortable for any investor, it is not uncommon. In fact, the average intra-year decline since 1980 is 13.8%.

For investors, expect negative years from time to time. However, the plans that we create have been tested in multiple market environments, thousands of different ways, via our planning software. Our plans include analyzing scenarios where portfolios experience multiple years of negative returns. On the front-end of our planning process, we ensure the risk taken is appropriate for each client.

For most clients, this means they are not just invested in stocks, but instead also hold bond assets. The low risk positions help weather the storm as the bonds can be a buffer in an uncertain market. Not every year ends positive for investors, that’s just the reality of investing. Market dips and down years are normal; they just don’t feel normal after 9 of the past 10 years have been positive. We remain confident in our approach for clients and our game plan hasn’t changed. Stay the course and weather the storm.

Please do not hesitate to reach out to our team of professionals should you have any questions or concerns about your portfolio. We continue to stand ready to assist you with your financial planning and investment management needs.