Many investors use the S&P 500 as a leading economic indicator of how well the U.S. economy is doing. This Wall Street benchmark is a stock market index that tracks the value of 500 large capitalization U.S. companies. How is the coronavirus affecting the stock market and specifically the S&P?

This index has rallied from the 2020 market low of 2,237.40 we experienced in March, to a record high on September 1st of 3,526.65. Despite the ongoing economic struggles due to the Coronavirus pandemic, the market index has fully recovered and in positive territory for the year, primarily driven by gains from big technology companies.

Although the overall index is at a record level, the majority of stocks in the index have yet to climb back to their pre-pandemic values. While it is easy to use this index to assess how the overall US stock market is doing, if we look under the hood, the results are skewed by the uneven proportions of individual companies and representation of sectors.

The technology sector has thrived during the 2020 coronavirus pandemic. Microsoft, Apple, Google, Amazon, and Facebook make up nearly 25% of the S&P 500’s market cap. The S&P 500 is a market-cap-weighted index, which means most of the gains or losses will inevitably come from the largest stocks. The smaller stocks are still participating in the overall return calculations, they just don’t move the needle as much due to the overall weighting. In reference to the S&P 500 index, the perceived overall positive market performance is masked by the recent success of a concentrated few.

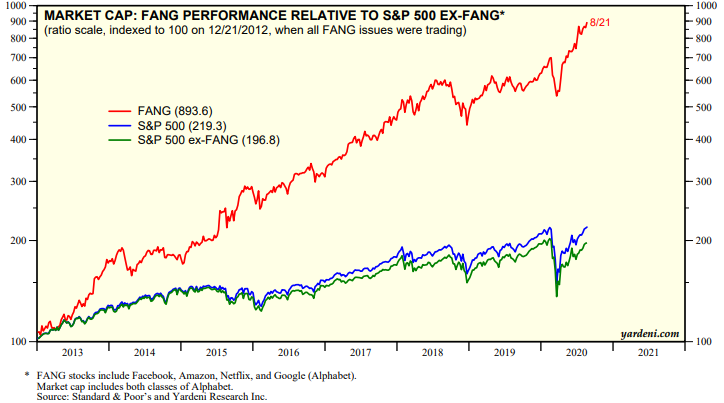

In fact, 62% of the S&P 500 companies in the 2020 pullback have yet to bounce back. This is evident in the chart below that shows the return of the “FANG” stocks in red (Facebook, Amazon, Netflix, and Google), compared to the much lower returning S&P 500 excluding the FANG stocks in green.

High market capitalization stocks can become so large that they wind up monopolizing the index. Investing solely in a cap-weighted index could result in overweighting those stocks that have the highest valuations. Experts fear the heavy concentration in a select few mega-cap companies poses a potential risk to the market. According to Goldman Sachs, the trend we are seeing in 2020 has some striking similarities to the late-1990s tech bubble. It is widely suspected that if any of the largest stocks tumble, the decline may kick off a wave of selling and strong bearish momentum.

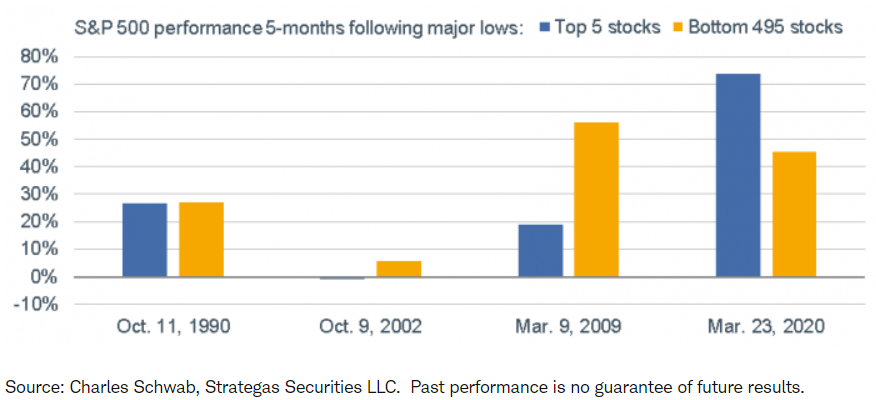

Another important characterization to note regarding our most recent market low is its uniqueness regarding the prompt and strong bounce back of the top market-cap stocks.

As illustrated below, following this year’s March 23rd low, the top 5 stocks in the S&P 500 have rebounded significantly stronger than the bottom 495. In 2002, the top 5 still had not fully recovered at the end of the 5 months following the major low. The returns illustrated following the 2009 major low supports the argument that there is risk associated with overexposure of the top weighted stocks, as they did not perform as well as the 495 other stocks in the S&P 500.

An S&P 500 ETF or mutual fund is a great way for an individual to participate in the entire index without purchasing all 500 holdings individually. It grants the investor access to wide market participation without restrictions due to limited investable assets. Therefore, it has become a staple in many portfolios, even though many investors do not consider the risks associated with the market capitalization weighted index. As a company grows larger and larger it comprises more and more of the S&P 500 index, thus inherently bringing the risk of over-exposure to the investor.

An alternative investment strategy that uses the stocks of the S&P 500 is an equal-weighted style. Instead of being market cap weighted, these indices are equally weighted to all 500 investments in the index. Each stock in the S&P 500 equal weight approach has a .2% allocation to the index. This strategy allows the investor to have full diversification and is intended to be a better measure of market performance with hopes of outperforming the capitalization-weighted index. The equal weight approach also offers protection if a large sector experiences a downturn.

The S&P 500 is a staple in the investment world and has its rightful place in many portfolios. Mutual funds and ETFs investing in this index offer the investor the opportunity to fully participate in the index. However, as with all investments, it is important to understand the characteristics and structure associated with the assets being held in your portfolio to best address unforeseen risks.

Both S&P 500 investment models aforementioned have their benefits and risks and can be implemented effectively with careful thought. At the end of the day, a well-diversified portfolio is the only way to mitigate risk, including those associated with over-exposure, volatility, and valuation. If you would like to speak with one of our experienced advisors about the structure and characteristics of your portfolio, the team at Voisard Asset Management is always happy to be of assistance.