If you have ever seen “David After Dentist” on YouTube, you will recall him asking “Is this real life?” after his trip to the dentist and copious amounts of general anesthesia. David, age 7, knew something wasn’t right, however couldn’t seem to grasp what was going on. Like David, many clients have been confused and are asking if the stock market is really worth what it is trading at. Or how David might put it, “is there something strange going on in the markets?”

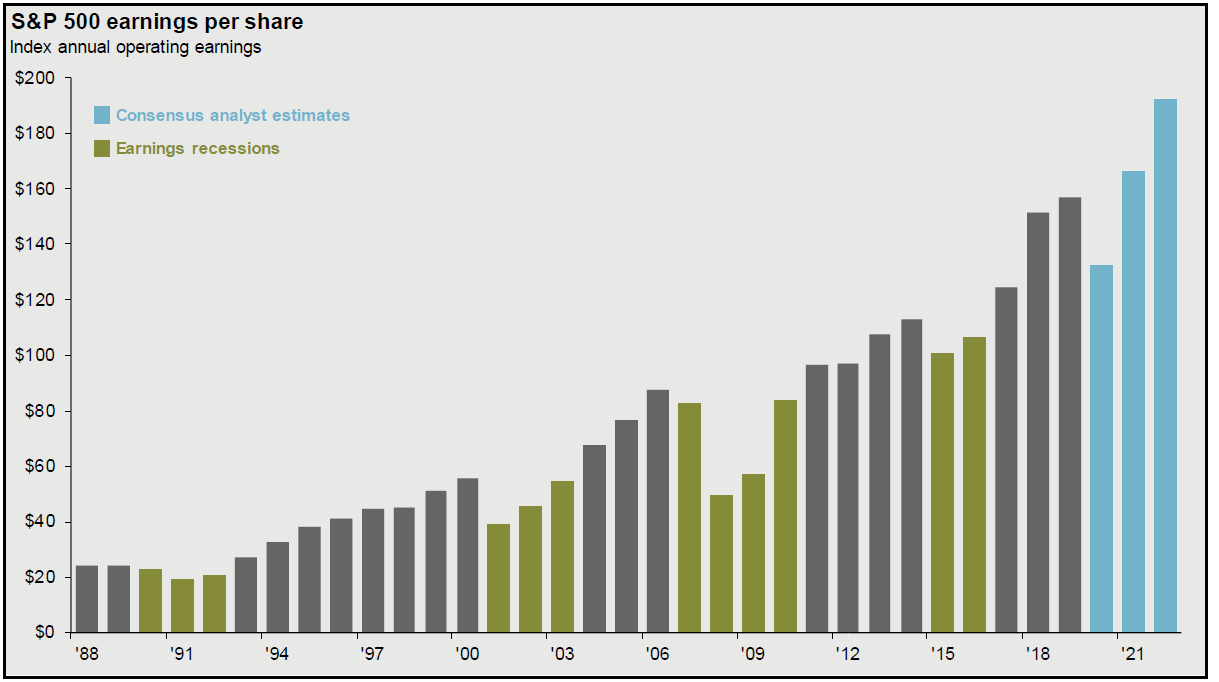

First, markets are anticipatory, so investors are essentially setting a price they would pay for a company based on what they project that company’s earnings to be in the future. If we look at the current PE ratio of the S&P 500 (Price-to-earnings ratio, a measure of what investors are willing to pay for $1 of earnings), it is 21.8x. The average PE for the S&P 50 since 1995 is 16.51x. So, simple math would suggest the market is overvalued. However, if we look at the chart below, analyst earnings estimate for 2021 and 2022 are much higher than what is expected in 2020. Therefore, one could argue that if analysts estimates come to fruition, the market could actually be undervalued at this point! What is the current PE ratio of the S&P 500?

If we play devil’s advocate and assume the analysts’ earnings projections are overly optimistic, the S&P 500 may be overvalued at this point given its already high PE ratio. There are several factors that will determine which of these scenarios is accurate. The rate of new Coronavirus cases, timing of a vaccine, reliance on future lockdowns, and political policy will all play a part in shaping future corporate earnings and profits. While we are in the midst of short-term uncertainty, over time U.S. businesses have proven they are resilient and adaptable to the changes that inevitably occur every year.

As with any well-rounded investment plan, our clients’ plans account for both the positive and negative items aforementioned. For those who aren’t clients, perhaps a friendly conversation would ease concerns about your investment path moving forward. As always, we stand ready to assist anyone that may need guidance navigating this unusual time.